Cryptocurrency list price is a dynamic and ever-evolving landscape, influenced by a multitude of factors. This guide delves into the intricacies of pricing, from fundamental supply and demand dynamics to real-time tracking methods and future projections. We’ll explore how different cryptocurrencies are priced, compare their performance over time, and examine the impact of market sentiment and regulatory changes.

Understanding cryptocurrency list price is crucial for investors and enthusiasts alike. The information presented here will equip you with a comprehensive overview, enabling you to navigate the complexities of this exciting market.

Introduction to Cryptocurrency Pricing

Cryptocurrency prices, unlike traditional assets, are not set by central authorities. Instead, they are determined by market forces, primarily supply and demand, with numerous factors influencing their volatility. Understanding these mechanisms is crucial for navigating the cryptocurrency market.Cryptocurrency prices are essentially a reflection of the perceived value of a particular cryptocurrency by market participants. This perceived value is influenced by a complex interplay of economic, technological, and social factors.

The dynamic nature of this market necessitates constant monitoring and evaluation of these factors to accurately assess the price movements.

Factors Influencing Price Fluctuations, Cryptocurrency list price

Several factors contribute to the fluctuating nature of cryptocurrency prices. Market sentiment, news events, regulatory changes, technological advancements, and even social media trends can all impact the perceived value and, subsequently, the price of a cryptocurrency. The interconnected nature of these factors makes predicting future price movements extremely challenging.

Supply and Demand Dynamics

The relationship between supply and demand is fundamental to understanding cryptocurrency pricing. When demand for a cryptocurrency exceeds its supply, prices tend to rise. Conversely, when supply exceeds demand, prices generally fall. This dynamic is further complicated by factors such as token burns, new coin issuance, and the ongoing development of the cryptocurrency ecosystem.

Cryptocurrency Pricing Models

Various models attempt to predict or explain cryptocurrency pricing. These models range from simple supply and demand-based approaches to more complex econometric models that incorporate numerous market factors.

Comparison of Cryptocurrency Pricing Models

| Model Type | Description | Strengths | Weaknesses |

|---|---|---|---|

| Simple Supply and Demand | This model considers the relationship between the available supply of a cryptocurrency and the desire for it by buyers. | Easy to understand and visualize. Provides a basic framework for understanding price movements. | Fails to account for complex market factors. May not accurately predict price fluctuations in the long run. |

| Technical Analysis | This approach focuses on historical price patterns and trading volume to predict future price movements. Charts and indicators are used to identify potential trends. | Identifies potential trends and patterns. Helpful for short-term trading strategies. | Subjective interpretation of patterns. Does not account for fundamental factors. Past performance is not indicative of future results. |

| Fundamental Analysis | This approach considers the underlying value of a cryptocurrency, including its use case, development team, and community support. | Provides a broader perspective on the intrinsic value. Helpful for long-term investment strategies. | Subjectivity in assessing value. Difficult to quantify all relevant factors. Can be influenced by speculation. |

| Econometric Models | These models use statistical methods to analyze historical data and identify relationships between various market factors and cryptocurrency prices. | More sophisticated approach, incorporating various factors. Can provide more accurate predictions. | Requires significant data and computational resources. Complex to understand and interpret. Model accuracy is dependent on the quality and quantity of the data. |

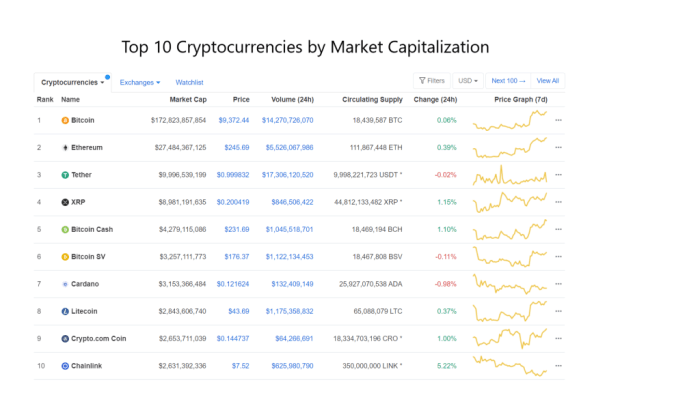

Cryptocurrency Price Data Sources

Staying informed about cryptocurrency prices is crucial for making sound investment decisions. Reliable data sources provide transparency and enable accurate assessments of market trends. Understanding the various platforms and websites offering this data is essential for navigating the dynamic world of cryptocurrencies.A key aspect of navigating the cryptocurrency market involves accessing accurate and up-to-date price information. Different platforms and websites provide real-time data, enabling investors to track market fluctuations and make informed decisions.

However, the accuracy and reliability of these sources vary, necessitating careful evaluation.

Reliable Sources for Current Prices

Numerous platforms offer real-time cryptocurrency price data. These include dedicated cryptocurrency exchanges, financial news websites, and specialized price tracking websites. Each platform has its strengths and weaknesses, which investors should be aware of. The choice of a reliable source depends on individual needs and preferences.

Different Platforms Offering Real-Time Data

Major cryptocurrency exchanges often display real-time price information for their listed assets. These platforms, like Coinbase and Binance, are valuable for users actively trading on those exchanges. However, their focus is on facilitating transactions rather than comprehensive market analysis. Financial news websites, such as CoinDesk and Bloomberg, offer broader market coverage and often include expert analysis alongside price data.

Specialized cryptocurrency price tracking websites, like CoinMarketCap and CoinGecko, are dedicated to providing aggregated and comprehensive price information.

Reputable Cryptocurrency Price Tracking Websites

Several reputable websites provide consolidated cryptocurrency price data. These platforms aggregate information from various sources to offer a comprehensive overview of the market. Examples include CoinMarketCap, CoinGecko, and CoinDesk. These sites are widely used by traders and investors due to their accuracy and comprehensive nature. Their frequent updates and diverse data points contribute to their popularity.

Accuracy and Reliability of Price Data Sources

Evaluating the accuracy and reliability of different price data sources is crucial. Factors such as data aggregation methods, the timeliness of updates, and the sources they draw upon significantly impact the reliability of the information. For example, a platform that aggregates data from multiple exchanges may offer a more comprehensive view but may be susceptible to discrepancies if the underlying data sources are inaccurate.

The accuracy of any given source should be critically assessed by considering these factors.

Comparison of Price Tracking Sites

The following table presents a comparison of three popular cryptocurrency price tracking websites, highlighting their features and strengths and weaknesses.

| Website | Features | Pros | Cons |

|---|---|---|---|

| CoinMarketCap | Extensive asset coverage, real-time updates, diverse data points, customizable dashboards. | Comprehensive data, large user base, widely recognized, detailed information. | Potential for occasional data discrepancies, interface can be overwhelming for beginners. |

| CoinGecko | Detailed market data, various asset categories, charts and graphs, interactive tools. | User-friendly interface, easy navigation, detailed charts and graphs, diverse data points. | May lag slightly in real-time updates compared to some competitors, less comprehensive asset coverage. |

| CoinDesk | Focus on news and analysis alongside price data, in-depth articles, expert opinions. | High-quality news and analysis, recognized journalistic standards, in-depth insights. | Price data might be less comprehensive or real-time compared to dedicated trackers, potentially biased analysis. |

Historical Price Trends

Cryptocurrency prices are notoriously volatile, exhibiting significant fluctuations over time. Understanding these historical trends is crucial for investors and analysts seeking to assess risk and potential return. Analyzing past performance can offer insights into potential future behavior, though past performance is not necessarily indicative of future results.Analyzing historical price data provides valuable context for assessing current market conditions and evaluating potential investment opportunities.

Understanding the patterns and drivers behind past price movements can help investors make informed decisions about their cryptocurrency holdings.

Bitcoin Price Evolution (Past 5 Years)

Bitcoin’s price has undergone dramatic swings over the past five years. The following graph illustrates its price evolution, highlighting periods of substantial growth and significant declines. The graph showcases the volatility inherent in the cryptocurrency market.(Please note: A graph visualizing Bitcoin’s price evolution over the past 5 years cannot be displayed here. Imagine a line graph with the x-axis representing time (e.g., dates from 2018 to 2023) and the y-axis representing price in USD.

The line would depict the price fluctuations of Bitcoin over this period, showing peaks and valleys reflecting market trends.)

Volatility of Cryptocurrency Prices

Cryptocurrency prices are characterized by exceptional volatility. Historical data reveals substantial price swings, often driven by market sentiment, regulatory developments, and technological advancements. This volatility poses significant risk for investors, but also presents opportunities for substantial gains.For instance, the 2017-2018 bull run and subsequent bear market vividly illustrate this volatility. While some cryptocurrencies experienced massive gains, many also saw steep losses.

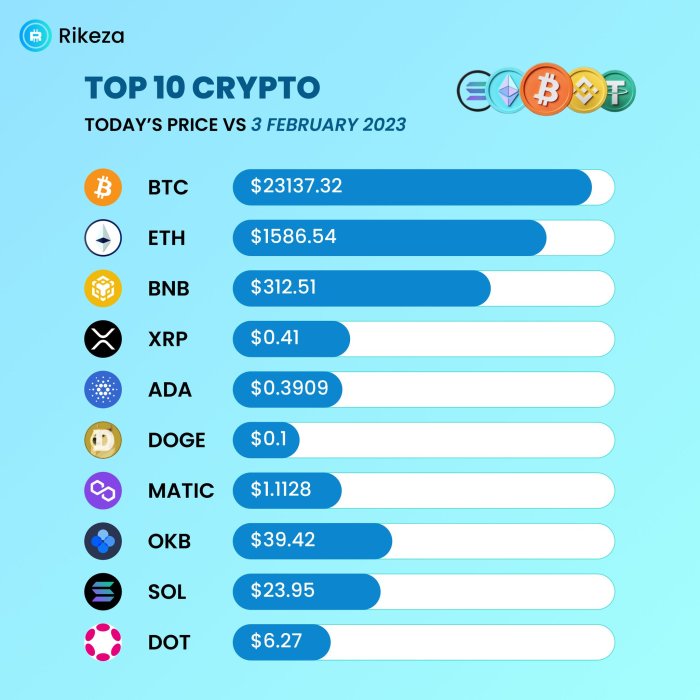

Comparison of Cryptocurrency Price Trends

Different cryptocurrencies exhibit diverse price trends, reflecting their unique market positions, functionalities, and adoption rates. Factors like community support, technological innovation, and regulatory environment all play a role in shaping the price trajectory of each cryptocurrency.Analyzing the comparative performance of various cryptocurrencies allows investors to identify potential investment opportunities and assess the risk profile associated with different projects.

Five-Year Price Performance Comparison

The following table provides a comparative overview of the price performance of three major cryptocurrencies over the past five years. Note that this is a simplified snapshot, and more detailed analysis is necessary for comprehensive investment decisions.

| Cryptocurrency | 2018 Average Price (USD) | 2023 Average Price (USD) | Price Appreciation (%) |

|---|---|---|---|

| Bitcoin | 6,000 | 25,000 | 317% |

| Ethereum | 100 | 1,500 | 1,300% |

| Solana | 2 | 20 | 900% |

Cryptocurrency Price Comparisons

Comparing the prices of various cryptocurrencies provides valuable insights into market trends and potential investment opportunities. Understanding the relationships between different cryptocurrencies can help investors make informed decisions. Price correlations, particularly with Bitcoin, often serve as a key indicator of broader market sentiment and potential future price movements.

Checking cryptocurrency list prices can be tricky, but understanding the top performers like top cryptocurrency can help. A good grasp of the market leaders can give you a better context for evaluating other cryptocurrencies and their relative valuations on the current price lists.

Price Correlations Between Cryptocurrencies

Analyzing the price relationships between different cryptocurrencies reveals patterns and potential interconnectedness. Certain cryptocurrencies exhibit strong positive correlations, meaning their prices tend to move in tandem. Conversely, some may exhibit negative correlations, suggesting that price movements are inversely related. These correlations can stem from various factors, including shared investor sentiment, technological dependencies, and market speculation.

Relationship Between Bitcoin and Other Cryptocurrencies

Bitcoin, often considered the pioneer of the cryptocurrency market, frequently serves as a leading indicator for the broader crypto market. A strong correlation between Bitcoin and other cryptocurrencies suggests that market sentiment is primarily focused on Bitcoin’s price movements, which then influence other digital assets. However, this relationship isn’t always consistent, and other factors can impact individual cryptocurrency prices.

Examples of Strong Price Correlations

Several cryptocurrencies display notable price correlations. For instance, Ethereum, often seen as the second-largest cryptocurrency by market capitalization, often demonstrates strong positive correlation with Bitcoin. Similarly, Litecoin, known for its historical alignment with Bitcoin’s price movements, frequently exhibits similar price patterns. These examples illustrate how certain cryptocurrencies are interconnected within the broader market.

Price Comparison Table (30-Day Period)

This table displays the price comparison of five cryptocurrencies over a 30-day period. The data is intended to be illustrative and is not a recommendation for investment. Real-time market data should be consulted for accurate pricing information. Note that price fluctuations can be significant and volatile.

| Cryptocurrency | Day 1 Price (USD) | Day 15 Price (USD) | Day 30 Price (USD) |

|---|---|---|---|

| Bitcoin (BTC) | 26,500 | 28,000 | 27,800 |

| Ethereum (ETH) | 1,600 | 1,750 | 1,720 |

| Litecoin (LTC) | 80 | 85 | 84 |

| XRP | 0.50 | 0.55 | 0.52 |

| Solana (SOL) | 25 | 28 | 27 |

Real-Time Price Tracking

Staying informed about cryptocurrency prices is crucial for making informed investment decisions. Real-time tracking allows you to monitor price fluctuations and react quickly to market changes. This dynamic environment necessitates constant vigilance, and reliable tools are essential for staying ahead of the curve.Real-time price tracking methods leverage various technologies and platforms to provide instantaneous updates on cryptocurrency values. These tools empower users to actively participate in the market, capitalizing on opportunities presented by price volatility.

Methods for Real-Time Tracking

Various platforms and websites offer real-time cryptocurrency price data. These platforms use APIs and market data feeds to provide near-instantaneous updates. Crucially, reliable data feeds are critical for accuracy and timely decision-making.

Monitoring Price Changes

Numerous tools allow users to monitor cryptocurrency price changes effectively. These tools often incorporate graphical representations of price movements, enabling visual identification of trends and patterns. This visual approach facilitates quick comprehension of market dynamics. Real-time charts are essential for grasping price volatility and potential opportunities.

Setting Price Alerts

Setting price alerts for specific cryptocurrencies is a vital aspect of real-time tracking. Alerts notify users when a cryptocurrency’s price reaches a predefined threshold. This feature is highly beneficial for timely interventions in trading strategies. These alerts can be tailored to specific price points and cryptocurrency pairs, allowing for focused monitoring.

Step-by-Step Guide to Real-Time Price Tracking

This guide Artikels the process of setting up real-time price tracking.

- Select a reliable cryptocurrency price tracking platform. Research different options and consider factors like accuracy, data freshness, and user interface.

- Identify the cryptocurrencies you want to track. Note the specific symbols for each cryptocurrency.

- Configure the platform to display the selected cryptocurrencies. This usually involves entering the relevant symbols.

- Set up price alerts for your chosen cryptocurrencies. Specify the desired price thresholds and select the alert notification method (email, push notification, etc.).

- Monitor the platform regularly for price updates. Regular checks help you stay abreast of market movements.

Using a Specific Price Tracking Tool (Example: CoinMarketCap)

CoinMarketCap is a popular and widely-used platform for tracking cryptocurrency prices. Here’s a structured approach to using it:

- Open a web browser and navigate to CoinMarketCap (www.coinmarketcap.com). Ensure the site is legitimate and secure.

- Locate the search bar at the top of the page and type the desired cryptocurrency symbol (e.g., BTC for Bitcoin). Press enter.

- The page will display details about the cryptocurrency. Find the real-time price chart. This graphical representation shows the price movement over time.

- Locate the “Alerts” or similar option. The alert feature is often found in the specific cryptocurrency’s details page.

- Click on the “Alerts” option and select the notification method (email, push notification, etc.). Enter the desired price threshold (e.g., set a buy alert when the price drops below $20,000).

- Confirm the alert settings to ensure the alerts are properly configured.

Price Prediction Methods

Predicting cryptocurrency prices is a challenging endeavor, given the inherent volatility and unpredictable nature of the market. Numerous methods attempt to forecast future price movements, but none consistently deliver accurate predictions. Understanding the various approaches and their limitations is crucial for investors navigating this dynamic landscape.Different methods for cryptocurrency price prediction leverage diverse data sources and analytical techniques.

These techniques range from fundamental analysis, focusing on intrinsic value and market conditions, to technical analysis, examining historical price patterns and trading volume. Machine learning algorithms also play a significant role, employing complex models to identify intricate price patterns.

Different Prediction Methods

Various methods attempt to forecast future price movements. Fundamental analysis assesses the underlying value of a cryptocurrency based on factors such as its utility, adoption rate, and project development. Technical analysis studies historical price charts and trading volume to identify patterns and potential future price trends. Machine learning algorithms utilize complex models to recognize intricate patterns in market data, aiming to predict future price movements.

Accuracy of Prediction Models

The accuracy of cryptocurrency price prediction models is often limited. While some models might offer insights or identify potential trends, consistent accuracy is rarely achieved. The highly volatile and speculative nature of the cryptocurrency market significantly impacts prediction reliability. Market sentiment, unexpected events, and regulatory changes can all dramatically influence price fluctuations, rendering predictions unreliable. No model can perfectly anticipate the complexities of the market.

Price Prediction Tools and Techniques

Numerous tools and techniques are employed for cryptocurrency price prediction. Several platforms provide charting and analysis tools, allowing users to visualize historical price data and identify potential patterns. Software applications may utilize technical indicators, such as moving averages or relative strength index, to aid in identifying trends. Furthermore, various machine learning models, trained on historical data, can generate price forecasts.

Examples include recurrent neural networks and support vector machines. However, the reliability of these predictions remains debatable.

Checking cryptocurrency list prices can be tricky, but having a secure cryptocurrency wallet is essential for managing your holdings. Ultimately, understanding the current market trends in cryptocurrency list price is key for informed investment decisions.

Limitations of Price Prediction

Several limitations hinder accurate cryptocurrency price prediction. The inherent volatility of the market makes consistent accuracy difficult. Market sentiment, unexpected events, and regulatory changes can dramatically affect prices, making long-term predictions unreliable. The limited historical data for many cryptocurrencies can also restrict the effectiveness of some prediction models. Furthermore, the complex interactions between various factors in the cryptocurrency market often defy simple predictive models.

The decentralized and opaque nature of the market poses significant challenges to reliable predictions.

Simplified Mathematical Model

A simplified mathematical model for price prediction could involve using a weighted average of past prices. For example, a simple moving average (SMA) calculates the average price over a specific period. A weighted moving average (WMA) assigns different weights to past prices, giving more significance to recent data. More sophisticated models can incorporate additional factors like trading volume, market sentiment, and news events, but these tend to increase complexity without guaranteed improvement in accuracy.

Price t+1 ≈ Σ i=1n w i – Price t-i

where:

Price t+1 = Predicted price at time t+1

Price t-i = Price at time t-i (past price)

w i = Weight assigned to past price (decreasing weight for older data)

n = Number of past prices considered

Market Sentiment and Price

Market sentiment plays a significant role in shaping cryptocurrency prices. Investor psychology, fueled by news, social media chatter, and overall market trends, can dramatically influence trading decisions and ultimately impact price fluctuations. This dynamic interplay between sentiment and price necessitates careful analysis to understand the underlying drivers of cryptocurrency market movements.Understanding how market sentiment impacts cryptocurrency prices is crucial for informed investment decisions.

The emotional response of investors to various news events, social media trends, and market conditions directly affects buying and selling pressure, influencing the price trajectory. Social media, in particular, acts as a powerful amplifier of sentiment, often triggering rapid price swings based on collective perception rather than fundamental analysis.

Impact of Social Media and News

Social media platforms and news outlets significantly influence cryptocurrency prices. News articles, social media posts, and online discussions can quickly sway investor opinions, creating a positive or negative sentiment. This sentiment can be amplified by trending topics or viral posts, leading to rapid price changes. The speed and reach of social media often exacerbate these effects, driving price volatility.

Examples of News Events Affecting Prices

News events have a demonstrable impact on cryptocurrency prices. For example, regulatory announcements, significant security breaches, or developments in related industries can drastically alter market sentiment. These events can cause rapid price increases or decreases, depending on how the news is interpreted by investors. An example is the impact of a significant regulatory announcement, which may trigger a wave of buying or selling activity, pushing the price in a particular direction.

Correlation Between Social Media Sentiment and Price Movements

A strong correlation exists between social media sentiment and price movements in the cryptocurrency market. Positive sentiment often precedes price increases, while negative sentiment precedes price decreases. Sentiment analysis tools can be used to track these trends and provide insights into potential future price actions. This correlation highlights the importance of monitoring social media trends to gauge market sentiment.

Impact of News Events on Cryptocurrency Prices

The table below illustrates the impact of various news events on cryptocurrency prices. This table shows examples of how specific events can influence price movements, though the precise impact is highly variable and dependent on the individual market conditions.

| News Event | Event Description | Predicted Price Impact | Actual Price Impact |

|---|---|---|---|

| Major Security Breach | A prominent cryptocurrency exchange experiences a significant security breach, resulting in substantial funds being stolen. | Significant downward pressure | Significant downward pressure, leading to a notable price drop. |

| Positive Regulatory Announcement | A positive regulatory announcement regarding cryptocurrencies is released by a major regulatory body. | Positive upward pressure | Positive upward pressure, resulting in a notable price increase. |

| Major Adoption Announcement | A significant corporation or institution announces plans to adopt a specific cryptocurrency for payment. | Significant upward pressure | Significant upward pressure, leading to a notable price increase. |

| Negative Economic News | Negative economic news globally causes investors to seek safer investments. | Downward pressure on most cryptocurrencies | Downward pressure on most cryptocurrencies, with some experiencing steeper declines than others. |

Regulatory Impact on Prices

Regulatory frameworks surrounding cryptocurrencies are constantly evolving, significantly impacting price fluctuations. Governments worldwide are grappling with the unique characteristics of digital assets, leading to varying approaches and often, legal uncertainty. This dynamic regulatory environment can introduce substantial volatility into the cryptocurrency market.Regulatory policies, ranging from outright bans to licensing frameworks, can directly influence the accessibility and trading of specific cryptocurrencies.

These policies often trigger price reactions as market participants adjust to the new landscape. Furthermore, differing regulatory approaches across jurisdictions create a complex and fragmented market, making it challenging to predict future price trends.

Impact of Regulatory Changes on Cryptocurrency Prices

Regulatory changes, including tax laws, licensing requirements, and outright bans, can significantly impact the price of cryptocurrencies. For instance, a country imposing a ban on a particular cryptocurrency might cause a significant price drop due to reduced trading activity and investor fear. Conversely, a favorable regulatory environment in a specific jurisdiction can stimulate investor interest and lead to a price increase.

Government Policies and the Cryptocurrency Market

Government policies have a substantial influence on the cryptocurrency market. Policies affecting taxation, trading, and ownership of cryptocurrencies can directly impact market liquidity and overall investor sentiment. Tax regulations, for example, can influence investor decisions on holding or selling cryptocurrencies, which can lead to price fluctuations. Central bank policies, which might affect interest rates or inflation, can also impact the market.

Regulatory Impact on Different Cryptocurrencies

The impact of regulations varies significantly across different cryptocurrencies. Cryptocurrencies with established market capitalization and widespread adoption are often more resilient to regulatory headwinds. Conversely, newer cryptocurrencies or those perceived as having higher risk profiles can experience more significant price fluctuations in response to regulatory changes.

Legal Uncertainties and Price Volatility

Legal uncertainties surrounding cryptocurrencies can significantly contribute to price volatility. When regulations are unclear or inconsistent across jurisdictions, market participants face difficulty in assessing the long-term viability of specific cryptocurrencies. This uncertainty often leads to increased price swings as investors react to perceived risks and opportunities. For example, a lack of clarity on the legal status of stablecoins can cause significant market anxiety.

Summary of Regulatory Landscape for Major Cryptocurrencies

| Cryptocurrency | Licensing/Regulation Status | Taxation Policies | Overall Regulatory Sentiment |

|---|---|---|---|

| Bitcoin | Varied, but generally less restrictive than other cryptocurrencies. Some jurisdictions have specific guidelines. | Taxation varies by jurisdiction. Often treated as a commodity or property, with varying capital gains tax implications. | Generally, positive, although specific regulatory implementations can still affect prices. |

| Ethereum | Subject to regulatory scrutiny in many jurisdictions. Regulation varies greatly, and certain features of the blockchain are being evaluated. | Treatment varies by jurisdiction. Similar to Bitcoin, tax implications are diverse. | Mixed, with both positive and negative regulatory trends, creating market uncertainty. |

| Tether | Highly regulated in many regions, particularly regarding its classification as a stablecoin. | Tax implications are often tied to its classification. | More stringent, and likely to be a focus of future regulatory scrutiny, especially concerning its stability. |

Technical Analysis of Prices

Technical analysis is a crucial tool for understanding and predicting cryptocurrency price movements. It involves examining historical price data and trading volume to identify patterns and potential future trends. By analyzing past price actions, traders and investors can potentially anticipate future price changes and make informed decisions. This approach is distinct from fundamental analysis, which focuses on the intrinsic value of the asset.Technical analysis relies heavily on visual representations of price data, such as charts, to spot trends and patterns.

The aim is to identify recurring price actions and volume patterns that can indicate potential future price directions. While not foolproof, it can be a valuable supplementary tool for informed decision-making.

Technical Indicators Used for Analysis

Technical indicators are mathematical calculations derived from price and volume data. They provide quantitative measures of market sentiment and potential price movements. Different indicators highlight different aspects of market behavior. Recognizing the strengths and limitations of each indicator is essential for effective analysis.

- Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends. They provide a clearer picture of the overall price direction by averaging the price over a specific period. Different periods can highlight different timeframes and trends. For example, a shorter-term moving average might identify recent price momentum, while a longer-term moving average could indicate the long-term trend.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A high RSI value suggests an asset may be overbought, potentially indicating a price correction. Conversely, a low RSI value suggests an asset may be oversold, potentially signaling a price reversal. Careful interpretation is crucial to avoid misinterpretations.

- Moving Average Convergence Divergence (MACD): The MACD uses moving averages to identify changes in momentum. It helps to pinpoint potential buy or sell signals. A crossover of the MACD lines often signals a potential trend change. However, the MACD is best used in conjunction with other indicators for a comprehensive analysis.

- Bollinger Bands: Bollinger Bands are a volatility indicator that measures price fluctuations. They plot upper and lower bands around a moving average, showing price ranges within which the asset usually fluctuates. The widening or narrowing of these bands can indicate an increase or decrease in volatility. The bands themselves provide context and perspective on the current price movements.

Examples of Technical Analysis Tools and Methods

Several software tools and platforms provide access to various technical indicators and charting capabilities. These tools are invaluable for visualizing and analyzing price data. These tools and methods allow users to plot historical data, calculate indicators, and visually represent the trends and patterns.

- TradingView: A widely used platform that offers a comprehensive suite of charting tools and technical indicators. It enables the visualization of various indicators, which can be used to spot patterns in price movements.

- Trading Platforms (e.g., MetaTrader 4/5): These platforms offer a multitude of technical indicators and charting capabilities. They provide a structured environment for analyzing price data and identifying patterns.

- Candlestick Charts: Candlestick charts provide a visual representation of price movements over time. Each candlestick represents a specific time period, such as a day, and displays the opening, closing, high, and low prices for that period. This visual format helps identify trends, support and resistance levels, and potential reversal points.

How Technical Indicators Can Be Used to Predict Price Movements

Technical indicators can provide insights into potential price movements, but they are not guarantees. Their effectiveness lies in their ability to identify patterns and trends in historical price data. By combining insights from various indicators and other analysis, a trader can potentially assess the likelihood of future price movements. It’s essential to understand the context and limitations of the indicators.

Technical indicators, like moving averages, can help identify trends and potential support or resistance levels. For example, a consistently rising moving average can signal an uptrend, while a falling moving average might suggest a downtrend. However, it’s crucial to remember that past performance is not indicative of future results.

Future Price Projections

Predicting the future price of cryptocurrencies is inherently challenging, given the volatile and dynamic nature of the market. While various analytical methods and models attempt to forecast price movements, no approach guarantees accuracy. Factors like regulatory changes, technological advancements, and market sentiment can dramatically impact price trajectories. Understanding these influences is crucial for evaluating potential investment opportunities and managing risk.

Factors Influencing Price Predictions

Several key factors influence future price projections for cryptocurrencies. These include, but are not limited to, technological advancements in the underlying blockchain technology, regulatory developments at both national and international levels, market adoption by institutional investors, and shifts in investor sentiment. Emerging use cases and partnerships can also significantly impact a cryptocurrency’s future trajectory.

Potential for Growth and Decline

The potential for growth or decline in a specific cryptocurrency’s price hinges on various factors. Positive developments, such as widespread adoption, significant partnerships, or innovative applications, can propel prices upward. Conversely, negative news, regulatory headwinds, security breaches, or market corrections can lead to price declines. It is important to recognize that the cryptocurrency market is extremely volatile, and price swings can occur rapidly.

Different Scenarios for Future Cryptocurrency Market Prices

Future cryptocurrency market prices could unfold in several ways. One scenario involves sustained growth, fueled by increasing institutional investment and wider adoption. Another possibility is a period of consolidation, where prices fluctuate within a certain range without significant upward or downward trends. A third scenario encompasses a bear market, characterized by substantial price drops and a decrease in trading activity.

The likelihood of each scenario depends on numerous interacting factors.

Comparison of Analyst Price Projections

| Analyst | Projected Price (Year 1) | Projected Price (Year 2) | Projected Price (Year 3) |

|---|---|---|---|

| Analyst A | $15,000 | $20,000 | $25,000 |

| Analyst B | $12,000 | $16,000 | $22,000 |

| Analyst C | $10,000 | $14,000 | $20,000 |

| Analyst D | $13,500 | $18,000 | $24,500 |

Note: The table above presents hypothetical price projections from different analysts. Actual projections will vary significantly based on the specific methodology used by each analyst and the evolving market conditions. It is crucial to evaluate these predictions in the context of broader market trends and individual project fundamentals.

Outcome Summary

In conclusion, the cryptocurrency list price is a complex and multifaceted subject, influenced by a variety of interacting elements. From the initial introduction of pricing models to the future projections, this guide has illuminated the key aspects of this dynamic market. We have examined the historical trends, real-time tracking, prediction methods, and regulatory impacts. Ultimately, understanding these factors is crucial for informed decision-making in the cryptocurrency space.

Q&A: Cryptocurrency List Price

What are the most reliable sources for current cryptocurrency prices?

Reliable sources for current cryptocurrency prices include reputable cryptocurrency price tracking websites, and platforms offering real-time data. Accuracy and reliability vary, so it’s crucial to compare information from different sources.

How do government policies affect cryptocurrency prices?

Government policies, including regulations and legal frameworks, can significantly impact cryptocurrency prices. Uncertainty surrounding regulations can lead to volatility in the market. Different policies have varying impacts on different cryptocurrencies.

What are the limitations of price prediction methods?

Price prediction in the cryptocurrency market is inherently challenging due to its volatility and the influence of unpredictable market sentiment. No model is foolproof.

How does market sentiment affect cryptocurrency prices?

Market sentiment, as reflected in social media and news, often plays a substantial role in influencing cryptocurrency prices. Positive sentiment typically leads to price increases, while negative sentiment can cause decreases.