What is cryptocurrency? It’s a digital or virtual currency designed to work as a medium of exchange, secured by cryptography, and not subject to central authorities. This fascinating new financial system is built on complex concepts like blockchain technology and decentralized networks, offering potential benefits and risks for users.

This exploration delves into the world of cryptocurrencies, covering their history, technology, finance, security, regulation, and future prospects. We’ll examine how they function, their impact on the financial world, and the potential applications beyond just transactions.

Introduction to Cryptocurrency

Cryptocurrency represents a revolutionary shift in how value is exchanged and managed. It’s a digital or virtual form of currency that utilizes cryptography for security and operates independently of central banks. This digital alternative offers a decentralized and potentially more efficient financial system.Cryptocurrencies leverage blockchain technology, a distributed ledger system that records transactions across multiple computers. This decentralized nature makes them resistant to single points of failure and potentially reduces the risk of manipulation by central authorities.

The transparency inherent in blockchain further enhances security and trust among users.

Fundamental Principles of Cryptocurrency

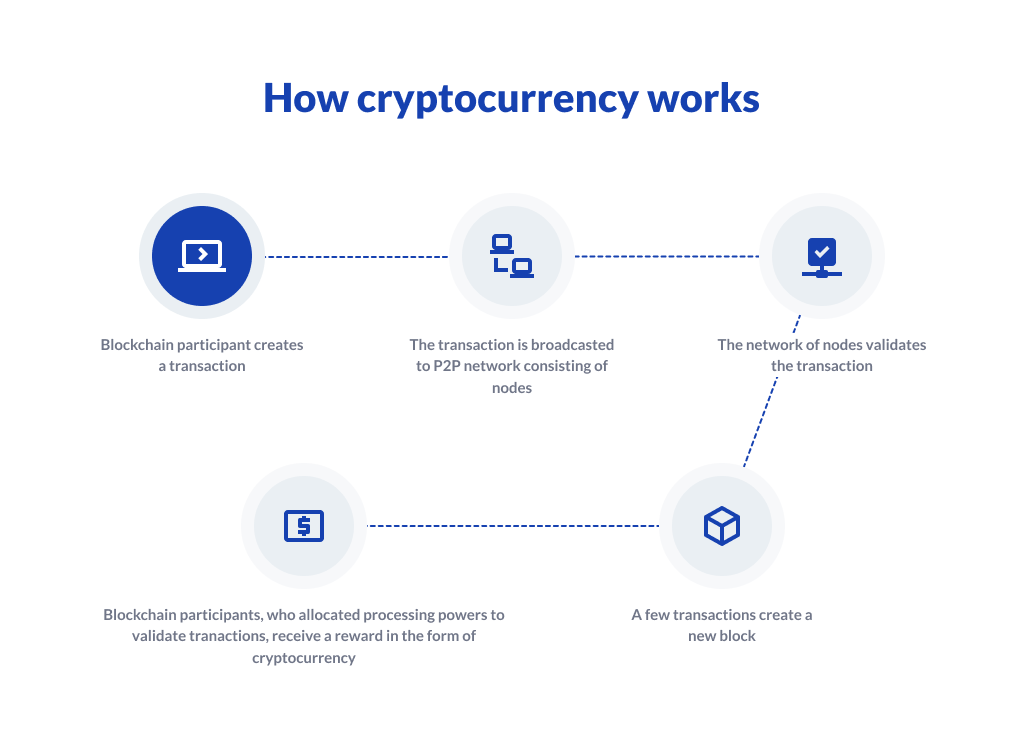

Cryptocurrencies are built upon several key principles. Decentralization, a fundamental aspect, removes the need for intermediaries like banks. Transactions are verified and recorded directly by participants on the network, enhancing efficiency and potentially lowering transaction costs. This is often facilitated by cryptography, which provides secure and verifiable transactions.

Different Types of Cryptocurrencies

A diverse range of cryptocurrencies exists, each with unique characteristics. Bitcoin, often considered the pioneer, is known for its scarcity and limited supply. Ethereum, on the other hand, focuses on smart contracts and decentralized applications (dApps). Stablecoins, like Tether, aim to maintain a stable value pegged to another asset, such as the US dollar, offering a potential solution to the volatility of other cryptocurrencies.

Process of Creating a Cryptocurrency

Creating a cryptocurrency involves a meticulous process of designing the underlying protocol, establishing the network’s rules, and securing the network’s operation. This usually involves the development of a consensus mechanism, which determines how transactions are verified and added to the blockchain. The creation often includes establishing a mining process, defining tokenomics (e.g., supply, distribution, and governance), and creating a community of users and developers.

Key Differences Between Cryptocurrency Types

| Cryptocurrency Type | Primary Function | Use Case | Notable Features |

|---|---|---|---|

| Bitcoin | Digital currency for transactions | Peer-to-peer payments, online purchases | Decentralized, limited supply |

| Ethereum | Platform for decentralized applications | Smart contracts, decentralized finance (DeFi) | Smart contract functionality, decentralized applications |

| Stablecoin | Maintain stable value relative to another asset | Hedging against volatility, facilitating transactions | Pegged to another asset, like the US dollar |

History and Evolution

Cryptocurrency’s journey has been remarkable, evolving from a theoretical concept to a global phenomenon impacting finance and technology. Its emergence was driven by a confluence of factors, including dissatisfaction with traditional financial systems and the desire for decentralized solutions. This evolution has been marked by key milestones, highlighting the rapid growth and adaptability of the technology.The early days of cryptocurrency were characterized by a focus on establishing the fundamental principles and technologies, laying the groundwork for future development.

This period saw the emergence of key figures and projects that shaped the landscape, demonstrating both the potential and the challenges of this nascent field. Factors like security concerns, regulatory hurdles, and market volatility have also played a role in shaping the trajectory of cryptocurrency.

Key Milestones in Cryptocurrency Development

The evolution of cryptocurrency is marked by pivotal events that propelled its adoption and influenced its trajectory. These events represent significant steps in the journey of this innovative technology.

- 2008: Satoshi Nakamoto published the Bitcoin whitepaper, outlining the concept of a decentralized digital currency. This seminal work laid the foundation for the entire cryptocurrency ecosystem, introducing the revolutionary idea of a peer-to-peer electronic cash system.

- 2009: The first Bitcoin transaction took place, marking a critical moment in the history of cryptocurrency. This event signifies the transition from theoretical concept to practical application.

- 2010-2017: The initial years saw the emergence of other cryptocurrencies, such as Litecoin and Ethereum, expanding the options available and introducing diverse functionalities. This period also witnessed significant price fluctuations and growing community interest.

- 2017-2021: The “crypto winter” and “crypto summer” phases demonstrate the volatility of the market, but also the increasing recognition of cryptocurrency. These periods showcased both the risks and the potential rewards inherent in this new financial paradigm.

- 2021-Present: The integration of blockchain technology into various sectors beyond finance, including supply chain management and voting systems, is a testament to its versatility and adaptability. The continued evolution and expansion of the ecosystem demonstrate the potential of blockchain technology in addressing global challenges.

Influential Factors in Cryptocurrency Growth

Several factors have influenced the rise and growth of cryptocurrency. Understanding these factors provides insight into the forces shaping the landscape.

- Decentralization: The desire for an alternative to traditional financial systems, which often suffer from centralized control and potential vulnerabilities, was a major driver. Cryptocurrency’s decentralized nature offered a compelling alternative.

- Technological Advancements: Innovations in blockchain technology, particularly in areas like consensus mechanisms and security protocols, have contributed significantly to the development and adoption of cryptocurrencies.

- Community and Adoption: The active and engaged cryptocurrency community played a crucial role in fostering adoption and spreading awareness about the technology. Early adopters and pioneers were essential in shaping the early landscape.

- Investment and Speculation: The potential for high returns and the allure of speculation attracted considerable investment, further accelerating the growth of the cryptocurrency market.

Timeline of Significant Events, What is cryptocurrency

The history of cryptocurrency is marked by a series of significant events that shaped its trajectory. A timeline helps to understand the sequence of developments.

- 2008: Bitcoin whitepaper published

- 2009: First Bitcoin transaction

- 2010: First Bitcoin exchange emerges

- 2013-2017: Rise and fall of cryptocurrency markets

- 2017: Ethereum launched

- 2021: Increased institutional adoption

Evolution of Key Cryptocurrency Technologies

A table illustrating the evolution of key cryptocurrency technologies across time offers a clear overview of the developments in the field.

| Year | Technology | Description |

|---|---|---|

| 2009 | Bitcoin | First decentralized digital currency, based on blockchain |

| 2011 | Litecoin | Alternative cryptocurrency, faster transaction speeds |

| 2015 | Ethereum | Decentralized platform for applications, smart contracts |

| 2017 | Blockchain 2.0 | Increased scalability and efficiency |

| 2021 | Layer-2 solutions | Improved transaction speeds and reduced costs |

Early Adopters and Pioneers

Early adopters and pioneers played a critical role in shaping the cryptocurrency landscape. Their contributions, both technical and community-driven, were instrumental in the development of this new technology.

- Satoshi Nakamoto: The pseudonymous creator of Bitcoin, whose contributions remain highly influential.

- Vitalik Buterin: The creator of Ethereum, who played a key role in developing smart contract technology.

- Other key developers and entrepreneurs: A multitude of individuals and teams contributed to the advancement of blockchain technology and cryptocurrencies.

Blockchain Technology

Blockchain technology forms the bedrock of many cryptocurrencies, offering a novel approach to secure and transparent data management. Its decentralized nature and inherent immutability are key features that distinguish it from traditional systems. This technology enables secure and verifiable transactions without the need for a central authority.

Core Concepts

Blockchain’s core concepts underpin its revolutionary capabilities. Cryptography ensures the security and integrity of transactions. Decentralization eliminates reliance on a single entity, fostering trust and transparency. Immutability, through cryptographic hashing, makes alterations to the blockchain virtually impossible, preserving data integrity.

Cryptography

Cryptographic hashing functions are fundamental to blockchain security. These functions create unique fingerprints for data blocks, ensuring any attempt to alter data within a block would change the hash, alerting the network to the tampering. Cryptographic techniques like asymmetric encryption secure transactions by using public and private keys, allowing secure transfer of assets and verifying the sender’s identity.

This cryptographic architecture is essential for maintaining the trust and security of the blockchain.

Decentralization

Blockchain’s decentralized nature removes the need for a central authority to manage transactions and validate data. Instead, the network of participants validates and records transactions, distributing control and enhancing security. This eliminates single points of failure and makes the system resilient to attacks targeting a central point of control.

Immutability

A critical aspect of blockchain technology is its immutability. Once a block is added to the chain, its data cannot be altered or deleted without compromising the entire chain’s integrity. This immutability is achieved through cryptographic hashing, where each block contains a hash of the previous block, creating a linked chain of data. The unchangeable nature of blockchain records makes it highly suitable for applications requiring tamper-proof records.

Security and Transparency in Cryptocurrency Transactions

Blockchain’s security relies on the cryptographic hashing of blocks and the consensus mechanisms employed by the network. The decentralized nature of the network ensures no single entity controls the validation process, increasing security against attacks. Transparency arises from the public nature of the blockchain, where all transactions are visible to the network participants. This transparency enhances trust and accountability in the cryptocurrency ecosystem.

Creating and Verifying a Block

The process of creating a block involves several steps. First, transactions are grouped together. Then, a cryptographic hash of the previous block and the transactions is calculated. This hash, along with timestamp and other metadata, forms the new block header. This block is then added to the blockchain.

Verification occurs through the consensus mechanism employed by the network, where multiple participants validate the new block and its transactions.

Beyond Cryptocurrency

Blockchain’s application extends far beyond cryptocurrencies. Supply chain management benefits from the secure and transparent tracking of goods. Healthcare records can be stored and shared securely. Voting systems can be enhanced by the immutability of blockchain records. Digital identity management offers a secure and verifiable method of identification.

Blockchain vs. Traditional Database Systems

| Feature | Blockchain | Traditional Database |

|---|---|---|

| Data Structure | Linked chain of blocks | Hierarchical or relational |

| Data Modification | Immutable; new blocks added | Data can be modified, deleted, or updated |

| Data Validation | Decentralized; network consensus | Centralized; managed by a database administrator |

| Security | High due to cryptographic hashing and consensus | Security varies; vulnerable to attacks on the central server |

| Transparency | Public; all transactions visible | Often private; limited access to data |

Cryptocurrencies and Finance

Cryptocurrencies are increasingly integrated into the global financial landscape, presenting both opportunities and challenges for traditional financial systems. Their decentralized nature and potential for disrupting established processes have spurred significant interest and investment. This section delves into the role of cryptocurrencies in finance, examining their relationship with traditional currencies, and analyzing the advantages and disadvantages of using them in transactions.

Investment strategies for cryptocurrencies are also contrasted with traditional investment approaches.

The Role of Cryptocurrency in the Financial System

Cryptocurrencies are emerging as a significant alternative to traditional financial instruments. Their decentralized nature offers potential benefits in terms of reduced transaction costs and improved accessibility. However, the lack of central regulation and oversight raises concerns regarding security and stability. Furthermore, their volatility presents unique challenges for investors.

The Relationship Between Cryptocurrency and Traditional Currencies

The relationship between cryptocurrencies and traditional currencies is complex and evolving. Cryptocurrencies function as alternative payment systems, potentially offering competitive advantages in cross-border transactions or in regions with limited access to traditional banking services. However, they often exhibit greater volatility than fiat currencies, making them unsuitable for everyday transactions in many contexts. This volatility makes their value highly dependent on market forces and speculative activity.

Potential Advantages and Disadvantages of Using Cryptocurrency in Financial Transactions

Cryptocurrency transactions often feature lower transaction fees compared to traditional methods, particularly for international transfers. This efficiency can be a significant advantage for businesses and individuals. However, the volatility of cryptocurrencies can lead to substantial losses if not carefully managed, as the value of cryptocurrencies fluctuates significantly. Security concerns surrounding crypto exchanges and wallets also pose a risk.

The lack of central oversight and the anonymity associated with some cryptocurrencies also create potential risks for money laundering and other illicit activities.

Comparison of Cryptocurrency Investment Strategies with Traditional Investments

Cryptocurrency investment strategies differ significantly from traditional investments. While traditional investments often focus on long-term growth and diversification, cryptocurrency investments are frequently associated with short-term gains and high risk. Investors often prioritize factors such as market sentiment and technical analysis over fundamental factors, as seen in the rapid price swings in the cryptocurrency market.

Methods for Buying and Selling Cryptocurrencies

Various methods exist for acquiring and selling cryptocurrencies. The selection of a method often depends on factors like convenience, security, and transaction fees.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Crypto Exchanges | Centralized platforms facilitating cryptocurrency trading. | Ease of use, wide selection of cryptocurrencies, liquidity. | Security risks, potential for hacking, regulations vary. |

| Over-the-Counter (OTC) Trading | Direct transactions between buyers and sellers outside of centralized exchanges. | Potentially lower fees, greater control over transactions. | Higher risk of fraud, limited liquidity, less transparency. |

| Peer-to-Peer (P2P) Trading | Direct transactions between individuals using various platforms. | Potentially lower fees, flexibility in terms of payment methods. | Higher risk of scams, security concerns related to individual transactions. |

| Brokerage Platforms | Platforms offering both traditional and cryptocurrency investments. | One-stop shop for investment, established platform security. | Potential for higher fees, less focused on crypto-specific expertise. |

Security and Risks

Cryptocurrency transactions, while offering potential benefits, come with inherent security risks. Understanding these risks and implementing appropriate security measures is crucial for safeguarding investments. This section delves into the security protocols used in cryptocurrency transactions, potential investment pitfalls, common threats, and best practices for protecting your digital assets.

Security Measures in Cryptocurrency Transactions

Cryptocurrency transactions rely on cryptographic techniques for security. These techniques, combined with decentralized ledger technology, aim to ensure the integrity and immutability of transactions. Public-key cryptography, a cornerstone of many cryptocurrencies, allows for secure communication and verification without compromising the privacy of users.

Potential Risks Associated with Cryptocurrency Investment

Cryptocurrency investment, while promising, is not without its risks. Market volatility is a significant concern, as the value of cryptocurrencies can fluctuate dramatically in short periods. The decentralized nature of cryptocurrencies, while a strength, also means that there is no central authority to oversee or regulate the market. Scams and fraudulent activities also pose significant threats to investors.

Furthermore, regulatory uncertainty can lead to unforeseen legal implications.

Common Security Threats and Vulnerabilities

The cryptocurrency ecosystem faces various security threats. Phishing attacks, where attackers attempt to trick users into revealing private keys or login credentials, are a significant concern. Malware, designed to steal or compromise cryptocurrency wallets, is another common threat. Exchange hacks, where attackers exploit vulnerabilities in cryptocurrency exchanges, can lead to substantial financial losses for users. The lack of regulatory oversight in some jurisdictions can further exacerbate these risks.

Examples of Security Protocols Used by Various Cryptocurrencies

Different cryptocurrencies employ various security protocols. Bitcoin, for instance, utilizes Proof-of-Work, a consensus mechanism that requires significant computational power to validate transactions. Ethereum employs a different mechanism, called Proof-of-Stake, which uses staked cryptocurrencies to validate transactions. Other cryptocurrencies utilize various hybrid or unique approaches to security and consensus.

Protecting Your Cryptocurrency Assets

Protecting your cryptocurrency assets requires a multi-faceted approach. Use strong, unique passwords for your wallets and accounts. Enable two-factor authentication (2FA) wherever possible. Regularly monitor your accounts for suspicious activity. Avoid clicking on suspicious links or downloading untrusted software.

Consider using hardware wallets to securely store your private keys offline. Educate yourself about common security threats to better protect yourself.

Importance of Secure Wallets

Secure wallets are critical for safeguarding cryptocurrency assets. These wallets store private keys, which are essential for accessing and controlling your cryptocurrency. Choosing a reputable and secure wallet is paramount to preventing unauthorized access. Hardware wallets offer an extra layer of security by storing private keys offline.

Regulatory Landscape and Cryptocurrency

The regulatory landscape surrounding cryptocurrencies is still evolving. Different jurisdictions have varying approaches to regulating cryptocurrencies, leading to complexities for investors. The lack of consistent global regulations can create uncertainties in the market. This evolving regulatory landscape should be carefully considered by potential investors.

Regulation and Legal Aspects: What Is Cryptocurrency

The burgeoning cryptocurrency market presents unique challenges for regulators worldwide. Existing financial regulations often struggle to adapt to the decentralized and borderless nature of cryptocurrencies. This necessitates the development of tailored legal frameworks that balance innovation with investor protection and financial stability. Different jurisdictions are approaching this challenge with varying degrees of success and ambition.The lack of a globally standardized regulatory approach creates uncertainty for businesses operating across borders and for investors seeking clarity on their rights and responsibilities.

Consequently, this regulatory void can impede the broader adoption of cryptocurrencies and hinder the growth of related industries. This section will delve into the current regulatory landscape, examining the legal frameworks in different jurisdictions and the significant challenges involved in governing this evolving sector.

Regulatory Landscape Surrounding Cryptocurrency

The regulatory landscape surrounding cryptocurrencies is fragmented and dynamic, reflecting the diverse approaches of different jurisdictions. No single, universally accepted framework currently exists. Some countries have embraced a cautious approach, while others have opted for more proactive regulations. This varied approach reflects the ongoing debate about the appropriate balance between fostering innovation and mitigating risks.

Legal Frameworks Concerning Cryptocurrency Transactions

Different countries have implemented various legal frameworks to address cryptocurrency transactions. Some countries have treated cryptocurrencies as securities, while others have classified them as commodities or as something distinct from traditional financial assets. This has resulted in varied legal treatment for cryptocurrency exchanges, transactions, and related activities.

- The United States, for example, employs a multifaceted approach, with different agencies – such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) – playing a role in regulating different aspects of the cryptocurrency market. This often leads to overlapping jurisdictions and inconsistencies in the application of rules.

- In contrast, some countries in Europe have adopted more harmonized approaches, aiming for a unified framework to address the regulatory challenges presented by cryptocurrencies. However, the implementation and enforcement of these rules across different European Union member states remain a subject of ongoing discussion.

Challenges and Complexities of Regulating Cryptocurrency

Regulating cryptocurrencies presents numerous challenges. The decentralized nature of cryptocurrencies, their borderless transactions, and the rapidly evolving technological landscape pose significant hurdles for traditional regulatory bodies. Furthermore, the lack of a clear legal definition of cryptocurrencies in many jurisdictions contributes to the complexity.

- The anonymity associated with some cryptocurrencies and the potential for illicit activities necessitate robust anti-money laundering (AML) and counter-terrorism financing (CTF) measures, often requiring international cooperation. These measures are challenging to implement due to the nature of decentralized ledger technology.

- The rapid evolution of the technology, with new cryptocurrencies and applications emerging constantly, necessitates regulatory agility and the ability to adapt quickly to the changing landscape. This is a continuous process requiring vigilance and proactive policymaking.

Examples of Current Regulations and Policies on Cryptocurrency

Numerous countries are actively developing or implementing regulations and policies pertaining to cryptocurrencies. These policies vary widely based on the specific context and priorities of each jurisdiction. The goal in many cases is to strike a balance between fostering innovation and protecting investors.

- Many countries are adopting a “wait-and-see” approach, carefully observing the market’s evolution and potential risks before enacting stringent regulations.

- The European Union is exploring harmonized regulations for crypto assets, recognizing the need for a common framework to address the complexities and potential risks.

Potential Legal Implications of Cryptocurrency Adoption

The widespread adoption of cryptocurrencies carries significant legal implications, impacting various sectors and industries. It is crucial to anticipate and address these implications to ensure a stable and predictable regulatory environment.

- Intellectual property rights related to cryptocurrency projects and associated technologies, such as blockchain patents, are increasingly relevant and require careful legal consideration.

- Taxation of cryptocurrency gains and losses poses complex legal questions, requiring clear guidelines and rules to prevent tax evasion and ensure fair treatment for all stakeholders.

Mining and Consensus Mechanisms

Cryptocurrency mining is a crucial process for validating transactions and adding new blocks to the blockchain. Different cryptocurrencies employ various consensus mechanisms to achieve this validation, each with its own strengths and weaknesses. Understanding these mechanisms is essential for evaluating the security and efficiency of a cryptocurrency.The process of mining involves solving complex mathematical problems to validate transactions and add new blocks to the blockchain.

This process requires significant computational power and energy, which has become a subject of discussion due to the environmental impact. The consensus mechanism determines how these blocks are validated and added to the chain, ensuring a consistent and secure record of transactions.

Cryptocurrency Mining Process

The process of mining involves a complex series of steps to add new blocks to the blockchain. Nodes compete to solve cryptographic puzzles to validate transactions. The first node to successfully solve the puzzle adds the block to the blockchain and receives a reward. This process ensures that transactions are recorded in a secure and verifiable manner.

Consensus Mechanisms

Different cryptocurrencies employ various consensus mechanisms to ensure the integrity and security of the blockchain. These mechanisms determine how transactions are validated and new blocks are added to the chain.

- Proof-of-Work (PoW): This mechanism requires significant computational power to solve complex mathematical problems. Bitcoin utilizes PoW. The computational effort involved in solving these puzzles acts as a deterrent to malicious actors. Examples include Bitcoin, Litecoin, and Ethereum (before the transition to Proof-of-Stake).

- Proof-of-Stake (PoS): This mechanism requires validators to hold a certain amount of the cryptocurrency. Validators are randomly selected to add new blocks to the blockchain, based on their stake. This reduces the energy consumption compared to PoW. Examples include Cardano, Tezos, and Polkadot.

- Delegated Proof-of-Stake (DPoS): This mechanism allows a pre-determined set of validators to add new blocks to the blockchain. These validators are elected by the community, and the process is designed to be more efficient than PoW or PoS. Examples include EOS and Lisk.

Energy Consumption of Mining

The computational power required for mining cryptocurrencies using PoW consensus mechanisms has a substantial environmental impact. Large-scale mining operations often utilize specialized hardware and require considerable energy to operate. This energy consumption raises concerns about the environmental sustainability of certain cryptocurrencies.

| Consensus Mechanism | Energy Consumption | Explanation |

|---|---|---|

| Proof-of-Work (PoW) | High | Requires significant computational power to solve complex problems, often leading to high energy consumption. |

| Proof-of-Stake (PoS) | Low | Validators are selected based on their stake, requiring less energy compared to PoW. |

| Delegated Proof-of-Stake (DPoS) | Moderate | A balance between PoW and PoS, generally lower than PoW but higher than PoS in some cases. |

Comparison of Consensus Mechanisms

Comparing PoW and PoS mechanisms reveals key differences in their approach to security and energy consumption. PoW relies on the computational power of miners, which can lead to substantial energy consumption. PoS, on the other hand, relies on the stake held by validators, potentially leading to reduced energy consumption. The choice of mechanism often depends on the specific priorities of the cryptocurrency project.

Use Cases and Applications

Cryptocurrency’s utility extends far beyond simple financial transactions. Its decentralized nature and inherent transparency are enabling innovative applications across various sectors. This section explores the diverse ways cryptocurrency is being employed and its potential impact on different industries. From remittances to micropayments, the possibilities are continually evolving.Beyond its initial purpose as a digital currency, cryptocurrency is increasingly being adopted for a wide range of purposes.

This adoption is driven by its potential to streamline processes, reduce costs, and enhance security.

Remittances and Micropayments

The speed and low transaction fees associated with many cryptocurrencies make them attractive for international remittances. Individuals can send money across borders more efficiently and cost-effectively than traditional methods. This is particularly beneficial for those in regions with limited or unreliable banking infrastructure. Furthermore, the potential for micropayments is significant. These small-value transactions can facilitate new business models, such as peer-to-peer content sharing and micro-services.

Supply Chain Management

Cryptocurrency’s transparency and immutability can improve supply chain efficiency. By tracking goods throughout the supply chain using blockchain technology, companies can enhance traceability and reduce fraud. This increased visibility allows for better inventory management, reduced waste, and greater accountability. The potential to automate and secure transactions, further streamlining the process, is a significant benefit.

Voting and Civic Engagement

Cryptocurrency can enhance transparency and security in voting processes. Blockchain technology can create a secure and auditable record of votes, reducing the risk of fraud and manipulation. This has the potential to improve voter confidence and participation in elections. The decentralized nature of cryptocurrency can also empower citizens to participate in decision-making processes in a more direct and efficient manner.

Digital Identity and Access Control

Cryptocurrency can facilitate secure and efficient digital identity management. By using cryptographic keys and blockchain technology, individuals can control their digital identities and access to services. This offers greater control and privacy compared to centralized systems. The potential for secure authentication and access control opens new avenues for digital services and online interactions.

Art and Collectibles

Cryptocurrency is being used to facilitate the sale and ownership of digital art and collectibles. Blockchain technology provides a secure and transparent platform for verifying ownership and provenance. This has led to new opportunities for artists and collectors to engage in the digital art market. The authenticity and immutability of blockchain records can also provide significant value to these assets.

Table Summarizing Diverse Applications

| Application Area | Description | Impact |

|---|---|---|

| Remittances | Facilitating cross-border money transfers | Reduced fees, increased speed |

| Micropayments | Enabling small-value transactions | New business models, increased efficiency |

| Supply Chain | Tracking goods throughout the supply chain | Enhanced traceability, reduced fraud |

| Voting | Securing and enhancing voting processes | Increased transparency, reduced manipulation |

| Digital Identity | Managing digital identities securely | Enhanced control, increased privacy |

| Art/Collectibles | Facilitating the sale of digital art | Secure ownership, verified provenance |

Future Trends and Predictions

The cryptocurrency market, a dynamic and rapidly evolving landscape, is poised for significant transformations in the years ahead. Technological advancements, regulatory shifts, and evolving user adoption patterns will shape the future of cryptocurrencies and their integration into broader financial systems. Understanding these potential developments is crucial for navigating this complex environment.The future trajectory of cryptocurrencies hinges on factors like the development and adoption of new technologies, the evolving regulatory environment, and the increasing sophistication of users.

This section will delve into potential future developments, exploring the likely impact of these trends on the cryptocurrency ecosystem.

Potential Future Developments in the Cryptocurrency Market

The cryptocurrency market is characterized by innovation and constant evolution. Several factors suggest potential future developments, including the growing adoption of cryptocurrencies by mainstream institutions, the expansion of decentralized finance (DeFi) applications, and the increasing use of blockchain technology in various sectors.

- Institutional Adoption: Major financial institutions are increasingly exploring the potential of cryptocurrencies. This trend suggests a growing acceptance of cryptocurrencies as legitimate investment assets and a possible integration into traditional financial infrastructure. Examples include banks experimenting with crypto custody solutions and institutional investors exploring opportunities in the cryptocurrency market.

- Decentralized Finance (DeFi) Expansion: DeFi protocols are experiencing rapid growth and development. The potential future of DeFi lies in its ability to offer more sophisticated financial products and services, potentially disintermediating traditional financial institutions. The expanding range of DeFi applications, such as lending, borrowing, and trading, could revolutionize how financial services are delivered.

- Blockchain Technology Integration: Blockchain technology is showing promise in a variety of sectors beyond cryptocurrency. Future applications of blockchain extend to supply chain management, healthcare, and voting systems, among others. The adaptability and versatility of blockchain technology suggest a growing integration into various industries, leading to increased efficiency and transparency.

The Future of Blockchain Technology

Blockchain technology, the underlying infrastructure of many cryptocurrencies, is evolving rapidly. The potential implications of these advancements extend far beyond the cryptocurrency realm.

- Scalability Improvements: Many blockchain networks face challenges in handling a large number of transactions. Ongoing research and development focus on enhancing scalability, aiming to improve transaction speeds and reduce transaction fees. This will likely lead to greater mainstream adoption, especially in areas requiring high transaction volumes.

- Enhanced Security Measures: As the use of blockchain technologies grows, the importance of robust security measures increases. Future development will likely focus on mitigating vulnerabilities and enhancing the resilience of blockchain networks to attacks.

- Interoperability Solutions: Different blockchain networks often operate in isolation. Future blockchain development will likely focus on creating solutions that allow different blockchain networks to communicate and interact, facilitating seamless data exchange and interoperability. This will enable broader applications and adoption.

Impact of Technological Advancements

Technological advancements are significantly impacting the cryptocurrency ecosystem. These advancements often drive innovation and create new opportunities.

- Artificial Intelligence (AI): AI is being integrated into various aspects of the cryptocurrency market, from algorithmic trading to fraud detection. AI-powered tools can analyze vast amounts of data, leading to more informed investment decisions and enhanced security measures. The impact of AI in this sector is likely to increase in the future.

- Internet of Things (IoT): IoT devices are becoming increasingly prevalent, and blockchain technology has the potential to enhance data security and transparency in IoT networks. This is opening up new avenues for cryptocurrency application, particularly in sectors such as supply chain management.

Likely Future Trends of Cryptocurrency Regulation

Cryptocurrency regulation is evolving at a rapid pace as governments worldwide grapple with the implications of this new technology.

- Gradual Standardization: As the adoption of cryptocurrencies grows, governments are likely to establish clearer regulatory frameworks. This trend towards standardization will provide greater clarity and security for investors and businesses.

- Differentiated Approaches: Different jurisdictions will likely adopt varying regulatory approaches, reflecting their unique economic and social contexts. This will lead to a complex patchwork of regulations across the globe.

User Experience and Adoption

Cryptocurrency adoption hinges significantly on the user experience. A seamless and intuitive interface is crucial for attracting and retaining users. This section explores the complexities of interacting with crypto platforms, highlighting the factors that drive adoption and the obstacles that hinder it.

User Experience on Cryptocurrency Platforms

The user experience across cryptocurrency platforms varies widely. Ease of navigation, clarity of information, and security features all contribute to the overall user experience. Platforms often feature dashboards for monitoring portfolios, facilitating transactions, and providing access to relevant information. Well-designed platforms provide clear pathways for users to complete transactions, while poor design can deter users.

Factors Influencing Cryptocurrency Adoption

Several factors influence the adoption of cryptocurrency. These include factors such as perceived security, ease of use, and the perceived value proposition of cryptocurrencies. Growing awareness of cryptocurrencies, fueled by media coverage and increased accessibility through user-friendly platforms, has significantly influenced adoption. Additionally, favorable regulatory environments in some jurisdictions contribute to the growth and adoption of cryptocurrencies.

Barriers to Widespread Cryptocurrency Adoption

Despite the growing interest, several barriers impede widespread adoption. Volatility remains a significant concern for many potential users. The complexities associated with technical aspects, such as understanding blockchain technology and different cryptocurrencies, deter many. Regulatory uncertainty in various jurisdictions, coupled with a lack of clear legal frameworks, also creates apprehension among potential adopters.

User Interfaces for Cryptocurrency Exchanges

Cryptocurrency exchanges utilize diverse user interfaces. Modern exchanges employ intuitive interfaces for navigating various sections such as trading, portfolio management, and order placement. These interfaces often include real-time market data displays, charts, and order books, enhancing the user’s ability to execute trades efficiently. A crucial element of exchange interfaces is the ability to securely store user funds.

User Interactions with Crypto Wallets

Cryptocurrency wallets are integral to user interactions. Different wallet types offer varying levels of security and features. Software wallets, accessible via computers or mobile devices, allow for easy management of crypto assets. Hardware wallets, typically physical devices, provide enhanced security by storing private keys offline. Users interact with wallets for sending, receiving, and storing cryptocurrencies.

Final Wrap-Up

In conclusion, cryptocurrency represents a revolutionary shift in finance, with the potential to reshape how we think about money and transactions. While it presents unique challenges and risks, understanding its underlying principles and potential applications is crucial for navigating this emerging landscape. From the early adopters to the latest technological advancements, this discussion offers a comprehensive overview of this evolving digital realm.

Top FAQs

What are some common use cases for cryptocurrency beyond financial transactions?

Cryptocurrency can be used for remittances, micropayments, and in various industries like supply chain management and voting systems. Its decentralized nature allows for faster and potentially cheaper transactions compared to traditional methods.

What are the main security risks associated with cryptocurrency investments?

Security risks include hacking, scams, and the volatility of the market. It’s crucial to understand the security measures employed by different cryptocurrencies and platforms, as well as protecting your private keys and storing your assets securely.

How does blockchain technology differ from traditional database systems?

Blockchain’s decentralized and immutable nature contrasts sharply with traditional databases, which are centralized and can be altered. This inherent structure provides enhanced security and transparency for cryptocurrency transactions.

What are the different consensus mechanisms used in cryptocurrencies?

Different consensus mechanisms like Proof-of-Work and Proof-of-Stake govern how transactions are verified on the blockchain. Each method has its own advantages and disadvantages in terms of energy consumption and security.