Cryptocurrency mining, the process of validating and adding transactions to a blockchain, is a fascinating and complex field. It’s a crucial component of many cryptocurrencies, driving their security and functionality. This exploration delves into the core principles, hardware, software, and economics behind this intricate process.

From the historical evolution of mining to the latest trends, we’ll cover all aspects of cryptocurrency mining. Understanding the energy consumption and environmental impact is also paramount, alongside the security risks and strategies to mitigate them.

Introduction to Cryptocurrency Mining

Cryptocurrency mining is a computational process crucial for securing and validating transactions within cryptocurrency networks. It’s a complex system, but understanding its fundamentals is essential for navigating the world of digital assets. This process ensures the integrity and security of the network, preventing fraudulent activities.The core of cryptocurrency mining involves solving complex mathematical problems. This computational work is rewarded with newly minted cryptocurrency, incentivizing participants to maintain the network’s health.

The process requires substantial computational power, often utilizing specialized hardware. Understanding the different types of mining and the history of the process provides valuable context.

Cryptocurrency Mining Process

The process of cryptocurrency mining hinges on the network’s cryptographic algorithms. These algorithms are designed to be computationally intensive, requiring significant processing power to solve. This inherent difficulty makes it practically impossible for individuals or groups to manipulate the network’s data or transactions. The validation of transactions and the addition of new blocks to the blockchain are facilitated by the solutions to these problems.

Types of Cryptocurrencies Utilizing Mining

Numerous cryptocurrencies rely on mining mechanisms to secure their networks. Bitcoin, the pioneer cryptocurrency, employs Proof-of-Work (PoW) mining. Ethereum, another prominent example, has transitioned to a Proof-of-Stake (PoS) model, although PoW is still used in some related projects. Other cryptocurrencies, such as Litecoin and Monero, also utilize mining, employing variations of the PoW algorithm. Understanding these variations is key to comprehending the diversity of the cryptocurrency landscape.

Historical Context of Cryptocurrency Mining

The history of cryptocurrency mining is intertwined with the development of blockchain technology. Bitcoin’s emergence in 2009 marked the genesis of mining, initially requiring modest computational resources. As the network’s popularity grew, the computational demands increased, necessitating more powerful hardware. This evolution is reflected in the growing sophistication of mining equipment and the ever-increasing complexity of the mining process.

The initial mining was done by individuals with relatively simple computers, while today’s mining is done by large-scale operations utilizing specialized hardware.

Key Components of a Mining Setup

A successful mining operation necessitates a range of components. These components work together to solve the complex mathematical problems required for validating transactions and adding new blocks to the blockchain. The key components are crucial for optimal performance.

| Component | Description |

|---|---|

| Graphics Processing Units (GPUs) | GPUs are specialized electronic circuits designed for rendering images. They are highly effective at parallel processing, making them suitable for mining. |

| Central Processing Units (CPUs) | CPUs are the general-purpose processors in a computer. While less efficient for mining than GPUs, they can still be utilized for simpler cryptocurrencies. |

| Mining Software | Dedicated software manages the mining process, communicating with the network and solving the required cryptographic problems. |

| Power Supply | A robust power supply is essential for providing the necessary electricity for the mining hardware. High-power consumption is often associated with high-performance mining setups. |

| Cooling System | Mining hardware generates significant heat, necessitating effective cooling solutions to prevent overheating and potential damage. |

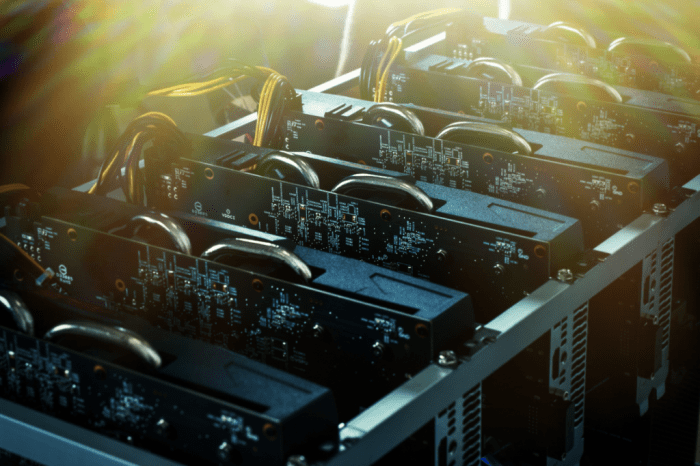

Mining Hardware and Equipment

Cryptocurrency mining relies heavily on specialized hardware designed for the computationally intensive tasks required to validate transactions and create new blocks. Different types of hardware offer varying levels of efficiency and cost-effectiveness, impacting the profitability of mining operations. Understanding these hardware choices is crucial for any prospective miner.

ASICs (Application-Specific Integrated Circuits)

ASICs are purpose-built chips specifically designed for cryptocurrency mining algorithms. They are optimized for a particular cryptocurrency’s hashing algorithm, achieving significantly higher processing speeds compared to general-purpose processors. This specialization results in substantial performance gains, often outperforming other hardware types in terms of hash rate. A significant advantage of ASICs is their focus on efficiency; they are built to handle the specific computational requirements of mining.

GPUs (Graphics Processing Units)

GPUs, commonly found in personal computers, are also used for cryptocurrency mining. Their parallel processing architecture makes them suitable for tasks involving numerous calculations. However, ASICs have largely superseded GPUs in terms of efficiency and cost-effectiveness for most cryptocurrencies. GPUs are typically more affordable but offer significantly lower hash rates than ASICs, especially for complex algorithms. Their popularity in the past was due to their accessibility, but their role has diminished with the rise of specialized ASICs.

FPGAs (Field-Programmable Gate Arrays)

FPGAs offer a flexible alternative to ASICs and GPUs. They can be programmed to perform specific tasks, adapting to different algorithms and potentially providing a more adaptable solution for mining. Their flexibility allows for tailoring to specific mining algorithms. However, their cost often outweighs the advantages compared to ASICs, and they generally fall between GPUs and ASICs in terms of efficiency and cost-effectiveness.

FPGAs are often a choice for those exploring or testing mining algorithms.

Cost-Effectiveness Comparison

The cost-effectiveness of mining hardware depends on factors like the cryptocurrency’s algorithm, the current market price of the hardware, and the power consumption. ASICs, although initially expensive, often provide the best long-term return on investment due to their high efficiency and hash rates. GPUs offer a more affordable entry point but may not be profitable for most current cryptocurrencies.

FPGAs, while adaptable, generally fall between ASICs and GPUs in terms of cost-effectiveness. The initial investment cost must be balanced against the projected profitability and energy consumption.

Energy Consumption

Cryptocurrency mining has a significant environmental impact due to the substantial energy consumption of mining hardware. ASICs, being highly optimized, can have lower energy consumption per hash rate compared to GPUs. However, the sheer scale of mining operations can still contribute to substantial energy use. Energy costs are a critical factor in determining the profitability of a mining operation.

Understanding and managing energy consumption is crucial for both economic and environmental sustainability.

Technical Specifications Table

| Hardware Type | Model | Hash Rate (TH/s) | Power Consumption (kW) | Cost (USD) |

|---|---|---|---|---|

| ASIC | Antminer S19 Pro | 90 | 3.3 | $10,000 |

| GPU | RTX 3090 | 1.5 | 350 | $1,500 |

| FPGA | Xilinx UltraScale+ | 5-20 | 1-5 | $5,000 – $20,000 |

Note: Values are approximate and can vary based on specific models and market conditions.

Mining Algorithms and Protocols: Cryptocurrency Mining

Cryptocurrency mining relies on sophisticated cryptographic algorithms to secure the network and validate transactions. These algorithms dictate the computational effort required to solve complex mathematical problems, directly influencing the profitability and competitiveness of mining operations. Understanding these algorithms is crucial for assessing the viability and potential risks associated with cryptocurrency mining.

Different Cryptographic Algorithms

Various cryptographic hashing algorithms are employed in cryptocurrency mining. These algorithms transform input data into a fixed-size output, known as a hash. The critical characteristic is the algorithm’s resistance to finding inputs that produce a specific desired hash. SHA-256, a widely used algorithm, is employed in Bitcoin mining. Other algorithms like Scrypt and X11 are used in different cryptocurrencies, each with varying computational requirements.

Proof-of-Work (PoW) Consensus Mechanisms

Proof-of-Work (PoW) is a consensus mechanism fundamental to many cryptocurrencies. It ensures that new blocks are added to the blockchain in a secure and verifiable manner. The process involves miners competing to solve complex mathematical puzzles. The first miner to successfully solve the puzzle and broadcast the solution to the network adds the new block to the blockchain, earning the associated reward.

“The difficulty of the puzzle is adjusted dynamically to maintain a target block time, ensuring the network remains secure and efficient.”

This adjustment mechanism, often referred to as difficulty adjustment, is crucial for maintaining a consistent rate of block creation.

Security Implications of Mining Algorithms

The security of a mining algorithm is directly related to its computational complexity. Algorithms with high computational complexity are generally considered more secure, as they require more computational power and time to crack. The inherent security is based on the computational cost required to find a valid hash, making it computationally infeasible to manipulate the blockchain. However, vulnerabilities can arise in specific implementations or in the underlying hardware used in the mining process.

Comparative Analysis of Mining Protocols

Different mining algorithms exhibit varying levels of energy consumption and computational requirements. This directly affects the profitability and sustainability of mining operations. Bitcoin’s SHA-256 algorithm, for example, demands significant computational power, often leading to high energy consumption. Other algorithms, like Scrypt, are designed to be less energy-intensive, potentially leading to more environmentally friendly mining operations.

Key Characteristics of Mining Algorithms

| Algorithm | Complexity | Energy Consumption | Security | Example Cryptocurrency |

|---|---|---|---|---|

| SHA-256 | High | High | High | Bitcoin |

| Scrypt | Medium | Medium | Medium | Litecoin |

| X11 | Medium | Medium | Medium | Ethereum (pre-Merge) |

The table above provides a basic comparison of different mining algorithms. It’s important to note that the complexity, energy consumption, and security levels are relative and can vary depending on specific implementations and hardware used. For example, newer versions of mining algorithms may introduce changes in their underlying architecture that impact the above parameters.

Mining Software and Tools

Mining software plays a crucial role in managing and optimizing cryptocurrency mining operations. It automates tasks, monitors hardware performance, and facilitates the interaction with mining pools or solo mining activities. A robust mining software solution is essential for maximizing profitability and minimizing operational inefficiencies.

Popular Mining Software and Platforms

Several software platforms cater to various mining needs. Some are dedicated to specific cryptocurrencies, while others provide a broader range of functionalities. These platforms facilitate different levels of control, from basic setup to complex management options.

Key Functionalities of Mining Software Tools

Effective mining software typically includes features for hardware monitoring, algorithm selection, pool management, and wallet integration. These tools often offer real-time data on hash rate, temperature, power consumption, and other crucial metrics. Furthermore, sophisticated tools often integrate with cloud services, providing remote access and management capabilities.

Methods for Managing and Monitoring Mining Operations

Various methods are available for managing and monitoring mining operations. Detailed logs and dashboards provide insights into performance trends. Real-time monitoring enables proactive identification of potential issues, such as hardware malfunctions or network connectivity problems. These tools are often customizable, allowing users to tailor their monitoring approach to specific needs.

Importance of Mining Software Security

Security is paramount in mining software. Robust security measures protect mining operations from malicious attacks, ensuring data integrity and preventing unauthorized access. Features like multi-factor authentication, secure communication protocols, and regular software updates are crucial components for a secure mining environment. Compromised software can lead to significant financial losses and operational disruptions.

List of Popular Mining Software Tools

- C-Miner: A versatile mining software known for its extensive configuration options, suitable for both solo and pool mining. It supports various cryptocurrencies and algorithms. C-Miner is also noted for its ability to optimize settings for specific hardware configurations.

- BFGMiner: This is another widely used mining software known for its support of multiple algorithms. BFGMiner excels in its efficiency and performance, and its ability to handle substantial computational demands. It also offers good integration with mining pools.

- Claymore’s Dual Ethereum Miner: Specialized for mining Ethereum, this software provides excellent performance and optimization. It is highly regarded for its efficiency in extracting ETH, particularly relevant in the context of the Ethereum network.

- MultiMiner: A popular choice for mining various cryptocurrencies, MultiMiner’s versatility and multi-algorithm support make it a robust option for miners. Its support for a wide range of cryptocurrencies and mining pools provides substantial flexibility.

Energy Consumption and Environmental Impact

Cryptocurrency mining, while offering exciting possibilities, carries a significant environmental burden due to its substantial energy consumption. The process of validating transactions and adding new blocks to the blockchain requires substantial computational power, often leading to substantial electricity use. This energy consumption raises concerns about the environmental impact of this burgeoning industry.The environmental footprint of cryptocurrency mining is not merely theoretical; it manifests in real-world consequences.

From increased greenhouse gas emissions to potential strain on local energy grids, the environmental impact is multifaceted and requires careful consideration. Understanding and mitigating these impacts is crucial for the long-term sustainability of the cryptocurrency ecosystem.

Energy Consumption of Cryptocurrency Mining

The energy demands of cryptocurrency mining vary significantly depending on the specific algorithm used and the hardware employed. Proof-of-Work (PoW) algorithms, like the one used by Bitcoin, are particularly energy-intensive, demanding substantial computational resources to solve complex mathematical problems. This high energy consumption is a key concern, as it can lead to significant carbon emissions and strain on energy grids.

Examples of Environmental Impact

Several examples illustrate the environmental impact of cryptocurrency mining. Large-scale mining operations in regions with significant reliance on fossil fuels can contribute substantially to greenhouse gas emissions. The strain on local energy grids can also lead to increased energy costs for consumers and potentially disrupt local power supplies. Furthermore, the disposal of mining equipment can introduce electronic waste into the environment.

Strategies to Mitigate Environmental Impact

Several strategies can be implemented to mitigate the environmental impact of cryptocurrency mining. Transitioning to more energy-efficient mining hardware and algorithms is a critical step. Implementing renewable energy sources for mining operations is another effective approach. Furthermore, promoting sustainable practices throughout the entire mining lifecycle is essential. Finally, fostering transparency and accountability in the mining industry is crucial for encouraging responsible environmental practices.

Comparison of Approaches to Reduce Energy Footprint

Different approaches to reducing the energy footprint of mining have varying degrees of effectiveness and practicality. The use of more energy-efficient hardware, such as specialized ASICs, is one approach. Another is transitioning to alternative consensus mechanisms like Proof-of-Stake (PoS), which can reduce the computational demands significantly. Further, adopting renewable energy sources like solar or hydroelectric power to power mining operations can also contribute to reducing the carbon footprint.

Implementing policies that incentivize energy efficiency in the mining industry can also drive significant improvements.

Energy Consumption Data for Mining Hardware and Cryptocurrencies

| Mining Hardware | Cryptocurrency | Estimated Energy Consumption (kWh/day) |

|---|---|---|

| ASIC Miner (Antminer S19) | Bitcoin | 200-500 |

| GPU rig (multiple GPUs) | Ethereum (pre-merge) | 50-200 |

| ASIC Miner (Antminer L3+ – specialized) | Ethereum (post-merge) | 5-20 |

| ASIC Miner (specialized) | Litecoin | 50-150 |

Note: Values are estimates and can vary based on factors like location, efficiency of equipment, and operational practices.

Mining Rewards and Economics

Cryptocurrency mining is fundamentally driven by financial incentives. Understanding the rewards structure and associated economics is crucial for assessing the viability and risk of participating in mining operations. Profitability hinges on several factors, including the specific cryptocurrency, the mining hardware employed, and the prevailing market conditions.

Financial Incentives for Mining

Mining cryptocurrency provides a potential return on investment. Participants earn rewards for successfully adding new blocks to the blockchain. These rewards, often in the form of the cryptocurrency itself, incentivize miners to invest resources in the process.

Cryptocurrency mining involves a complex process of verifying transactions and adding them to the blockchain. Understanding what cryptocurrency is, fundamentally, is key to grasping this process. what cryptocurrency is a digital or virtual currency secured by cryptography, making it decentralized and resistant to counterfeiting. This decentralized nature is directly related to the need for miners to secure the network.

Mining Rewards and Block Rewards

Mining rewards represent the compensation for the computational work miners undertake to validate transactions and add new blocks to the blockchain. These rewards are typically a combination of the cryptocurrency being mined and transaction fees. Block rewards are the fixed amount of cryptocurrency awarded for successfully creating a new block, and these amounts often decrease over time as a built-in mechanism for controlling the supply of the cryptocurrency.

Economics of Cryptocurrency Mining

The economics of cryptocurrency mining involve a complex interplay of factors influencing profitability. The return on investment (ROI) is not guaranteed, as it depends on many variables including electricity costs, hardware costs, and the cryptocurrency’s market price. Profitability is not a simple calculation. Several key factors need careful consideration to determine the potential for a successful mining operation.

Risks associated with fluctuations in the cryptocurrency market and evolving mining difficulty should also be factored in.

Factors Influencing Mining Profitability

Profitability is determined by a combination of factors, which should be thoroughly evaluated before entering the mining arena.

- Electricity Costs: The cost of electricity is a significant expense in mining operations. Higher electricity costs directly reduce the profitability of mining operations. Locations with lower electricity costs are attractive to miners seeking higher potential returns.

- Hardware Costs: Mining hardware, including specialized ASICs (Application-Specific Integrated Circuits), can be expensive. The cost of hardware significantly impacts the initial investment required and the potential ROI. The cost of hardware directly affects the overall expenses for a mining operation.

- Mining Difficulty: The computational difficulty of mining increases as more miners join the network. Increased difficulty requires more computational power to solve the cryptographic problems and successfully add new blocks to the blockchain, directly affecting the profitability of miners.

- Cryptocurrency Market Price: The market price of the cryptocurrency being mined directly impacts the value of the rewards received. Volatility in the cryptocurrency market can lead to substantial fluctuations in profitability.

Detailed Illustration of Mining Reward Calculation

The process of calculating mining rewards involves several steps.

| Step | Description |

|---|---|

| 1 | Block Header Generation: The miner generates a block header, which includes data about the previous block, timestamp, and transaction data. |

| 2 | Proof-of-Work Calculation: The miner calculates a proof-of-work (PoW) value based on the block header, using a specific algorithm. This involves extensive computations. |

| 3 | Validation: The miner’s solution is verified by the network. If the PoW value is valid, the block is added to the blockchain. If not, the miner attempts to find a new solution. |

| 4 | Reward Distribution: Upon successful block addition, the miner receives a reward. The reward is typically a pre-determined amount of the cryptocurrency, adjusted based on the current mining difficulty. |

The reward is often a combination of a fixed block reward and transaction fees included in the block.

Security and Risks in Cryptocurrency Mining

Cryptocurrency mining, while potentially lucrative, is not without its security vulnerabilities. Protecting mining operations from various threats is crucial for maintaining profitability and integrity. A robust security posture is essential to mitigate the risks associated with malicious actors and technical failures.

Security Risks Associated with Mining Hardware

Mining hardware, particularly specialized Application-Specific Integrated Circuits (ASICs), is often a prime target for attackers. These devices are expensive and can represent a significant investment for miners. Compromised hardware can lead to significant financial losses, including the loss of mining rigs and the cryptocurrencies they generate. Furthermore, malicious actors could potentially gain unauthorized access to the mining pool or network, diverting earnings or disrupting the mining process.

Potential Vulnerabilities in Mining Operations

Mining operations are susceptible to a variety of vulnerabilities. These include compromised software, weak passwords, insecure network configurations, and insufficient physical security measures. The use of shared resources or networks exposes mining pools to the potential for cross-contamination. Vulnerabilities in the underlying operating system of mining rigs, or in the software used to manage mining pools, can create entry points for attackers.

Furthermore, inadequate security training for personnel can lead to human error and create opportunities for breaches.

Examples of Common Attacks Targeting Mining Operations

Several types of attacks are frequently employed against mining operations. These include denial-of-service (DoS) attacks, which aim to overwhelm the network, and malware infections, which can compromise the integrity of mining software or hardware. Phishing attacks targeting mining personnel or stakeholders are also a concern, particularly in obtaining sensitive login credentials. Ransomware attacks targeting mining infrastructure can result in significant downtime and financial losses.

Strategies for Securing Cryptocurrency Mining Operations

Implementing strong security measures is paramount for mitigating these risks. This includes using robust authentication protocols, regularly updating software and firmware, employing intrusion detection systems, and implementing multi-factor authentication. Maintaining a secure network infrastructure is critical, ensuring firewalls and appropriate access controls are in place. Implementing strong password policies and providing security awareness training for personnel are vital components of a comprehensive security strategy.

Regular audits and penetration testing are crucial for identifying vulnerabilities and ensuring the security posture remains robust.

Table of Potential Security Threats and Countermeasures

| Potential Security Threat | Countermeasure |

|---|---|

| Compromised Hardware | Regular hardware checks, rigorous vendor selection, secure storage, and strong access controls. |

| Malware Infections | Employ robust antivirus software, regularly update software, and enforce strong security policies. |

| Weak Passwords | Implement complex password policies, enforce multi-factor authentication, and provide security training. |

| Insecure Network Configurations | Employ firewalls, use virtual private networks (VPNs), and regularly audit network configurations. |

| Denial-of-Service (DoS) Attacks | Implement DDoS mitigation strategies, configure robust load balancers, and have redundancy plans. |

| Phishing Attacks | Implement security awareness training, educate staff on phishing tactics, and monitor for suspicious activity. |

| Ransomware Attacks | Maintain regular backups, implement robust data encryption, and test recovery procedures. |

Future Trends and Developments in Cryptocurrency Mining

The cryptocurrency mining landscape is constantly evolving, driven by advancements in technology and the pursuit of greater efficiency and profitability. This dynamic environment necessitates a continuous adaptation for miners to stay competitive and capitalize on emerging opportunities. The future holds significant potential for changes in mining techniques, hardware, and overall operational strategies.The ongoing quest for higher efficiency and lower energy consumption is a major driver of innovation.

The increasing scrutiny of the environmental impact of cryptocurrency mining is also pushing developers and miners to explore alternative approaches.

Cryptocurrency mining’s energy consumption is a hot topic, right? Staying up-to-date on the latest trends in the space is crucial. For example, checking out cryptocurrency news will help you grasp the evolving landscape and potential implications for miners. Ultimately, understanding the broader market dynamics is key to navigating the complexities of cryptocurrency mining.

Emerging Trends in Mining Hardware, Cryptocurrency mining

Advancements in hardware are critical to the efficiency and profitability of cryptocurrency mining. Specialized ASICs (Application-Specific Integrated Circuits) continue to evolve, optimizing performance for specific algorithms. The trend towards larger, more powerful mining rigs is likely to persist. Increased integration of AI and machine learning in the design of mining hardware is also anticipated. This includes more sophisticated algorithms to anticipate algorithm changes and adjust hardware accordingly.

Evolution of Mining Algorithms and Protocols

Cryptocurrency mining algorithms are constantly being updated, sometimes leading to significant changes in the strategies needed for effective mining. The emergence of new proof-of-stake (PoS) algorithms and their potential impact on the mining landscape is a significant factor. The rise of more complex consensus mechanisms and their effect on hardware requirements is another area of evolution. This complexity requires a higher level of specialized knowledge in algorithms and computational power to maintain a competitive edge.

Potential Impact of Advancements on Mining Operations

New advancements in hardware and algorithms have significant implications for mining operations. The ability to adapt to changes in algorithms and protocols is paramount for profitability. The integration of automation and AI into mining operations is a growing trend. This includes self-adjusting equipment that can react to changing mining conditions. The potential for increased efficiency and lower operating costs is evident.

Future Directions for Cryptocurrency Mining

The future of cryptocurrency mining likely involves a combination of factors. The trend towards decentralized mining pools and specialized hardware solutions is predicted to continue. A notable shift towards greater energy efficiency and sustainability in mining operations is also expected. This may lead to a greater focus on renewable energy sources. Further research and development in specialized hardware and software for mining specific cryptocurrencies is likely to emerge.

Overview of Future Trends

| Trend | Description |

|---|---|

| Hardware Specialization | Continued development of ASICs tailored for specific algorithms, leading to more specialized and powerful mining rigs. |

| Algorithm Adaptability | Mining operations must adapt to evolving consensus mechanisms and algorithms to maintain profitability. |

| Decentralization and Automation | Increased use of decentralized mining pools and automated systems to optimize operations. |

| Sustainability Focus | Growing emphasis on renewable energy sources and more sustainable mining practices to address environmental concerns. |

Final Thoughts

In conclusion, cryptocurrency mining is a dynamic and ever-evolving landscape. The interplay of technology, economics, and security creates a challenging yet rewarding environment. As technology advances, so will the methods and challenges of cryptocurrency mining, demanding a continuous adaptation to stay relevant.

FAQ Summary

What are the main types of mining hardware?

ASICs (Application-Specific Integrated Circuits), GPUs (Graphics Processing Units), and FPGAs (Field-Programmable Gate Arrays) are the primary hardware options for cryptocurrency mining. Each has unique strengths and weaknesses, impacting cost-effectiveness and energy efficiency.

What are the security risks associated with mining?

Security risks include malware, denial-of-service attacks, and theft of mining hardware. Implementing robust security measures, including strong passwords and regular software updates, is crucial for mitigating these risks.

How do mining pools work?

Mining pools allow multiple miners to pool their computational resources, increasing their chances of finding blocks and earning rewards. This collaboration significantly enhances the profitability of individual miners compared to solo mining.

What are the environmental concerns related to cryptocurrency mining?

Cryptocurrency mining can have a significant environmental impact due to its high energy consumption. Strategies to mitigate this include using renewable energy sources, improving hardware efficiency, and exploring alternative consensus mechanisms.