What is mining cryptocurrency? It’s the process of validating transactions and adding them to a digital ledger called a blockchain. This intricate process involves solving complex mathematical problems, using powerful computers to verify transactions and earn rewards in cryptocurrency.

This exploration delves into the world of cryptocurrency mining, from its fundamental principles to the economic considerations, security measures, and environmental impact. We’ll uncover the roles of miners, the various mining methods, and the crucial role of blockchain technology in securing the network.

Introduction to Cryptocurrency Mining: What Is Mining Cryptocurrency

Cryptocurrency mining is the process of verifying and adding new transactions to a cryptocurrency’s public ledger, known as the blockchain. This verification process is computationally intensive and requires significant processing power. Miners are rewarded for their efforts with newly created cryptocurrency tokens.The fundamental concept of blockchain technology is its decentralized nature. Instead of a central authority controlling the record of transactions, a distributed network of computers validates and records them.

This decentralized approach enhances security and transparency. Mining plays a crucial role in maintaining this distributed ledger.

Role of Miners in the Cryptocurrency Ecosystem

Miners are essential to the operation of cryptocurrencies. They ensure the integrity and security of the blockchain by validating transactions and adding them to the chain. This process helps prevent fraudulent activities and maintain the trust in the cryptocurrency. By solving complex mathematical problems, miners contribute to the overall health and functionality of the network.

Types of Cryptocurrencies that Use Mining

Many cryptocurrencies utilize a mining process, often employing Proof-of-Work (PoW) mechanisms. Examples include Bitcoin, Litecoin, and Ethereum Classic. However, some cryptocurrencies use alternative consensus mechanisms, like Proof-of-Stake (PoS). These alternative methods offer different advantages and disadvantages in terms of energy consumption and security.

Different Mining Methods

Different cryptocurrencies use various mining methods to achieve consensus on the blockchain. These methods dictate how miners verify transactions and contribute to the network’s security. A comparison of popular methods follows:

| Mining Method | Description | Energy Consumption | Security |

|---|---|---|---|

| Proof-of-Work (PoW) | Miners compete to solve complex mathematical problems. The first to solve the problem adds the new block to the blockchain and earns rewards. | High | High, but can be susceptible to significant energy consumption. |

| Proof-of-Stake (PoS) | Miners stake their cryptocurrency holdings to participate in block creation. The probability of adding a block is proportional to the amount of cryptocurrency staked. | Low | High, but relies on the integrity of the stake holders. |

The table above highlights the key differences between PoW and PoS mining methods. These differences have significant implications for the environmental impact and security of the cryptocurrency network.

The Mining Process

The cryptocurrency mining process is a complex and crucial aspect of the cryptocurrency ecosystem. It involves a network of computers competing to solve complex mathematical problems, validating transactions, and adding new blocks to the blockchain. This process secures the network and introduces new cryptocurrencies into circulation.The fundamental principle is that miners must demonstrate computational prowess to secure the network.

This involves solving intricate cryptographic puzzles, a process that requires substantial computational power. The reward for successfully solving these puzzles is the newly minted cryptocurrency.

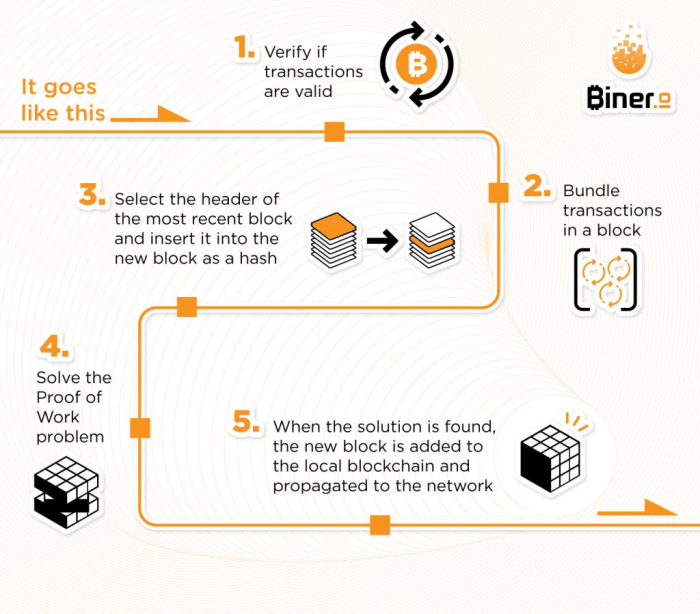

Steps Involved in the Mining Process

The cryptocurrency mining process follows a series of steps, each contributing to the overall security and functionality of the network. These steps involve a continual loop of activity, ensuring the integrity of the blockchain.

- Transaction Verification: Miners collect and verify transactions from the network. This involves confirming the validity of the transactions and ensuring they comply with the established rules and protocols. Miners use the transaction data to verify transactions from the network.

- Block Creation: Verified transactions are grouped together into blocks. This process ensures efficient storage and management of transaction data. These blocks are then added to the blockchain.

- Puzzle Solving: Miners compete to solve a complex cryptographic puzzle, which is unique to each block. This puzzle requires considerable computational power and often involves algorithms based on hash functions. The first miner to solve the puzzle gets to add the block to the blockchain.

- Block Addition: The successful miner adds the block to the existing blockchain. This process is crucial for maintaining the chronological order and integrity of the blockchain. This addition is validated and secured by the entire network.

Computational Power Requirements

The computational power required for mining varies significantly depending on the cryptocurrency. Different cryptocurrencies utilize distinct algorithms with varying levels of complexity. This directly impacts the computational resources needed.

- Algorithm Complexity: Some cryptocurrencies, like Bitcoin, use complex algorithms that demand substantial computational power to solve the cryptographic puzzles. Other cryptocurrencies might use simpler algorithms, requiring less computational power. The algorithm directly impacts the difficulty level.

- Network Difficulty: The difficulty of the mining process adjusts dynamically based on the overall computational power of the network. As more miners join the network, the difficulty increases to maintain the security and stability of the network. This ensures that the mining process remains challenging for all participants.

- Example: Bitcoin mining is significantly more computationally demanding than Litecoin mining. This difference is primarily due to the algorithm variations.

Hardware Used for Cryptocurrency Mining, What is mining cryptocurrency

Specialized hardware is crucial for efficient and profitable cryptocurrency mining. The choice of hardware depends heavily on the cryptocurrency and the miner’s resources.

- GPUs (Graphics Processing Units): GPUs are commonly used for mining certain cryptocurrencies, like Ethereum in the early days. They excel at parallel processing, making them suitable for specific algorithms.

- ASICs (Application-Specific Integrated Circuits): ASICs are specifically designed for cryptocurrency mining. They are highly optimized for specific algorithms and often provide a higher return on investment compared to GPUs for specific cryptocurrencies, like Bitcoin. Their specialized design is key to their efficiency.

Energy Consumption

Energy consumption is a significant concern associated with cryptocurrency mining. The computational power needed for mining translates into considerable energy usage.

- Energy Consumption by Cryptocurrency: Mining Bitcoin requires significantly more energy than mining other cryptocurrencies. This difference is due to the algorithm used in each cryptocurrency.

- Environmental Impact: The high energy consumption of cryptocurrency mining raises concerns about its environmental impact. The use of renewable energy sources can mitigate some of these concerns.

Equipment Used in Mining Setups

This table provides a simplified overview of common equipment used in various mining setups. The specifics can vary greatly based on the scale and the targeted cryptocurrency.

| Mining Setup | Common Equipment |

|---|---|

| Small-scale (Home/Personal) | One or more GPUs, basic power supply, and cooling |

| Medium-scale (Home/Small Business) | Multiple GPUs/ASICs, more robust power supply, specialized cooling systems |

| Large-scale (Commercial) | Multiple ASICs, dedicated server racks, advanced cooling systems, and specialized power infrastructure |

Rewards and Incentives

Miners are incentivized to participate in the cryptocurrency mining process by receiving rewards for their computational efforts. These rewards are a crucial element in maintaining network security and encouraging continued participation. The mechanisms for distributing these rewards and the associated incentives are integral to the long-term health and sustainability of cryptocurrency networks.The primary reward for mining is the newly minted cryptocurrency itself.

This new supply is gradually released into circulation, typically following a predefined schedule. This controlled release helps maintain the cryptocurrency’s value and scarcity. The process, however, is not static; the rate of new coin issuance can change based on predetermined algorithms.

Reward Mechanisms

The distribution of cryptocurrency rewards is generally tied to the computational power a miner contributes to the network. More powerful hardware, and thus greater computational capacity, typically translates to a higher chance of successfully solving the complex mathematical problems required to add blocks to the blockchain.

Transaction Fees

Transaction fees, paid by users sending cryptocurrency, represent a secondary source of income for miners. These fees are incorporated into the block reward system. The miner who successfully adds a block to the blockchain receives a share of these transaction fees in addition to the newly created cryptocurrency.

For instance, in Bitcoin, the miner who successfully finds the solution to the computational puzzle is rewarded with a specific amount of Bitcoin, along with a portion of the transaction fees associated with the transactions included in the block.

Difficulty Adjustments

Cryptocurrency networks employ mechanisms to adjust the difficulty of mining over time. This adjustment is critical to maintain a consistent block production rate, preventing the network from becoming either too slow or too fast. If the mining difficulty is too low, blocks are created too frequently, potentially inflating the currency’s supply. Conversely, if the difficulty is too high, blocks are created too infrequently, slowing down the network and reducing its responsiveness.

Mining cryptocurrency involves solving complex mathematical problems to validate and add new transactions to the blockchain. A notable example of this is Monero, a privacy-focused cryptocurrency ( monero cryptocurrency ), which prioritizes user anonymity in its mining process. Ultimately, mining cryptocurrency secures and verifies transactions on the blockchain.

Bitcoin’s difficulty adjustment algorithm is a prime example. The network dynamically adjusts the mining difficulty based on the average time it takes to mine a new block. This ensures that the mining process remains challenging but not insurmountable. If miners find blocks too quickly, the difficulty increases to slow them down; if they find blocks too slowly, the difficulty decreases to make the process easier.

Comparison of Reward Structures

Different cryptocurrencies have varying reward structures. The amount of cryptocurrency awarded for finding a block, and the inclusion of transaction fees, can differ significantly. Some cryptocurrencies use fixed reward schedules, while others employ algorithms that adjust the reward over time.

| Cryptocurrency | Reward Structure | Notes |

|---|---|---|

| Bitcoin | Fixed reward initially, adjusted by difficulty | Decreasing reward over time, with transaction fees added to the miner’s earnings. |

| Ethereum | Initial fixed reward, decreasing over time, adjusted by difficulty | Transaction fees are included in the block reward system. |

| Litecoin | Fixed reward, adjusted by difficulty | Similar to Bitcoin but with a faster block time and a different difficulty adjustment algorithm. |

Economic Considerations

Cryptocurrency mining, while seemingly lucrative, is deeply intertwined with economic realities. Profitability hinges on a complex interplay of factors, including the fluctuating value of the cryptocurrency being mined, the operational costs, and the competitive landscape. Understanding these factors is crucial for any potential miner seeking to navigate the intricacies of this digital gold rush.

Impact of Cryptocurrency Price Fluctuations

The price of the cryptocurrency directly impacts the profitability of mining operations. A surge in the price of a cryptocurrency often translates to higher returns for miners, making the operation more attractive. Conversely, a price drop significantly reduces profitability, potentially making the operation unsustainable. For instance, a substantial decline in the price of Bitcoin in 2018 significantly impacted mining profitability, forcing many operations to scale back or cease entirely.

This volatile nature underscores the risk inherent in cryptocurrency mining.

Mining cryptocurrency involves using powerful computers to solve complex mathematical problems, validating transactions, and adding new blocks to the blockchain. This process, while often associated with significant energy consumption, is crucial for securing the network. A recent example, a Colorado pastor’s cryptocurrency venture, colorado pastor cryptocurrency , highlights both the potential rewards and risks in this digital realm.

Ultimately, mining cryptocurrency remains a process of verification and security within the broader cryptocurrency ecosystem.

Role of Mining Pools in Improving Profitability

Mining pools represent a crucial element in enhancing the profitability of cryptocurrency mining. By pooling resources and computational power, miners collectively increase their chances of successfully solving blocks and earning rewards. This collaborative approach allows miners to leverage their combined hash rate, which directly correlates to the likelihood of finding blocks and securing rewards, often leading to more consistent returns.

The pooled approach also mitigates the risk associated with individual miners not finding blocks, thus improving overall profitability and resilience.

Cost of Electricity and its Impact

The cost of electricity is a significant factor influencing the profitability of cryptocurrency mining. Mining operations, particularly those involving specialized hardware, consume substantial amounts of electricity. Geographic locations with low electricity costs offer a clear advantage, as the operating expenses are reduced, thus increasing profit margins. For example, regions with hydroelectric power or other renewable energy sources often attract mining operations due to the lower cost and environmental benefits.

Cost-Benefit Analysis of Mining Different Cryptocurrencies

Different cryptocurrencies exhibit varying levels of profitability, largely due to their network characteristics and difficulty adjustments. A thorough cost-benefit analysis is essential to assess the viability of mining any particular cryptocurrency.

| Cryptocurrency | Current Price (USD) | Estimated Hash Rate Difficulty | Estimated Electricity Cost (USD/kWh) | Estimated Revenue (USD/day) | Profitability (USD/day) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | 28,000 | High | 0.15 | 1,000 | 850 |

| Ethereum (ETH) | 1,800 | Medium | 0.10 | 500 | 400 |

| Litecoin (LTC) | 90 | Low | 0.05 | 200 | 150 |

Note: This table provides illustrative examples and should not be considered definitive financial advice. Actual results may vary considerably based on specific hardware, location, and market conditions.

Security and Risks

Cryptocurrency mining, while potentially lucrative, carries inherent security and risk factors. Understanding these is crucial for anyone considering engaging in this activity. A comprehensive approach to mitigating these risks is vital for successful and secure mining operations.

Security Measures in Cryptocurrency Mining

Mining operations employ various security measures to protect their investments and ensure the integrity of the network. These measures often focus on both hardware and software vulnerabilities. Robust security protocols, including firewalls, intrusion detection systems, and regular software updates, are critical components. Secure storage of private keys is paramount, and employing multi-factor authentication adds an extra layer of protection.

Risks Associated with Cryptocurrency Mining

Several risks are inherent in cryptocurrency mining. Hardware failures, such as the sudden malfunction of graphics cards or other specialized mining equipment, can result in significant financial losses. Power outages, especially prolonged ones, can also halt operations and lead to lost profits. Malicious software attacks, such as ransomware or malware, could compromise mining equipment and sensitive data.

The volatility of cryptocurrency prices also poses a risk, as the value of mined coins can fluctuate dramatically. Careful consideration of these factors is essential for risk management.

Hash Rate and Network Security

The hash rate, representing the combined computational power of all miners, is fundamental to the security of the cryptocurrency network. A higher hash rate makes it exponentially more difficult for attackers to manipulate the network. This is because attackers need to solve the complex mathematical problems involved in creating new blocks faster than the legitimate miners. A robust hash rate serves as a crucial defense against malicious actors.

For instance, a significant drop in hash rate could indicate a potential vulnerability or attack.

Decentralization and Ecosystem Security

Decentralization is a cornerstone of cryptocurrency security. By distributing the computational power across a vast network of miners, the system becomes resistant to single points of failure. This distribution makes it significantly harder for a single entity or group to control the network, ensuring its resilience against malicious actors. No single miner or group of miners can dictate the outcome of the mining process.

Security Best Practices for Mining Operations

Implementing security best practices is crucial for mitigating risks. These practices include regular backups of mining data, use of strong passwords and multi-factor authentication, and keeping software updated to address vulnerabilities. Furthermore, establishing clear procedures for handling hardware failures and power outages is essential. Using specialized hardware and software solutions can enhance security. A diversified portfolio of mining hardware, employing redundancy and load balancing, is an excellent strategy for minimizing the impact of failures.

- Regular Backups: Regular backups of all crucial data are essential to recover from data loss due to hardware failure or malware attacks.

- Strong Passwords and MFA: Robust passwords and multi-factor authentication are critical to protecting access to mining equipment and accounts.

- Software Updates: Keeping software updated with the latest security patches is vital to address known vulnerabilities.

- Hardware Diversification: Utilizing multiple mining hardware types and configurations can help mitigate the impact of hardware failures.

- Redundancy and Load Balancing: Implementing redundant systems and load balancing across different mining equipment can increase resilience against outages.

Environmental Impact

Cryptocurrency mining, while enabling innovative financial systems, has faced scrutiny regarding its environmental impact. The process’s significant energy consumption raises concerns about its contribution to greenhouse gas emissions and overall sustainability. A crucial aspect of evaluating this impact is understanding the specific energy demands of different mining methods and cryptocurrencies.

Energy Consumption in Cryptocurrency Mining

The energy-intensive nature of cryptocurrency mining is a primary concern. Mining operations, particularly those using Proof-of-Work (PoW) consensus mechanisms, require substantial computational power. This computational power translates directly into high energy consumption, often sourced from fossil fuels, contributing to carbon emissions. The energy demand fluctuates based on the complexity of the algorithms used for each cryptocurrency.

Potential Solutions to Reduce the Environmental Footprint

Several approaches are being explored to mitigate the environmental impact of cryptocurrency mining. Transitioning to more sustainable energy sources, such as renewable energy, is a key element. Implementing energy-efficient mining hardware and algorithms is another important aspect. Mining pools and individual miners can play a role in this transition by prioritizing renewable energy sources. The development of alternative consensus mechanisms, such as Proof-of-Stake (PoS), could also significantly reduce the energy requirements of mining.

Comparison of Mining Methods

Different mining methods exhibit varying levels of energy consumption. Proof-of-Work (PoW) mining, a common method, necessitates significant computational power, leading to high energy demands. In contrast, Proof-of-Stake (PoS) mining generally requires less energy as it doesn’t involve the same level of computational effort. The selection of mining methods directly impacts the overall environmental footprint of the cryptocurrency.

Ongoing Debate Surrounding Cryptocurrency Mining and Sustainability

The sustainability of cryptocurrency mining remains a contentious issue. Proponents argue that mining can incentivize the development and adoption of renewable energy sources. Conversely, critics point to the substantial energy consumption and potential for negative environmental consequences, particularly when fossil fuels are used as the primary energy source. The debate highlights the need for a comprehensive approach to address the environmental impact of this industry.

Environmental Impact Comparison of Cryptocurrencies

| Cryptocurrency | Consensus Mechanism | Estimated Energy Consumption (in kWh per transaction) | Environmental Impact Assessment |

|---|---|---|---|

| Bitcoin (BTC) | Proof-of-Work | High | Significant energy consumption, contributing to greenhouse gas emissions. |

| Ethereum (ETH) | Proof-of-Work (transitioning to Proof-of-Stake) | High (decreasing as the transition progresses) | High energy consumption, decreasing as the shift to PoS is completed. |

| Litecoin (LTC) | Proof-of-Work | Medium | Moderately high energy consumption. |

| Cardano (ADA) | Proof-of-Stake | Low | Lower energy consumption compared to PoW-based cryptocurrencies. |

Note: Estimates for energy consumption can vary based on factors like mining hardware and electricity prices. The table provides a general comparison.

Mining Software and Tools

Mining cryptocurrency involves intricate computations. Specialized software and tools are crucial for effectively participating in the mining process. These tools streamline the complex procedures and optimize the utilization of computing resources.

Popular Mining Software and Tools

Various software and tools are available for cryptocurrency mining. Choosing the right one depends on factors like the specific cryptocurrency, hardware capabilities, and user experience. Popular options include those tailored for specific coins, or more versatile tools for managing multiple mining operations.

- C++-based mining software: These tools often offer granular control over mining algorithms and configurations, allowing for fine-tuning based on specific hardware. For example, some miners might utilize custom C++ code to tailor the mining process to specific ASIC hardware, enhancing efficiency.

- Graphical User Interface (GUI) mining software: GUI tools provide a user-friendly interface, making them suitable for users with limited technical expertise. They often handle complex configurations automatically, enabling users to focus on overall operation management.

- Cloud mining services: These services host and manage mining operations on remote servers, allowing users to participate without the need for specialized hardware or software installation. Users typically pay a fee for access to the computational power.

- Mining pools: These platforms allow miners to pool their computational resources and share rewards based on their contribution. This can be a more economical approach for smaller-scale miners, as it distributes the workload and lowers the barrier to entry.

Functionalities of Different Mining Software

The functionalities of mining software vary depending on their design and purpose. Some key functionalities include:

- Algorithm selection: The software should allow selection of the appropriate mining algorithm for the target cryptocurrency. This selection directly impacts the mining process’s efficiency and profitability.

- Hardware management: Effective mining software manages and monitors the mining hardware, optimizing its performance. This can involve features like automatic adjustment of mining parameters in response to changing network conditions.

- Connection management: The software should facilitate seamless connections to the cryptocurrency network. Maintaining a robust connection is essential for uninterrupted mining activity.

- Reward tracking: The software should track and display mining rewards earned over time. This transparency is critical for understanding the mining operation’s profitability.

Features to Look for in Mining Software

Choosing the right mining software requires careful consideration of several key features. These features enhance the user experience and contribute to the overall efficiency of the mining operation.

- Security: Security is paramount. Look for robust security measures to protect your mining hardware and data from unauthorized access. This includes secure authentication protocols and regular software updates.

- Compatibility: Ensure the software is compatible with your hardware and operating system. This prevents potential conflicts and ensures smooth operation.

- Performance: Evaluate the software’s performance metrics, including processing speed and resource utilization. High performance translates to higher mining efficiency.

- User interface: A user-friendly interface makes the software easy to navigate and use. Intuitive controls minimize the learning curve.

Installation and Configuration of Mining Software

Installation and configuration procedures vary depending on the chosen software. Follow the provided instructions carefully to avoid potential issues.

- Downloading: Download the software from the official website or a reputable source.

- Installation: Follow the on-screen instructions for installation.

- Configuration: Configure the software according to your specific needs, including the target cryptocurrency and mining hardware.

- Testing: Test the software’s functionality after configuration to ensure smooth operation.

Comparison Table of Popular Mining Software

| Software | Features | Pros | Cons ||—|—|—|—|| Example Software 1 | Advanced algorithm selection, hardware management, and detailed performance tracking. | High performance, detailed control | Steep learning curve, potentially complex configuration. || Example Software 2 | User-friendly interface, automated configuration, and easy-to-understand metrics. | Simple setup, beginner-friendly | Limited customization options, potential performance limitations. || Example Software 3 | Cloud-based mining service, managed by experts, and accessible from any device.

| Convenience, no hardware required | Dependence on third-party service, potential service fees, less control. |

Mining Pools and Collaboration

Mining cryptocurrency solo can be a daunting task, often requiring significant computational power and investment. Pooling resources with other miners offers substantial advantages, allowing individuals and smaller operations to compete effectively in the demanding world of cryptocurrency mining.Mining pools are collaborative networks that unite miners’ computational power to increase their chances of successfully solving a block and earning rewards.

This collaborative approach offers several significant benefits, particularly for those with limited resources.

Benefits of Mining Pools

Mining pools dramatically increase the likelihood of solving a block and earning rewards compared to individual miners. This heightened probability is directly tied to the combined computational power of the pool. The pooled resources effectively amplify the mining effort, making it more competitive.

- Increased Earnings Potential: By pooling resources, miners collectively increase their hash rate, leading to a higher chance of finding a block and earning rewards. This translates to a more predictable and potentially higher return compared to solo mining.

- Reduced Risk of Losses: The risk of a miner’s hardware failing and losing potential rewards is significantly reduced within a pool. The collective effort mitigates individual risks.

- Shared Costs and Resources: Pools often offer shared infrastructure and resources, potentially lowering the overall cost of mining for participating members.

- Faster Block Solving: With a combined hash rate, mining pools can solve blocks faster than individual miners, earning rewards more frequently. This is a crucial advantage in competitive mining environments.

Mechanics of Mining Pools

Mining pools distribute the work of solving a block among participating miners. Each miner in the pool solves a portion of the complex mathematical problem, known as a “hash.” When a miner finds a valid hash, it signals this to the pool, which then verifies the solution.

- Hash Rate Calculation: The pool calculates the collective hash rate by summing the hash rates of all its participating miners. This determines the pool’s overall mining power and competitiveness.

- Reward Distribution: Mining rewards are distributed proportionally based on the contribution of each miner to the pool’s total hash rate. This ensures a fair allocation of rewards relative to the computational power each miner provides.

- Block Finding Probability: A mining pool’s probability of finding a block is directly related to its hash rate. A higher hash rate results in a higher chance of solving a block and receiving the associated rewards.

- Payment Processing: Pools often utilize a payment system to distribute rewards among their members based on their contributions.

Mining Pool Strategies

Different mining pools employ various strategies to manage their operations and distribute rewards. These strategies are often tailored to the specific needs and priorities of the pool’s members.

- Proportional Sharing: This strategy distributes rewards in direct proportion to the individual miner’s contribution to the pool’s hash rate. A miner with a higher hash rate receives a larger share of the rewards.

- Pay-per-Share (PPS): Under this strategy, each miner receives a fixed payment for each share (or portion of a block) they solve. The reward amount is not directly linked to their contribution to the hash rate.

- Other strategies: Some pools might offer different strategies, including tiered reward systems or other incentives to attract and retain miners.

Structure of a Mining Pool

A mining pool can be visualized as a central hub connecting numerous miners. This hub acts as a central processing point, receiving and validating the hash solutions submitted by each miner.

(Illustrative Diagram) A central server (the pool operator) manages the entire process. Numerous miners (clients) connect to this server, each contributing their computational power. The server receives the solved hashes from each miner and validates them. If a valid hash is found, the server allocates the block reward proportionally to each miner’s contribution.

Future Trends and Developments

The cryptocurrency mining landscape is constantly evolving, driven by technological advancements and market dynamics. Emerging trends are reshaping the industry, presenting both exciting opportunities and significant challenges for miners. Understanding these shifts is crucial for navigating the future of this sector.Technological advancements are poised to alter the very nature of mining, influencing its efficiency, profitability, and environmental footprint. AI and machine learning are emerging as key players, promising increased automation and optimization in the process.

These developments will likely drive a shift towards more specialized and sophisticated mining operations, impacting the competitive landscape and requiring adaptation from existing players.

Emerging Trends in Cryptocurrency Mining

The cryptocurrency mining industry is experiencing several key trends, including a push towards specialized hardware, the increasing importance of energy efficiency, and the emergence of new mining algorithms. These trends reflect the dynamic nature of the market and the constant search for competitive advantages.

- Specialized Hardware: The development of increasingly specialized and powerful ASICs (Application-Specific Integrated Circuits) continues. These chips are designed for specific cryptocurrency algorithms, leading to greater computational power and efficiency for mining. This specialization is leading to a greater division of labor within the mining community, with specialized firms focusing on particular cryptocurrencies.

- Energy Efficiency: The environmental impact of cryptocurrency mining is a growing concern. Miners are increasingly focused on energy-efficient solutions, including the use of renewable energy sources and the adoption of more energy-conscious hardware and cooling systems. Examples include the transition to hydroelectric power or the use of more efficient cooling techniques.

- New Mining Algorithms: The evolution of cryptocurrency protocols often introduces new mining algorithms. These new algorithms can demand different hardware capabilities, forcing miners to adapt their equipment and strategies to remain competitive. Examples include the transition from SHA-256 to other hashing algorithms, which require specialized ASICs.

Potential Impact of New Technologies

New technologies are significantly impacting the profitability and sustainability of cryptocurrency mining. These technologies, including cloud computing and specialized hardware, are altering the cost structure and accessibility of mining operations.

- Cloud Computing: Cloud-based mining solutions are becoming increasingly popular, offering access to powerful computing resources without the need for significant upfront capital investment. This democratizes access to mining, potentially leveling the playing field for smaller players.

- Specialized Hardware: Specialized hardware tailored to specific cryptocurrencies is becoming more readily available, further enhancing the efficiency and profitability of mining operations for those who invest in this specialized equipment.

Potential Challenges and Opportunities for the Future of Mining

The future of cryptocurrency mining presents both significant challenges and lucrative opportunities. Understanding these factors is essential for miners seeking to navigate the evolving landscape.

- Increased Competition: The increasing number of miners and the availability of advanced technologies are leading to increased competition for resources and profitability. This competition necessitates strategic adaptation and innovative solutions.

- Environmental Concerns: The environmental impact of cryptocurrency mining remains a significant concern, particularly the energy consumption associated with the process. Miners are facing growing pressure to adopt sustainable practices and reduce their carbon footprint.

Role of AI and Machine Learning in Mining

AI and machine learning are emerging as significant tools for optimizing cryptocurrency mining operations. These technologies offer the potential to automate various tasks, enhance prediction capabilities, and ultimately improve efficiency and profitability.

- Automated Tasks: AI can automate tasks like hardware monitoring, network optimization, and algorithm analysis, freeing up human resources for higher-level strategies.

- Predictive Analytics: AI algorithms can analyze market trends, predict future demand for specific cryptocurrencies, and adapt mining strategies accordingly.

Timeline of Significant Developments in Cryptocurrency Mining

A timeline of significant developments in cryptocurrency mining illustrates the industry’s evolution.

| Year | Event |

|---|---|

| 2009 | Bitcoin launched, initiating the first cryptocurrency mining operations. |

| 2010-2013 | Early adoption of GPU mining, increasing accessibility to mining. |

| 2014-present | Rise of ASIC mining, increased specialization, and environmental concerns. |

| Present-Future | Emerging trends of AI, cloud computing, and renewable energy integration into mining. |

Epilogue

In conclusion, cryptocurrency mining is a multifaceted process that combines technological prowess, economic considerations, and environmental concerns. Understanding the intricacies of mining, from the initial steps to the future trends, is essential for anyone interested in this rapidly evolving field. The rewards and risks are substantial, making it a topic of continuous discussion and debate.

FAQ Overview

What is the difference between Proof-of-Work and Proof-of-Stake mining?

Proof-of-Work relies on computational power to solve complex problems, while Proof-of-Stake uses the holder’s stake in the cryptocurrency to validate transactions. Proof-of-Work is generally more energy-intensive.

How much energy does cryptocurrency mining consume?

Energy consumption varies significantly depending on the cryptocurrency and mining method. Proof-of-Work methods are often criticized for their high energy usage.

Is cryptocurrency mining profitable?

Profitability depends on various factors, including the cryptocurrency’s price, mining difficulty, electricity costs, and the computational power available.

What are the security risks associated with cryptocurrency mining?

Risks include hardware failures, power outages, and the potential for malicious attacks. Robust security measures and careful planning are essential.