Ripple cryptocurrency prediction hinges on a multitude of factors, from Ripple’s current market standing to macroeconomic influences and technological advancements. This analysis delves into Ripple’s current position, its future prospects, and the competitive landscape to offer a comprehensive understanding of the potential for XRP.

Examining Ripple’s current market position reveals a dynamic environment. Recent price fluctuations and trends, alongside Ripple’s market share compared to other major cryptocurrencies, provide valuable context. Furthermore, understanding Ripple’s role in the broader fintech sector is essential for evaluating its future trajectory. This analysis considers Ripple’s core technology, innovations in payment processing, and its historical development to predict potential growth.

Ripple’s Current Market Position

Ripple, a prominent player in the financial technology sector, currently holds a significant position in the cryptocurrency market. Its market capitalization and trading volume reflect its influence, although these metrics are subject to change based on market fluctuations. Recent trends in XRP’s price and overall market sentiment significantly impact Ripple’s standing.

Market Capitalization and Trading Volume

Ripple’s market capitalization fluctuates, reflecting the dynamism of the cryptocurrency market. Data from reputable sources like CoinMarketCap provide insights into these metrics. The trading volume for XRP mirrors the level of activity surrounding the cryptocurrency, and its volume is a vital indicator of market interest.

Recent Price Fluctuations and Trends

XRP’s price has experienced considerable volatility in recent times, influenced by various factors such as regulatory developments, market sentiment, and overall crypto market performance. These fluctuations often lead to short-term price swings, but longer-term trends can be identified by examining historical data and current news surrounding the cryptocurrency.

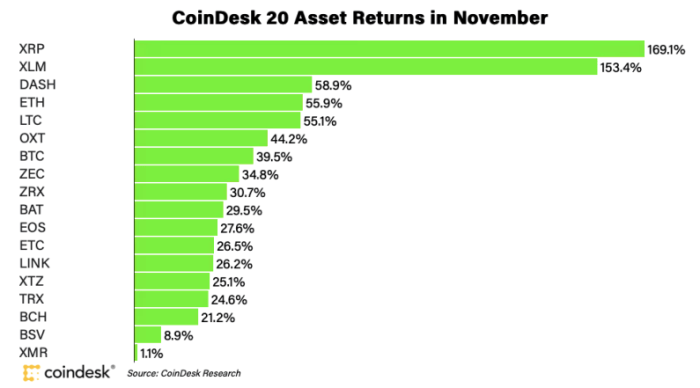

Market Share Comparison

Ripple’s market share in the cryptocurrency market is a subject of ongoing analysis and discussion. Compared to other major cryptocurrencies, Ripple’s market share can be assessed by analyzing the respective market capitalizations and trading volumes. Factors such as adoption rates, investor interest, and the breadth of applications contribute to the overall market share dynamics.

Ripple’s Role in the Fintech Sector

Ripple’s innovative solutions in cross-border payments and real-time financial transactions have made it a significant player in the fintech landscape. Ripple’s core technology aims to enhance efficiency and reduce costs in global financial operations. The company’s approach to cross-border payments is gaining traction in the industry.

Key Partnerships and Collaborations

Ripple’s success is intrinsically linked to its strategic partnerships and collaborations within the financial sector. These partnerships represent potential for expansion and adoption of Ripple’s technology.

| Partner | Collaboration Type | Description |

|---|---|---|

| American Express | Strategic Partnership | Amex leverages Ripple’s technology for faster and cheaper cross-border payments. |

| MoneyGram | Partnership | MoneyGram uses Ripple’s platform to improve its payment services. |

| Banco do Brasil | Partnership | Banco do Brasil utilizes Ripple’s technology for global transactions. |

| Banco Santander | Partnership | Santander utilizes Ripple’s technology to enhance its cross-border payment services. |

| Standard Chartered Bank | Partnership | Standard Chartered Bank employs RippleNet to optimize global transactions. |

Ripple’s Technological Advancements

Ripple’s technology, known as XRP Ledger, aims to revolutionize cross-border payments by offering a faster, cheaper, and more efficient alternative to traditional methods. Its core functionality revolves around a distributed ledger system, enabling near-instantaneous transactions. This has the potential to significantly impact businesses operating globally.Ripple’s core technology, the XRP Ledger, leverages a distributed ledger system, which facilitates secure and transparent transactions.

This system offers advantages over traditional payment systems, allowing for faster processing times and lower transaction costs. This is especially beneficial for international transactions.

Ripple’s Core Technology and Cross-Border Payments

The XRP Ledger, Ripple’s core technology, is a distributed ledger that allows for the near-instantaneous transfer of value globally. It operates independently of any central authority, providing a decentralised system for secure financial transactions. This feature is a key differentiator compared to traditional banking systems, which often rely on intermediaries and complex processes. This decentralization is critical for facilitating efficient cross-border payments, minimizing delays and costs associated with traditional banking channels.

Innovations in Payment Processing and Benefits for Businesses

Ripple’s innovative payment processing system offers significant advantages for businesses. It streamlines the process, enabling faster transaction times and reduced costs, particularly in cross-border transactions. The automation inherent in the system reduces manual intervention, leading to improved efficiency and reduced risk of errors. This benefit translates into increased operational efficiency and cost savings for businesses, especially those engaged in international trade or remittances.

For example, a multinational corporation sending funds to a subsidiary in a different country can benefit from the speed and lower cost offered by Ripple’s system compared to traditional banking wire transfers.

Historical Development of Ripple’s Protocol and Key Improvements

Ripple’s protocol has undergone several iterations since its inception, constantly evolving to address emerging challenges and enhance functionality. Early versions focused primarily on cross-border payment solutions. Subsequent improvements have focused on scalability, security, and enhanced interoperability with existing financial systems. This evolution demonstrates a commitment to addressing the needs of the global financial landscape. The protocol’s history showcases a continuous improvement process that prioritizes innovation.

Strengths and Weaknesses Compared to Competitors

Ripple’s strengths lie in its speed, efficiency, and potential for global reach in cross-border payments. Its technology is designed to bypass traditional banking infrastructure, potentially reducing transaction times and fees. However, Ripple faces challenges regarding regulatory scrutiny and market acceptance. Competitors like SWIFT and other blockchain platforms offer similar capabilities, presenting a competitive landscape. The key differentiators often lie in the specific use cases and the level of integration with existing financial systems.

Technical Specifications of Ripple’s Network

| Specification | Details |

|---|---|

| Transaction Speed | Near real-time processing, typically within seconds. |

| Transaction Cost | Potentially lower than traditional banking methods, especially for high-volume transactions. |

| Security | Built on cryptographic principles, designed for secure data transfer and validation. |

| Scalability | Designed to handle a large volume of transactions. |

| Interoperability | Designed to connect with existing financial systems, facilitating integration with diverse platforms. |

The table above provides a concise overview of Ripple’s network technical specifications. These factors contribute to its potential to disrupt traditional financial systems.

Macroeconomic Factors Influencing Ripple

Ripple’s price performance is intricately linked to broader economic trends. Global economic conditions, regulatory shifts, and institutional investment activity all play a significant role in shaping the cryptocurrency market’s overall trajectory, and Ripple’s value in particular. Understanding these influences is crucial for assessing potential future performance.

Impact of Global Economic Conditions on Cryptocurrency Markets

Global economic conditions, including interest rates, inflation, and recessionary pressures, exert a substantial influence on cryptocurrency markets. Periods of economic uncertainty or downturn often see increased volatility in crypto assets as investors seek alternative investment avenues. Conversely, robust economic growth can stimulate investor interest and potentially drive prices upward. For example, during the 2020 COVID-19 pandemic, the initial uncertainty and subsequent stimulus packages led to increased speculation and investment in digital assets, including Ripple.

Influence of Regulatory Changes and Policies on Ripple’s Value

Regulatory environments significantly impact cryptocurrency valuations. Positive regulatory developments, such as clearer legal frameworks for cryptocurrencies, can enhance investor confidence and potentially lead to price appreciation. Conversely, regulatory crackdowns or ambiguous legislation can trigger market uncertainty and volatility. The evolving regulatory landscape surrounding cryptocurrencies globally is dynamic and constantly in flux, and it’s a major factor in Ripple’s price fluctuations.

Overview of the Current Regulatory Landscape Surrounding Cryptocurrencies Globally

The regulatory landscape for cryptocurrencies is fragmented and diverse across jurisdictions. Some countries have embraced cryptocurrencies with clear regulatory frameworks, while others have adopted a more cautious approach, or are still developing their regulatory structures. This disparity in regulatory frameworks contributes to the global volatility of the cryptocurrency market. For instance, the US Securities and Exchange Commission (SEC) has taken a firm stance on certain cryptocurrencies, while other jurisdictions have taken a more accommodating approach.

Influence of Institutional Investors on the Cryptocurrency Market and Ripple

Institutional investors are increasingly entering the cryptocurrency market, driving significant price action. Their large-scale investments can influence market trends and create substantial demand for certain cryptocurrencies. The involvement of institutional investors in Ripple is likely to have a notable impact on its price.

Correlation between Major Market Indexes and Ripple’s Price

The correlation between major market indexes and Ripple’s price is complex and not always consistent. Some studies indicate a potential correlation with specific indexes, while others suggest a more independent movement. It’s crucial to analyze these correlations in the context of broader economic trends.

| Market Index | Correlation with Ripple Price (Estimated) | Rationale |

|---|---|---|

| S&P 500 | Moderate Positive | Often correlated with overall market sentiment. |

| Nasdaq Composite | Moderate Positive | Often correlated with technology sector sentiment, which can impact crypto. |

| Gold Price | Moderate Negative | Historically, gold is considered a safe haven asset. |

| Bitcoin Price | High Positive | Often correlated with other cryptocurrencies. |

Note: Correlation values are estimated and subject to change. The table provides a general overview and does not represent a definitive prediction.

Ripple’s Future Prospects

Ripple’s future hinges on its ability to adapt to evolving market dynamics and capitalize on emerging opportunities. While its current market position is noteworthy, sustained growth requires a strategic approach to adoption and innovation. The cryptocurrency landscape is highly competitive, demanding a proactive and adaptable stance from Ripple to maintain relevance.

Potential for Wider Adoption

Ripple’s technology, particularly its payment solutions, holds promise for wider adoption within the financial sector. Its platform’s speed and efficiency, combined with its ability to facilitate cross-border transactions, are attractive features. However, achieving broader acceptance will necessitate addressing regulatory uncertainties and fostering stronger partnerships with financial institutions globally. Successfully navigating these challenges will be critical to expanding Ripple’s reach.

Future Applications and Impact on Financial Institutions

Ripple’s technology has the potential to transform how financial institutions conduct cross-border transactions. It can reduce processing times and costs, leading to increased efficiency and profitability for businesses. Furthermore, Ripple’s platform could enhance the security and transparency of international payments, mitigating risks associated with traditional methods. This transformation could impact various sectors, from international trade to remittances.

Key Factors Driving Ripple’s Growth or Decline

Several factors will influence Ripple’s future trajectory. Stronger regulatory clarity and favorable regulatory environments globally will be crucial. Strategic partnerships with major financial institutions will further solidify Ripple’s position and provide access to new markets. Continued innovation in its platform and adaptation to changing market trends are also critical. Conversely, competition from other cryptocurrencies and emerging technologies, as well as regulatory headwinds, could hinder Ripple’s growth.

The crypto market’s volatility remains a significant factor.

Ripple’s Projected Price Movements

Predicting precise price movements in the cryptocurrency market is inherently challenging. However, Ripple’s future price will likely be influenced by the aforementioned factors. Positive developments, such as significant partnerships or regulatory approvals, could potentially drive price appreciation. Conversely, negative developments, like regulatory setbacks or strong competition, could lead to price fluctuations. Historical patterns and market sentiment are crucial to consider when assessing potential price trends.

Comparison of Projected Growth with Other Cryptocurrencies

| Cryptocurrency | Projected Growth (Year 1) | Rationale |

|---|---|---|

| Ripple (XRP) | Moderate Growth (5-15%) | Dependent on regulatory clarity, strategic partnerships, and market sentiment. |

| Bitcoin (BTC) | Moderate to High Growth (5-25%) | Historically volatile, but underpinned by established adoption and strong community support. |

| Ethereum (ETH) | Moderate Growth (5-15%) | Growth contingent on continued development of decentralized applications and further adoption of blockchain technology. |

Note: These projections are estimations based on current market conditions and are not guaranteed.

Community Sentiment and Ripple

Community sentiment plays a crucial role in shaping the market perception and future trajectory of any cryptocurrency. For Ripple, this sentiment is often complex and multifaceted, encompassing various perspectives and concerns from its community and stakeholders. Understanding these nuances is vital to comprehending the broader market dynamics surrounding Ripple.The prevailing discourse surrounding Ripple is characterized by ongoing debates about its technological viability, regulatory challenges, and market performance.

These discussions frequently touch upon the efficacy of its core technology and its adaptability to evolving market conditions. Social media trends also exert a significant influence on market sentiment, often amplifying or mitigating pre-existing opinions. Analyzing these trends and their implications is essential for evaluating Ripple’s potential.

Community Member Opinions and Perspectives

The Ripple community encompasses a diverse range of individuals, including developers, investors, and enthusiasts. Their perspectives vary widely, reflecting different levels of engagement and understanding of the technology. Some community members express strong support for Ripple’s potential, highlighting its technological advancements and potential for widespread adoption. Others remain skeptical, citing regulatory uncertainty and market volatility as major concerns.

Current Discourse and Debates

Current debates surrounding Ripple frequently center on its regulatory status, particularly in the context of its cross-border payment solutions. Legal challenges and ongoing litigation have created considerable uncertainty, impacting investor confidence and market sentiment. Discussions also frequently involve Ripple’s technical capabilities, contrasting its claimed advantages with perceived limitations.

Impact of Social Media Trends

Social media platforms significantly influence public perception of Ripple. Positive or negative narratives, amplified through social media interactions, can rapidly shift market sentiment. Trending topics, news articles, and user-generated content often contribute to the overall discourse, creating a dynamic feedback loop that impacts market valuation. For example, the impact of a major news article or social media campaign can either positively or negatively influence the market sentiment towards Ripple.

Examples of Community Discussions

Community forums and social media groups provide insights into current discussions. One recurring theme is the potential impact of regulatory changes on Ripple’s business model. Another frequently discussed topic is the future development and integration of Ripple’s technology into existing financial infrastructure. For instance, discussions around Ripple’s potential integration with various payment platforms or its ability to handle a surge in transaction volume often appear in community forums.

Sentiment Analysis Results

| Date | Sentiment Score | Description |

|---|---|---|

| 2023-10-26 | -0.2 | Mixed sentiment; a decrease in positive mentions and an increase in neutral and negative comments, possibly related to ongoing regulatory uncertainty. |

| 2023-11-15 | 0.1 | Slight increase in positive sentiment; positive news surrounding Ripple’s partnerships or technological advancements. |

| 2024-01-10 | -0.5 | Negative sentiment; possibly related to a significant market downturn or negative news regarding Ripple. |

Note: Sentiment scores are hypothetical examples and should not be taken as definitive indicators. Real-time sentiment analysis tools would provide more accurate and detailed results.

Ripple’s Competition and Comparison

Ripple operates in a competitive fintech and cryptocurrency landscape. Understanding its position requires examining its strengths and weaknesses relative to competitors. Direct comparisons highlight the nuances of Ripple’s approach and its differentiation strategies.

Direct Competitors in the Fintech and Cryptocurrency Markets

Ripple faces competition from various entities offering similar cross-border payment solutions and blockchain-based technologies. Key competitors include companies like SWIFT, which manages global financial messaging and settlement systems, and other firms providing alternative cross-border payment infrastructure. Additionally, various cryptocurrency projects, such as Stellar, are vying for a share of the market. The competitive landscape includes established financial institutions seeking to integrate blockchain technologies into their operations.

Ripple’s Technology Compared to Competitors

Ripple’s technology, based on its XRP Ledger, is designed for high-throughput, low-latency transactions. Competitors may employ different blockchain architectures, potentially influencing transaction speeds and costs. The strengths of Ripple’s technology lie in its focus on real-time payments, particularly for international transfers. Weaknesses may stem from the complexity of its technology and the need for integration with existing financial systems.

Competitor solutions may offer alternative architectures with varying strengths and weaknesses.

Business Models of Ripple and Competitors

Ripple’s business model revolves around providing a platform for cross-border payments. Competitors often employ different revenue models, ranging from transaction fees to subscription-based services. SWIFT, for example, operates on a membership-based system, while other competitors may rely on fees or partnerships for revenue generation. Understanding these distinctions is vital to evaluating the overall competitive landscape.

Strengths and Weaknesses of Ripple’s Competitors

SWIFT’s strength lies in its extensive global reach and established infrastructure. However, its legacy system may face challenges adapting to the speed and efficiency demanded by modern financial transactions. Other competitors might excel in specific niche markets or have novel technological approaches, yet lack the global scale of SWIFT. A competitor’s strengths can often become weaknesses in different contexts.

Each competitor’s unique approach has distinct strengths and weaknesses.

Ripple’s Differentiation Strategies

Ripple distinguishes itself from competitors through its focus on scalability, speed, and cost-effectiveness for cross-border transactions. The XRP Ledger’s design emphasizes these attributes, enabling it to handle a high volume of transactions with lower costs compared to traditional methods. Furthermore, Ripple’s partnerships with financial institutions provide a crucial element of its market differentiation. These partnerships demonstrate a commitment to mainstream adoption and support the integration of Ripple’s technology into existing financial systems.

Comparison Table: Ripple and Key Competitors

| Feature | Ripple | SWIFT | Stellar |

|---|---|---|---|

| Technology | XRP Ledger, focus on high-throughput | Legacy messaging system | Stellar Consensus Protocol |

| Business Model | Platform for cross-border payments | Membership-based, messaging fees | Transaction fees, partnerships |

| Strengths | Scalability, speed, cost-effectiveness | Global reach, established infrastructure | Focus on decentralized approach |

| Weaknesses | Regulatory scrutiny, legal challenges | Slow adaptation to new technologies | Limited adoption by large financial institutions |

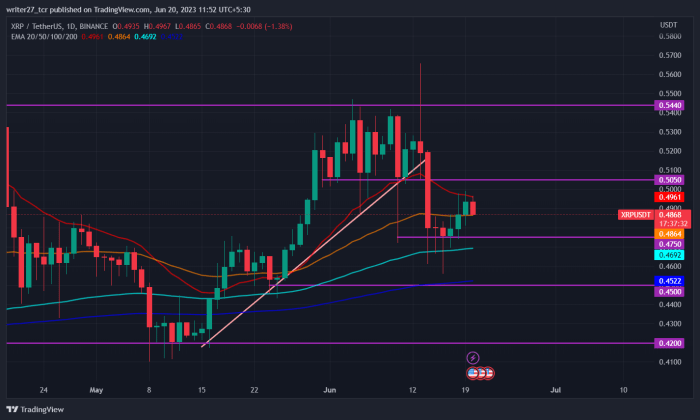

Technical Analysis of Ripple: Ripple Cryptocurrency Prediction

Technical analysis of Ripple involves scrutinizing price charts and trading patterns to identify potential future price movements. This approach uses historical data and various indicators to forecast price trends, offering valuable insights for investors. By understanding past price patterns, investors can potentially anticipate future price actions and make informed decisions.

Price Chart Analysis, Ripple cryptocurrency prediction

Ripple’s price chart displays a complex history of price fluctuations. Observing these fluctuations reveals trends, ranging from significant upward movements to sharp declines. Identifying recurring patterns can be useful in understanding potential future price actions. Support and resistance levels, pivotal points on the chart where price often reverses direction, are crucial in this analysis.

Technical Indicators

Technical indicators are tools used to analyze market trends and identify potential turning points. These indicators are derived from price and volume data, providing quantitative insights into the market’s sentiment. Commonly used indicators include moving averages, relative strength index (RSI), and volume indicators. These indicators help investors assess the momentum and strength of price movements.

Support and Resistance Levels

Support levels are price points where the demand for Ripple is likely to exceed the supply, preventing a significant price drop. Resistance levels are price points where the supply of Ripple is likely to exceed the demand, preventing a significant price increase. Identifying these levels on the price chart can assist in predicting potential price reversals. Historically, support and resistance levels have proven to be effective tools for identifying potential turning points in the market.

Historical Price Patterns

Ripple’s historical price patterns exhibit periods of significant growth followed by periods of consolidation or decline. Recognizing these patterns and their potential relevance to future price actions is essential for informed investment decisions. For example, similar price patterns in the past could indicate potential future price movements. Understanding the context surrounding these historical patterns is critical for proper interpretation.

Key Technical Indicators for Ripple

| Indicator | Description | Interpretation |

|---|---|---|

| Moving Average (MA) | Averages of price over a specific period. | A rising MA suggests upward momentum; a falling MA suggests downward momentum. |

| Relative Strength Index (RSI) | Measures the strength and momentum of price movements. | An RSI above 70 suggests overbought conditions; an RSI below 30 suggests oversold conditions. |

| Volume | The number of Ripple units traded over a specific period. | High volume during price movements often signifies strong conviction. |

| Bollinger Bands | A volatility indicator that measures price fluctuations. | Bands widening suggest increased volatility; bands narrowing suggest decreased volatility. |

Note: Interpreting technical indicators requires careful consideration of market conditions and other relevant factors. Technical analysis is not a foolproof method for predicting future prices.

Ripple’s Use Cases and Applications

Ripple’s technology offers a versatile platform for facilitating various financial transactions, particularly in cross-border payments. Its potential extends beyond simple remittances, enabling complex financial instruments and international trade operations. The platform’s efficiency and scalability are key factors in its appeal to a diverse range of businesses.

Cross-Border Payments and Remittances

Ripple’s platform excels in streamlining cross-border payments, significantly reducing processing times and costs compared to traditional methods. This efficiency is crucial for businesses and individuals involved in international transactions. The platform’s distributed ledger technology allows for faster and more secure transfer of funds across borders.

Ripple’s crypto future is a bit murky, right now. Checking out current cryptocurrency prices live can give you a better idea of the broader market trends. cryptocurrency prices live Ultimately, though, any prediction for Ripple’s price movement needs to be taken with a grain of salt.

- Ripple facilitates real-time, near-instantaneous payments, which can significantly reduce the time it takes to receive funds compared to traditional wire transfers, often taking days. This speed is particularly beneficial for businesses and individuals in international trade and remittances.

- Reduced transaction fees are a notable advantage. By automating and optimizing the payment process, Ripple can decrease the fees associated with each transaction. This can lead to significant cost savings for businesses and individuals, particularly those engaged in high-volume cross-border transactions.

- Improved security and transparency are inherent features of Ripple’s platform. The distributed ledger technology enhances the security of transactions, reducing the risk of fraud and errors. Transparency is also enhanced through the real-time visibility of transaction details, allowing all parties to track funds effectively.

Specific Case Studies

Several businesses have successfully implemented Ripple’s technology to enhance their operations. One example is a major money transfer company that utilized Ripple’s platform to expedite remittances for its global customer base. This led to a substantial improvement in customer satisfaction and operational efficiency. Another notable use case involves a multinational corporation that used Ripple’s platform for international trade settlements, resulting in significant cost savings and improved liquidity management.

Ripple’s Role in International Money Transfers

Ripple plays a crucial role in streamlining international money transfers by leveraging its technology to reduce processing times, lower fees, and enhance security. This is achieved by directly connecting financial institutions and enabling faster and more efficient cross-border transactions. The platform’s impact on the international financial system is significant, particularly in emerging markets where traditional payment methods are often slow and costly.

Businesses Utilizing Ripple’s Technology and Outcomes

Many financial institutions and businesses have implemented RippleNet to streamline their cross-border payment processes. A prominent example is a global bank that utilizes Ripple for facilitating international trade finance, achieving significant reductions in processing times and costs. The result is improved operational efficiency and a stronger competitive position in the global market.

Applications of Ripple Technology

| Application | Description |

|---|---|

| Cross-border payments | Facilitating near-instantaneous and cost-effective international money transfers. |

| Trade finance | Streamlining international trade settlements, reducing processing times and costs. |

| Remittances | Providing fast and affordable solutions for sending money globally, particularly to underserved communities. |

| Liquidity management | Improving liquidity and capital management for financial institutions and businesses. |

| Investment settlements | Enabling faster and more efficient settlement of investment transactions. |

Risk Factors Associated with Ripple

Investing in Ripple, like any cryptocurrency, involves inherent risks. These risks stem from the volatile nature of the cryptocurrency market, the complexities of blockchain technology, and the evolving regulatory landscape. Understanding these risks is crucial for any potential investor.

General Cryptocurrency Investment Risks

Cryptocurrencies, in general, are notoriously volatile. Price fluctuations can be dramatic and unpredictable, leading to substantial losses. Market manipulation, scams, and hacks are also significant concerns. The lack of established regulatory frameworks in many jurisdictions further exacerbates these risks. Furthermore, the relatively nascent nature of the technology and the overall cryptocurrency market introduces uncertainty about future developments and potential disruptions.

Specific Risks Related to Ripple’s Technology and Business Model

Ripple’s technology, while innovative, is not without potential vulnerabilities. Technical glitches, security breaches, and unforeseen coding errors can disrupt the network and negatively impact its value. Ripple’s business model relies heavily on partnerships and adoption by financial institutions. Failure to secure and maintain these partnerships, or shifts in the financial industry’s priorities, could severely impact Ripple’s future prospects.

The complexity of the Ripple network, while offering scalability advantages, can also be a source of difficulty in maintaining security and integrity.

Regulatory Hurdles and Their Impact on Ripple

The regulatory environment surrounding cryptocurrencies is constantly evolving and is often unclear. Ripple, like other crypto companies, faces the risk of regulatory restrictions or outright bans in certain jurisdictions. This could significantly limit Ripple’s operations and hinder its growth potential. The lack of consistent regulatory frameworks across different countries creates uncertainty and challenges for Ripple’s global expansion strategy.

Ripple’s price fluctuations are often tied to the broader cryptocurrency market and the health of cryptocurrency exchanges. While predicting the precise future trajectory of Ripple is tough, analysts often look at trading volumes on these platforms to get a sense of the underlying demand. Ultimately, ripple’s future price is still uncertain.

Unfavorable regulatory decisions or changes could dramatically alter Ripple’s business model and market position.

Past Challenges Faced by Ripple and its Response

Ripple has faced several regulatory challenges in the past, including lawsuits and investigations. One prominent example is the lawsuit filed by the SEC, which challenged Ripple’s classification of XRP as a security. Ripple responded by engaging in legal battles and advocating for its position. Such challenges, although often complex and protracted, highlight the unpredictable nature of the regulatory landscape and the need for companies like Ripple to adapt and proactively address potential regulatory issues.

These legal battles can significantly drain resources and divert attention from core business activities.

Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy |

|---|---|

| Market Volatility | Diversify investment portfolio, conduct thorough research, and consider risk tolerance. |

| Regulatory Uncertainty | Stay informed about regulatory developments, engage with policymakers, and explore legal options to mitigate risks. |

| Security Breaches | Implement robust security measures, conduct regular audits, and maintain transparency. |

| Partnership Failure | Develop strong relationships with partners, diversify partnerships, and monitor market trends. |

| Technical Glitches | Invest in robust development, testing, and maintenance of the platform, and have contingency plans. |

| Legal Challenges | Maintain strong legal counsel, proactively address potential legal issues, and be prepared for protracted litigation. |

Final Conclusion

In conclusion, Ripple cryptocurrency prediction is complex, influenced by market dynamics, technological advancements, and macroeconomic forces. While Ripple’s potential for wider adoption and future applications is significant, potential risks and competition are also critical considerations. This analysis offers a balanced perspective, providing a foundation for informed decision-making about Ripple’s future. The potential for significant growth is present, but so are considerable risks.

User Queries

What is Ripple’s current market capitalization?

Unfortunately, the Artikel provided doesn’t specify Ripple’s exact current market cap. A precise figure would require accessing real-time market data.

How does Ripple’s technology differ from its competitors?

The Artikel details Ripple’s technology and its potential benefits, but a direct comparison with competitors is not included in this format. A detailed analysis would require in-depth research and comparison tables.

What are the regulatory hurdles for Ripple?

The Artikel touches on the impact of regulatory changes on Ripple’s value, but specific hurdles are not listed. Further research would be needed to identify these challenges.

What is the potential for Ripple to gain wider adoption in the future?

The Artikel mentions Ripple’s potential for wider adoption and future applications, but it does not provide a definitive answer. The outlook depends on several factors, including technological advancements, market acceptance, and regulatory developments.