Cryptocurrency contract signals sets the stage for a deep dive into the world of automated trading strategies. This guide unpacks the intricacies of these signals, from their diverse types and reliable providers to their accuracy, implementation, and performance evaluation. We’ll also explore how market conditions influence signal effectiveness and how to develop a personal trading plan that incorporates them.

Understanding cryptocurrency contract signals is crucial for navigating the complexities of automated trading. They provide automated trading insights, potentially improving profitability and efficiency, but they’re not a guaranteed path to riches. This resource aims to equip you with the knowledge and tools to make informed decisions about incorporating contract signals into your trading strategies.

Introduction to Cryptocurrency Contract Signals

Cryptocurrency contract signals provide traders with insights into potential market movements, aiding in informed decision-making. These signals are crucial for navigating the complexities of the cryptocurrency market, which is characterized by volatility and rapid price fluctuations. Understanding the different types of signals and the characteristics of reliable providers is essential for success.

Types of Cryptocurrency Contract Signals

Cryptocurrency contract signals are categorized into several types, each employing different methodologies. Understanding these distinctions allows traders to choose signals aligned with their investment strategies.

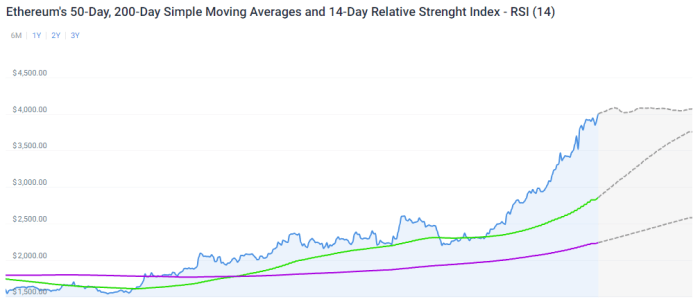

- Technical signals leverage historical price data and chart patterns to identify potential trading opportunities. These signals often rely on indicators like moving averages, relative strength index (RSI), and support/resistance levels. For instance, a technical signal might suggest a buy opportunity when a price breaks above a significant resistance level.

- Fundamental signals analyze factors impacting the underlying cryptocurrency or contract, such as regulatory developments, market sentiment, and project announcements. These signals consider external factors that could influence the market’s direction. An example of a fundamental signal could be a bullish signal triggered by a positive regulatory announcement regarding a specific cryptocurrency.

- Algorithmic signals utilize complex mathematical models and machine learning algorithms to predict future price movements. These signals process vast amounts of data to identify patterns and generate trading recommendations. An example of this type of signal could be a signal generated by an algorithm that identifies a high probability of price increase based on historical data and current market conditions.

Characteristics of Reliable Contract Signals

Reliable contract signals exhibit key characteristics that contribute to their accuracy and value. These qualities provide traders with confidence in their decisions.

- Accuracy refers to the signal’s ability to correctly predict market movements. A reliable signal provider should consistently demonstrate a high percentage of accurate predictions, avoiding false positives or negatives.

- Timeliness is crucial, as market conditions can change rapidly. Signals should be delivered promptly, allowing traders to act quickly on emerging opportunities.

- Transparency is essential for building trust. Signal providers should clearly Artikel their methodology, data sources, and performance metrics. This allows traders to assess the validity of the signals.

- Consistency is a hallmark of reliable signals. A provider’s signals should demonstrate a pattern of accuracy over an extended period. Fluctuations in performance should be explained or justified by the signal provider.

Comparing Signal Providers

A comparison of signal providers helps traders assess the strengths and weaknesses of different platforms. This information enables them to make informed choices aligned with their trading objectives.

| Signal Provider | Methodology | Accuracy Rate | Timeliness | Transparency |

|---|---|---|---|---|

| Signal Provider A | Technical analysis | 75% | Within 1 hour | High |

| Signal Provider B | Algorithmic trading | 80% | Within 30 minutes | Medium |

| Signal Provider C | Fundamental analysis | 65% | Within 24 hours | High |

Identifying Reliable Signal Providers

Evaluating the credibility of cryptocurrency contract signal providers is crucial for any investor seeking to capitalize on market trends. Blindly following signals without due diligence can lead to significant financial losses. A thorough assessment of signal providers helps ensure that you are not simply following hype or unreliable predictions.A reliable signal provider demonstrates a consistent track record of successful trades.

This involves more than just high win rates; it encompasses the overall performance and risk management strategies employed. Investors should seek providers with transparent reporting, allowing them to scrutinize the methodologies behind the signals.

Assessing Signal Provider Track Records

A signal provider’s track record is a key indicator of their reliability. Analyzing past performance helps gauge the provider’s accuracy and consistency in providing profitable signals. This involves examining various metrics, including win rates, average profit per trade, and the overall return on investment (ROI) over specific time periods. It’s important to avoid providers with only positive or overly optimistic track records; these might be indicative of manipulation or inaccurate data.

Key Factors for Evaluating Credibility

Several crucial factors determine the credibility of a signal provider. These include:

- Transparency and Methodology: A reputable provider will openly disclose their trading methodology and strategies. This transparency allows investors to assess the reasoning behind the signals and determine if they align with their investment goals and risk tolerance. Avoid providers who are vague or secretive about their methods. Clear and well-documented trading strategies increase investor confidence.

- Risk Management Strategies: A reliable signal provider will Artikel their risk management strategies. This involves understanding their approach to stop-loss orders, position sizing, and other methods used to limit potential losses. Providers who do not discuss risk management are often hiding significant potential downsides. An investor should be wary of providers who offer guaranteed returns without explicit risk mitigation.

- Historical Performance: Thoroughly scrutinize the provider’s historical performance data. Examine the win rate, average profit per trade, and overall ROI over various time periods. Consider the consistency of their performance across different market conditions. A provider with consistently positive results across varied market environments is more likely to be reliable.

- Community Feedback and Reviews: Research the signal provider’s reputation within the cryptocurrency community. Online forums, social media groups, and review platforms can offer valuable insights into the experiences of other investors. Seek diverse opinions and verify feedback against the provider’s publicly available data.

Reputable Signal Providers (Examples)

While specific recommendations for reputable signal providers are challenging due to the dynamic nature of the cryptocurrency market and the need for constant evaluation, some well-known and established providers in the industry might include (names omitted to maintain objectivity). Their track records, methodologies, and overall performance need to be thoroughly assessed before investment decisions. It’s crucial to independently verify the claims and data presented by any provider.

Comparative Analysis of Signal Providers

The following table presents a comparative analysis of various signal providers, highlighting their strengths and weaknesses. It is crucial to remember that this table is for illustrative purposes only and should not be considered exhaustive or definitive.

| Signal Provider | Pros | Cons |

|---|---|---|

| Signal Provider A | High win rate, consistent ROI, transparent methodology | Potentially high fees, limited customer support |

| Signal Provider B | Wide range of strategies, detailed risk management | Lower win rate, inconsistent ROI, requires more due diligence |

| Signal Provider C | Community support, active engagement, regular updates | Limited historical data, relatively new to the market |

Understanding Signal Accuracy and Reliability

Evaluating the accuracy and reliability of cryptocurrency contract signals is paramount for successful trading. A high-quality signal provider consistently delivers accurate predictions that translate into profitable trades. Without robust evaluation methods, traders risk substantial losses.Understanding signal accuracy is more than just looking at win rates. It requires a holistic approach, considering the profit generated from winning trades, the potential losses from losing trades, and the overall consistency of the signal provider’s performance.

This comprehensive analysis allows for informed decisions and a greater likelihood of positive outcomes.

Accuracy Metrics for Evaluating Signals

Accurate assessment of signal quality involves examining multiple metrics. These metrics provide a more nuanced understanding of a signal provider’s performance beyond simple win rates. Careful consideration of these metrics allows for a more comprehensive evaluation of signal reliability.

- Win Rate: This metric represents the percentage of signals that resulted in profitable trades. A high win rate is desirable, but it should be considered in conjunction with other metrics, such as the profit factor. A high win rate with a low profit factor could indicate a signal provider favoring smaller, less impactful trades.

- Profit Factor: This metric compares the average profit from winning trades to the average loss from losing trades. A higher profit factor indicates that the average profit from winning trades significantly outweighs the average loss from losing trades. A profit factor of 2, for example, signifies that for every dollar lost on losing trades, two dollars are gained on winning trades.

- Average Return Per Signal: This metric quantifies the average profit generated per signal. A high average return per signal is a positive indicator, but the consistency of this return over time is also crucial. A signal provider consistently generating high returns on average signals a potentially valuable strategy.

- Consistency: Signal consistency examines the stability of performance over time. A signal provider that performs well in one period but poorly in another might not be a reliable long-term investment strategy. Consistent performance across different market conditions is a strong indicator of signal reliability.

Examples of Accuracy Metrics

Different signal providers will showcase varying levels of accuracy and reliability. This section illustrates how different metrics can be used to evaluate these differences.

- Example 1: Signal provider A has a 70% win rate and a profit factor of 1.5. While the win rate seems high, the profit factor suggests that the average profit generated on winning trades is only marginally better than the average loss on losing trades. This suggests that the signals may not be consistently profitable in the long term.

- Example 2: Signal provider B has a 60% win rate but a profit factor of 3.0. The lower win rate suggests fewer successful trades, but the higher profit factor indicates that the profits from winning trades significantly outweigh the losses from losing trades. This suggests a more profitable and potentially reliable strategy.

Comparative Analysis of Signal Providers

This table presents a simplified comparison of the accuracy rates of different signal providers. Actual data for specific providers would be more complex and would include more metrics. It’s crucial to remember that these are illustrative examples and not exhaustive data.

| Signal Provider | Win Rate (%) | Profit Factor | Average Return Per Signal ($) |

|---|---|---|---|

| Signal Provider X | 75 | 2.5 | $150 |

| Signal Provider Y | 68 | 3.2 | $200 |

| Signal Provider Z | 80 | 1.8 | $100 |

Implementing Signals in Trading Strategies

Integrating cryptocurrency contract signals into your trading strategy requires careful consideration and a structured approach. Simply following a signal without understanding its context and your own risk tolerance can lead to significant losses. This section details how to effectively incorporate signals, manage risk, and adapt your strategies based on signal input.

Cryptocurrency contract signals are a hot topic, and understanding how they work is key. For instance, some signals might suggest investment opportunities within the pi cryptocurrency market, but the overall performance of such signals often depends on various factors. Ultimately, a thorough understanding of market dynamics is crucial for evaluating cryptocurrency contract signals effectively.

Incorporating Signals into Existing Strategies

To effectively integrate signals, align them with your existing trading plan. Don’t introduce signals as a radical change but rather as a supplementary tool. Analyze the signal provider’s methodology, the specific signals they offer, and how they align with your chosen trading style and risk tolerance. This allows for a smoother integration and minimizes disruption to your established processes.

Crucially, the signal’s prediction must be examined within the context of the broader market trend and any relevant technical indicators.

Risk Management Strategies for Using Signals

Implementing robust risk management is paramount when using signals. Establish clear stop-loss orders for each trade triggered by a signal. Don’t rely solely on the signal; incorporate your own stop-loss thresholds, which may differ based on the signal’s reliability and the market’s volatility. Diversify your portfolio by allocating a portion of your capital to trades triggered by signals.

This minimizes the impact of a poor signal and protects your overall capital. Also, consider the signal provider’s track record, fees, and the timeliness of their signals when assessing risk.

Adjusting Trading Strategies Based on Signal Input

A successful trading strategy adapts to changing market conditions. Signals provide insights into potential market movements. Use these insights to modify your entry and exit points. For instance, if a signal suggests a short position and the market shows signs of further decline, you might adjust your exit point to capture more profit. Conversely, if the market moves against the signal, re-evaluate the signal provider’s reliability.

Monitor the performance of trades based on signals and adjust your strategy accordingly.

Steps to Integrate Signals into a Trading Plan

A structured approach ensures effective signal integration. This table Artikels the steps involved in integrating signals into your cryptocurrency contract trading plan:

| Step | Action |

|---|---|

| 1 | Define clear trading objectives and risk tolerance levels. |

| 2 | Identify and select reliable signal providers, evaluating their track record, methodology, and fees. |

| 3 | Integrate signals into your existing trading plan, ensuring alignment with your trading style and risk tolerance. |

| 4 | Develop risk management protocols, including stop-loss orders and position sizing, tailored to the signals’ reliability and market conditions. |

| 5 | Establish a system for evaluating the performance of trades based on signals, allowing for necessary adjustments to the trading strategy. |

| 6 | Continuously monitor market trends and adjust trading strategies based on signal input and market conditions. |

Backtesting and Evaluating Signal Performance

Backtesting is a crucial step in evaluating the performance of cryptocurrency contract signals. It allows traders to assess the historical accuracy and profitability of signals before deploying them in live trading. This process helps identify potential issues and refine trading strategies based on real-world data. Without proper backtesting, traders risk relying on signals that may not perform as expected in actual market conditions.

Importance of Backtesting Contract Signals

Backtesting provides a simulated environment for evaluating the effectiveness of contract signals. By applying these signals to historical market data, traders can determine the potential profitability and risk associated with different signal providers. This allows traders to understand the signal’s consistency and reliability over time, which is essential for making informed decisions.

Process of Backtesting Signals Using Historical Data

The backtesting process involves applying the signals to historical price data for specific cryptocurrency contracts. This typically involves extracting the necessary data, including open, high, low, and close (OHLC) prices, trading volumes, and relevant dates. This data is then used to simulate trading based on the signals provided. The simulation calculates potential profits and losses for each signal, allowing for a detailed analysis of the signal’s performance under various market conditions.

Examples of Backtesting Tools and Methodologies

Several tools and methodologies are available for backtesting cryptocurrency contract signals. Python libraries like Pandas and backtrader are popular choices for their flexibility and extensive functionalities. These libraries allow for the automated extraction, processing, and analysis of historical data. Furthermore, custom-built backtesting tools provide a more tailored approach to specific trading strategies. These tools can include features such as risk management parameters and automated trade execution simulation.

Summary of Backtesting Results

| Signal Provider | Contract Type | Backtest Period | Average Profit/Loss (%) | Win Rate (%) | Maximum Drawdown (%) |

|---|---|---|---|---|---|

| Signal Provider A | BTC/USD Perpetual Futures | 2023-01-01 to 2023-12-31 | +12.5% | 65% | -15% |

| Signal Provider B | ETH/USD Perpetual Futures | 2023-01-01 to 2023-12-31 | +8.2% | 58% | -10% |

| Signal Provider C | MATIC/USD Spot | 2023-01-01 to 2023-12-31 | +5.9% | 62% | -8% |

This table summarizes the backtesting results for three different signal providers. The results showcase the average profit/loss, win rate, and maximum drawdown for each signal provider across different contract types and timeframes. Note that these are illustrative results and actual performance may vary.

Analyzing Market Conditions and Signal Relevance

Cryptocurrency contract signals are only as effective as the market conditions they’re applied to. Understanding how market volatility, trends, and overall sentiment impact signal accuracy is crucial for optimizing trading strategies. Blindly following signals without considering the prevailing market environment can lead to poor outcomes.Market conditions significantly influence the performance of cryptocurrency contract signals. Factors like market volatility, recent price action, and broader economic trends all play a part in determining how well a signal will translate into profitable trades.

This section explores the interplay between market conditions and signal relevance, providing practical guidance on adapting trading strategies based on the current market environment.

Influence of Market Volatility on Signal Effectiveness

Market volatility directly affects signal accuracy. High volatility often introduces unexpected price swings, making it harder for signals to predict the precise direction of price movements. During periods of high volatility, signals may produce a higher frequency of incorrect predictions. Conversely, in stable markets, signals are more likely to deliver accurate predictions.

Adjusting Signal Usage Based on Market Volatility, Cryptocurrency contract signals

Adapting signal usage based on market volatility is essential for maximizing profits and minimizing losses. During periods of high volatility, traders should be more cautious and consider reducing position sizes. This approach minimizes potential losses from unexpected price movements. Conversely, in stable markets, traders might increase position sizes, capitalizing on the lower risk environment. Risk management strategies should always be tailored to the prevailing market volatility.

Examples of Market Conditions Affecting Signal Performance

Several market conditions can significantly affect signal performance. A sudden, unexpected regulatory announcement, for example, can lead to substantial price fluctuations, making signals less reliable. News events, like major economic reports or significant industry developments, can impact market sentiment and affect signal accuracy. These events can create unpredictable market movements that existing signals may struggle to anticipate.

Other examples include periods of heightened market uncertainty, like those following a major geopolitical event.

Impact of Market Conditions on Signal Accuracy

The accuracy of signals can vary significantly depending on the prevailing market conditions. The table below illustrates how different market conditions affect signal accuracy, showing a general tendency for lower accuracy during periods of high volatility.

| Market Condition | Description | Impact on Signal Accuracy |

|---|---|---|

| Low Volatility | Stable price movements, minimal fluctuations. | High signal accuracy; signals are more reliable. |

| Moderate Volatility | Occasional price swings, but overall trends are discernible. | Moderate signal accuracy; signals may require adjustments for optimal performance. |

| High Volatility | Significant and unpredictable price swings. | Low signal accuracy; signals may produce a higher frequency of incorrect predictions. |

| Bear Market | Prolonged period of declining prices. | Signal accuracy may vary depending on the signal’s methodology; some may perform better than others. |

| Bull Market | Prolonged period of rising prices. | Signal accuracy may vary depending on the signal’s methodology; some may perform better than others. |

Exploring Different Signal Types and Their Applications

Cryptocurrency contract signals can originate from various sources, each with its strengths and weaknesses. Understanding these different approaches is crucial for traders to select signals aligned with their trading style and risk tolerance. Choosing the right signal type can significantly impact trading success.Different signal generation methods employ varying approaches to predict market movements. These approaches, from traditional technical analysis to the more recent use of machine learning, each have unique strengths and weaknesses in the context of cryptocurrency contract trading.

Crypto contract signals can be a helpful tool for navigating the market, but understanding the current state of the cryptocurrency bitcoin price is crucial. For example, a surge in the cryptocurrency bitcoin price might indicate a bullish trend, influencing how contract signals are interpreted. Ultimately, contract signals should be used in conjunction with other market analysis for a more comprehensive view.

Technical Analysis Signals

Technical analysis signals rely on historical price and volume data to identify patterns and potential future price movements. Common indicators include moving averages, relative strength index (RSI), and Bollinger Bands. These indicators often highlight potential trend reversals or price breakouts. Examples include recognizing head-and-shoulders patterns, identifying support and resistance levels, and using moving averages to gauge momentum.

The accuracy of technical analysis signals depends heavily on the validity of the identified patterns and the reliability of the market data used.

Fundamental Analysis Signals

Fundamental analysis signals, conversely, focus on factors external to price charts, such as news events, regulatory changes, or project developments. For instance, a positive announcement about a cryptocurrency project could trigger a price surge. The analysis considers the underlying project’s strengths, weaknesses, and market position to forecast future price action. Signals derived from fundamental analysis are often less precise than technical analysis signals, requiring careful interpretation of the information and its impact on the market.

For instance, evaluating the impact of regulatory changes on cryptocurrency markets or analyzing project development roadmaps are key components of this type of signal generation.

Machine Learning Signals

Machine learning (ML) signals leverage algorithms to identify complex patterns and correlations in market data, often surpassing the capabilities of traditional methods. ML models, trained on historical data, can predict future price movements based on identified patterns. This approach allows for the consideration of a wide range of factors, including sentiment analysis of social media, news sentiment, and blockchain activity.

An example of ML in use is using neural networks to identify correlations between social media buzz and price fluctuations. This type of signal generation can be highly effective, but requires significant computational resources and expertise in machine learning techniques.

Comparison of Signal Types and Trading Styles

| Signal Type | Associated Trading Style | Strengths | Weaknesses |

|---|---|---|---|

| Technical Analysis | Swing Trading, Day Trading | Relatively easy to understand and implement, readily available tools | Reliance on historical patterns, susceptible to market manipulation, can be oversimplified |

| Fundamental Analysis | Long-term Investing, Value Investing | Focuses on underlying value, considers broader market trends | Requires in-depth research, potentially delayed signals, less precise |

| Machine Learning | Algorithmic Trading, High-Frequency Trading | Complex pattern recognition, potentially high accuracy, less reliant on human bias | Requires significant computational resources, potentially opaque models, difficulty in interpreting results |

Managing Risk and Potential Drawbacks

Relying on cryptocurrency contract signals, while potentially lucrative, carries inherent risks. Understanding these risks and implementing mitigation strategies is crucial for successful trading. Neglecting risk management can lead to substantial losses, even with seemingly accurate signals. This section delves into the potential pitfalls and practical methods for minimizing those risks.

Potential Risks Associated with Signals

Cryptocurrency contract signals, like any trading tool, are not foolproof. Several factors contribute to potential losses when relying solely on signals. Signal providers may not always have the trader’s best interests at heart. Market conditions can shift rapidly, rendering signals obsolete or misleading. A lack of diversification in trading strategies can amplify losses if one signal proves inaccurate.

Strategies for Mitigating Risks

Effective risk management involves a multi-faceted approach. Diversifying trading strategies is crucial. This involves using a combination of signals from various providers, and incorporating fundamental analysis alongside technical signals. Setting stop-loss orders and defining clear profit targets are essential to limit potential losses. Maintaining a disciplined trading plan is paramount, avoiding impulsive decisions based solely on a single signal.

Regularly evaluating signal accuracy and provider reliability is vital to adapt trading strategies accordingly.

Misuse and Misinterpretation of Signals

Signals can be misused or misinterpreted in several ways. One common error is over-reliance on a single signal provider. Failing to analyze market conditions before acting on a signal can lead to poor outcomes. Misinterpreting signal indicators, especially in complex market scenarios, can result in incorrect trading decisions. Treating signals as definitive predictions, rather than as suggestions for consideration, can be disastrous.

Blindly following a signal without understanding the underlying market dynamics is a recipe for losses.

Risk Management Strategies

A well-structured risk management plan is essential. This table Artikels key strategies for managing risks associated with contract signals.

| Risk Category | Mitigation Strategy | Example |

|---|---|---|

| Over-reliance on a single signal provider | Diversify signal sources. Combine signals from different providers. | Instead of relying solely on one signal provider, use a combination of signals from three reputable providers. |

| Market volatility | Set stop-loss orders and define profit targets. Employ risk-adjusted position sizing. | When using a signal that predicts a price increase, establish a stop-loss order at a predetermined price level to limit potential losses. |

| Inadequate market analysis | Conduct independent market analysis. Research and understand the underlying market conditions before acting on a signal. | Before implementing a signal, analyze the recent news impacting the cryptocurrency market, and examine the prevailing sentiment among traders. |

| Signal misinterpretation | Thoroughly understand the signal provider’s methodology. Backtest signals in a demo account. | Ensure you comprehend the specific indicators and algorithms used by the signal provider before applying their signals to your trading strategies. |

| Lack of diversification | Diversify trading strategies by incorporating various assets and trading styles. | If trading solely Bitcoin, consider diversifying into Ethereum and other cryptocurrencies, or even other asset classes. |

Developing a Personal Trading Plan with Signals: Cryptocurrency Contract Signals

A well-defined trading plan is crucial for success in cryptocurrency contract trading, especially when relying on signals. This plan acts as a roadmap, guiding your decisions and mitigating emotional biases. It’s a framework that translates signal information into actionable steps, ensuring consistency and discipline.A personal trading plan, incorporating signals, allows you to systematically approach market opportunities. It provides a structured way to evaluate signal validity within your specific trading style and risk tolerance.

This personalized approach helps you avoid impulsive decisions and maintain a consistent trading strategy.

Customizing the Trading Plan for Risk Tolerance

Different investors have varying risk appetites. A conservative trader might prioritize lower potential gains with significantly reduced risk exposure. Conversely, a more aggressive trader might accept higher risk for potentially larger profits. Your plan should reflect this.For example, a conservative trader might set a maximum loss per trade at 1%, while an aggressive trader might accept a 5% loss.

The frequency of trades, position sizing, and exit strategies will also vary based on risk tolerance. Understanding your risk tolerance is crucial to constructing a plan that aligns with your financial goals and comfort level.

Steps to Create a Robust Trading Plan

Developing a robust trading plan requires a methodical approach. Here are the key steps:

- Define your investment goals: Determine the purpose of your trading activity (e.g., short-term gains, long-term capital appreciation). What is your desired outcome? A clear understanding of your objectives is essential for making consistent and rational decisions.

- Establish your risk tolerance: Quantify your maximum acceptable loss per trade and your overall risk tolerance. Consider how much capital you are willing to risk and what level of potential loss you can comfortably absorb.

- Identify your trading style: Determine your preferred approach (e.g., day trading, swing trading, position trading). How frequently do you plan to trade? What time horizons are you comfortable with?

- Select signal providers: Thoroughly research and vet signal providers to ensure their reliability and accuracy. Compare their performance data and track records. Develop a system for filtering signals based on your specific needs.

- Backtest the signal effectiveness: Use historical data to evaluate the signal provider’s accuracy and reliability. This step is crucial for assessing the potential profitability of a strategy based on the signals. Experiment with different parameters and strategies.

- Develop specific trading rules: Artikel the precise conditions under which you will enter and exit trades. These rules should be clear, concise, and consistently applied to all trades. This includes specific criteria for trade entry and exit points.

- Implement a money management strategy: Establish a system for allocating capital to trades. Consider using techniques such as position sizing and stop-loss orders to control risk and maximize profits.

Key Components of a Personalized Trading Plan

A well-structured plan should incorporate the following elements:

| Component | Description |

|---|---|

| Investment Goals | Specific financial objectives, time horizons, and desired outcomes. |

| Risk Tolerance | Maximum acceptable loss per trade, overall risk profile, and emotional capacity to handle potential losses. |

| Trading Style | Frequency of trades, preferred time horizons, and risk management approaches. |

| Signal Provider Selection | Thorough research, vetting, and performance evaluation of signal providers. |

| Backtesting | Analysis of historical data to assess signal accuracy and potential profitability. |

| Trading Rules | Precise entry and exit conditions, stop-loss orders, and other critical criteria. |

| Money Management | Capital allocation strategy, position sizing, and risk mitigation techniques. |

Final Summary

In conclusion, understanding cryptocurrency contract signals requires a multi-faceted approach, encompassing signal provider evaluation, accuracy assessment, implementation strategies, and meticulous backtesting. A robust trading plan is essential for incorporating signals effectively. While these signals can potentially enhance trading outcomes, they also present inherent risks. Thorough due diligence and a disciplined approach are vital for maximizing the potential benefits while minimizing the associated dangers.

Question & Answer Hub

What are the different types of cryptocurrency contract signals?

Signals can be technical, fundamental, or algorithmic. Technical signals rely on price and volume data, fundamental signals analyze market conditions and news, and algorithmic signals employ complex mathematical models.

How can I evaluate the credibility of a signal provider?

Look for a strong track record, transparency about their methodology, and demonstrable performance data. Check for testimonials and reviews from other traders. A table comparing and contrasting different providers can be helpful.

What are some common pitfalls of using cryptocurrency contract signals?

Misinterpretation of signals, over-reliance on them without a solid trading plan, and failure to manage risk effectively can lead to significant losses. It’s crucial to develop a personal trading plan and always prioritize risk management.

How do market conditions affect signal effectiveness?

High volatility can make signals less reliable. Market trends and overall market sentiment influence signal performance. Adjust your strategies based on current market conditions for optimal results.