Cryptocurrency coin, a digital or virtual currency secured by cryptography, has rapidly evolved from a niche concept to a significant force in the global financial landscape. Understanding its multifaceted nature is crucial for anyone interested in finance, technology, or investing. This comprehensive exploration delves into the technical intricacies, investment opportunities, and market trends surrounding this exciting asset class.

This in-depth guide examines various facets of cryptocurrency coins, from their fundamental principles and technical aspects to the intricate market dynamics and future projections. It covers everything from the historical context to potential risks and regulations, providing a complete picture of this rapidly changing field.

Overview of Cryptocurrency Coins

Cryptocurrency coins are digital or virtual currencies designed to function as a medium of exchange, similar to traditional fiat currencies. They utilize cryptography for security and are decentralized, meaning they operate independently of central banks or governments. This decentralized nature is a key characteristic that distinguishes them from traditional financial systems.These digital currencies are based on blockchain technology, a distributed ledger that records transactions across multiple computers.

This decentralized and transparent nature contributes to the security and immutability of the transactions recorded on the blockchain.

Definition of a Cryptocurrency Coin

A cryptocurrency coin represents a specific digital asset, often the foundational unit of a cryptocurrency ecosystem. It’s the fundamental unit of account and transaction within a particular cryptocurrency system. This is the primary means of exchange and transfer within that network.

Difference Between Coins and Tokens

Cryptocurrency coins are often fundamentally different from tokens. Coins are usually the native assets of a blockchain platform, while tokens are built on top of existing blockchains. Coins typically have their own consensus mechanisms and underlying protocols, while tokens often leverage the existing infrastructure of a coin. Tokens can represent various assets, like ownership shares or utility within an application, whereas coins are primarily intended for transactions and exchanges.

Types of Cryptocurrency Coins

Various cryptocurrency coins exist, each with unique characteristics and applications. Some prominent examples include:

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin was designed to be a peer-to-peer digital cash system. Its decentralized nature and limited supply have made it a significant player in the cryptocurrency market. Bitcoin transactions are typically processed relatively quickly, and it’s widely used in online marketplaces and peer-to-peer exchanges.

- Ethereum (ETH): Ethereum is a decentralized platform that allows for the creation of decentralized applications (dApps) and smart contracts. It uses its own native cryptocurrency, Ether (ETH), which facilitates transactions on the platform and empowers the execution of smart contracts. Ethereum’s smart contract functionality has led to a vast array of applications beyond simple transactions.

- Litecoin (LTC): Litecoin is a cryptocurrency that shares some similarities with Bitcoin but aims to offer faster transaction speeds and lower transaction fees. It has a slightly different algorithm and protocol than Bitcoin, enabling faster transaction processing. This has made it attractive to users who prioritize speed over the security or history of Bitcoin.

Historical Context of Cryptocurrency Coins

The history of cryptocurrency coins began with the invention of Bitcoin in 2009. This marked the initial emergence of a decentralized digital currency, challenging traditional financial systems. Subsequent developments saw the rise of other cryptocurrencies, each with its own innovations and objectives. The rapid growth and development of this sector have led to increased interest and investment in these digital assets.

Technical Aspects of Cryptocurrency Coins

Cryptocurrency coins rely on blockchain technology, a distributed ledger that records all transactions in a secure and transparent manner. The blockchain structure ensures that transactions are immutable, adding to the security of the network. Different consensus mechanisms are used to validate transactions, such as Proof-of-Work (PoW) used by Bitcoin and Proof-of-Stake (PoS) used by some other cryptocurrencies.

Consensus mechanisms determine how the network validates transactions and maintains the integrity of the blockchain. Different mechanisms have varying implications for energy consumption and network security.

Comparison Table of Cryptocurrency Coins

| Coin | Blockchain Type | Consensus Mechanism | Transaction Speed | Transaction Fees |

|---|---|---|---|---|

| Bitcoin | Proof-of-Work | Bitcoin’s Proof-of-Work | Slower | Higher |

| Ethereum | Ethereum Virtual Machine | Proof-of-Work (transitioning to Proof-of-Stake) | Moderate | Moderate |

| Litecoin | Scrypt | Proof-of-Work | Faster | Lower |

Investment Analysis of Cryptocurrency Coins

Cryptocurrency investment presents a unique blend of potential rewards and substantial risks. Understanding the factors driving price volatility, the inherent risks of different coins, and various investment strategies is crucial for navigating this dynamic market. A careful approach, encompassing thorough research and due diligence, is essential for mitigating risks and maximizing potential returns.The cryptocurrency market is characterized by its high volatility, making price predictions challenging.

This inherent volatility stems from numerous interconnected factors, from technological advancements to regulatory changes and market sentiment. Consequently, a robust understanding of these influences is paramount for informed decision-making.

Factors Influencing Price Fluctuations

Price fluctuations in cryptocurrency coins are influenced by a multitude of interconnected factors. These include market sentiment, news events, technological advancements, regulatory changes, and overall economic conditions. Changes in public perception of a coin can lead to significant price swings, as can announcements from regulatory bodies regarding the cryptocurrency market.

Investment Risks Associated with Various Cryptocurrency Coins

Different cryptocurrency coins carry varying degrees of risk. The level of risk is often correlated with the coin’s market capitalization, trading volume, and the strength of its underlying technology. Smaller, less established coins generally exhibit higher risk profiles due to their vulnerability to rapid price swings and lack of substantial market support. Conversely, coins with a significant market capitalization and strong community support tend to have a lower risk profile.

Investment Strategies for Cryptocurrency Coins

Several investment strategies are employed in the cryptocurrency market, each with its own set of advantages and disadvantages. Long-term holding, a strategy focused on accumulating coins with the anticipation of long-term growth, requires patience and a deep understanding of the coin’s potential. Day trading, on the other hand, involves making frequent trades based on short-term price fluctuations. This strategy necessitates a high level of market awareness and technical analysis skills.

Role of Market Sentiment and News in Coin Price Action

Market sentiment and news play a significant role in shaping cryptocurrency coin prices. Positive news, such as technological advancements or positive regulatory developments, can often lead to price increases. Conversely, negative news, like regulatory crackdowns or security breaches, can trigger significant price declines. Investors must carefully evaluate the validity and impact of news and market sentiment to make informed decisions.

Potential Indicators for Predicting Future Price Movements

Several indicators can potentially assist in predicting future price movements. These include technical indicators such as moving averages, relative strength index (RSI), and volume analysis. However, it’s important to recognize that these indicators are not foolproof and should be used in conjunction with other factors for a more comprehensive evaluation. Past performance is not necessarily indicative of future results in the volatile cryptocurrency market.

Importance of Due Diligence Before Investing

Thorough due diligence is paramount before investing in any cryptocurrency coin. Investors should conduct in-depth research into the coin’s underlying technology, its team, the market it serves, and its potential for long-term growth. Understanding the risks and potential rewards is essential to making sound investment decisions. Furthermore, diversifying investments across different coins is a crucial strategy to mitigate risk.

Historical Price Data

| Coin | Date | Price (USD) |

|---|---|---|

| Bitcoin (BTC) | 2023-01-01 | 22,000 |

| Ethereum (ETH) | 2023-01-01 | 1,500 |

| Binance Coin (BNB) | 2023-01-01 | 250 |

| Solana (SOL) | 2023-01-01 | 50 |

| Cardano (ADA) | 2023-01-01 | 0.50 |

Note: This table provides a sample of historical price data. Actual prices may vary. Data is for illustrative purposes only and should not be considered investment advice.

Technical Aspects of Cryptocurrency Coins

Cryptocurrency coins, while often perceived as digital currencies, rely on intricate technical underpinnings to function. These technical aspects are crucial for understanding their security, transaction processes, and overall operation. Understanding these details provides valuable insight into the strengths and vulnerabilities of various cryptocurrencies.

Cryptographic Algorithms

Cryptographic algorithms are the bedrock of security for most cryptocurrencies. They ensure the integrity and authenticity of transactions and the privacy of user data. Different coins employ various algorithms, each with its strengths and weaknesses. Bitcoin, for example, utilizes the SHA-256 hashing algorithm, known for its computational difficulty and resistance to tampering. Ethereum utilizes a more complex algorithm that supports smart contracts and decentralized applications.

Consensus Mechanisms

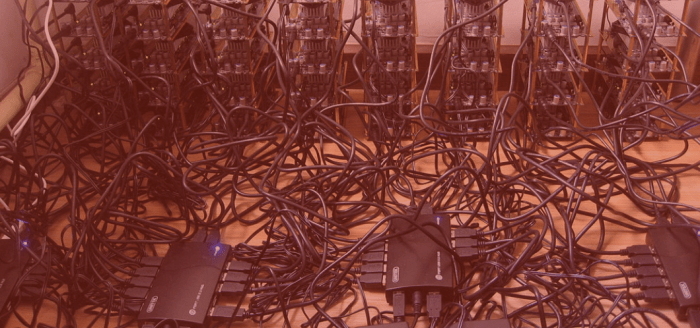

Consensus mechanisms dictate how transactions are verified and added to the blockchain. This is critical for ensuring the validity and consistency of the ledger. Proof-of-Work (PoW), used by Bitcoin, involves computationally intensive tasks to validate transactions, ensuring distributed consensus. Proof-of-Stake (PoS), used by many newer coins, relies on validators who “stake” their cryptocurrency to validate transactions, often reducing energy consumption.

The choice of mechanism affects the security, scalability, and environmental impact of a cryptocurrency.

Transaction Processes

The transaction process in a cryptocurrency involves a series of steps that ensure secure and verifiable transfers. Users initiate transactions, which are then broadcast to the network. Nodes on the network validate the transaction, and if valid, it’s added to the blockchain. The details of this process vary across different coins, but the core principle of secure and transparent transfer remains consistent.

This process is critical for ensuring the functionality and security of the entire cryptocurrency ecosystem.

Security Protocols

Security protocols are essential for protecting cryptocurrency transactions from unauthorized access and manipulation. These protocols involve encryption, digital signatures, and other cryptographic techniques. Robust security protocols are vital for maintaining user trust and preventing fraud. Advanced security measures, such as multi-factor authentication and transaction monitoring, are employed to enhance the safety of transactions.

Network Structure and Architecture

The network structure of a cryptocurrency is a decentralized network of computers, known as nodes. These nodes maintain a copy of the blockchain and participate in verifying transactions. The architecture varies depending on the coin. Bitcoin’s network is known for its robust structure, which has been resilient to attacks. Other coins may utilize different architectures, impacting scalability and transaction speeds.

The network structure directly influences the cryptocurrency’s efficiency and overall performance.

Transaction History Recording and Verification

Transaction history is recorded on the blockchain, a distributed ledger that is publicly viewable and immutable. Transactions are grouped into blocks, and these blocks are linked together to form a chain. This structure ensures the transparency and traceability of all transactions. Each block contains a hash of the previous block, creating a chain that’s difficult to tamper with.

This verification process ensures the integrity and authenticity of the cryptocurrency transactions.

Market Dynamics and Trends

The cryptocurrency market is a dynamic and volatile space, constantly evolving with new technologies and shifting investor sentiment. Understanding the current market trends, future projections, regulatory landscapes, and the role of exchanges is crucial for investors and stakeholders alike. This section delves into these key aspects, providing insights into the complexities and opportunities within the cryptocurrency ecosystem.

Current Market Trends

The cryptocurrency market is experiencing a period of consolidation after a period of significant growth. Several factors are influencing this trend, including regulatory uncertainty in certain jurisdictions, macroeconomic headwinds, and the emergence of more sophisticated competitors. Trading volumes have moderated, but there remains substantial activity across various cryptocurrencies. The adoption of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) continues to evolve.

Future Projections for Growth and Adoption

While the near-term outlook for cryptocurrency adoption may be tempered, long-term projections remain positive. Increased institutional investment, growing awareness among mainstream investors, and the development of innovative applications are anticipated to drive future growth. The expansion of DeFi and the increasing use of cryptocurrencies in various sectors, such as payments and supply chain management, are potential catalysts for adoption.

For example, the growing use of cryptocurrencies for cross-border payments, particularly in developing nations, suggests substantial potential for future adoption.

Regulatory Landscapes Across Countries

Cryptocurrency regulation varies significantly across countries. Some jurisdictions have embraced cryptocurrencies with clear regulatory frameworks, while others have taken a more cautious or restrictive approach. This disparity in regulatory landscapes creates challenges for global cryptocurrency businesses and investors. For example, countries like the United States are actively formulating regulations for the cryptocurrency industry, while other nations have yet to develop comprehensive policies.

Cryptocurrency coins are becoming increasingly popular, but navigating the regulatory landscape can be tricky. China’s stance on cryptocurrency, as detailed in china cryptocurrency , has significantly impacted the global market. Ultimately, understanding these nuances is key to successfully navigating the world of cryptocurrency coins.

This inconsistency poses both opportunities and risks for cryptocurrency projects and businesses.

Examples of Successful and Unsuccessful Projects

Numerous cryptocurrency projects have emerged, with varying degrees of success. Factors contributing to success include strong community support, innovative technology, and effective marketing strategies. Conversely, projects that fail often lack proper development, have inadequate security measures, or fail to attract significant community support. Bitcoin, for instance, has established itself as a leading cryptocurrency, driven by its underlying technology and strong community.

On the other hand, many altcoins have failed to achieve widespread adoption, often due to insufficient development or market hype.

Cryptocurrency coins are a hot topic these days, but understanding the top players in the market is key to navigating the space. For instance, knowing about the top cryptocurrency coins can give you a good starting point when researching potential investments. Top cryptocurrency lists can be a great resource for getting familiar with the major players, helping you make informed decisions about any particular cryptocurrency coin.

Role of Exchanges in Facilitating Trading

Cryptocurrency exchanges play a crucial role in facilitating the trading of cryptocurrencies. They provide a platform for buyers and sellers to interact, ensuring liquidity and price discovery. Exchanges vary in terms of their features, security measures, and user experience. Reliable exchanges are essential for maintaining market integrity and attracting investors. A well-established exchange with robust security measures and comprehensive user support contributes significantly to the overall health and growth of the cryptocurrency market.

Market Capitalization Distribution

The distribution of market capitalization among various cryptocurrencies reflects the current market dominance of specific projects. This can be visualized using a bar chart, where each bar represents a cryptocurrency, and the height of the bar corresponds to its market capitalization. This visualization illustrates the relative size and influence of different cryptocurrencies within the overall market. A visual representation would show the leading cryptocurrencies dominating the market share, with other coins holding smaller proportions.

Community and Development

The success of a cryptocurrency coin hinges significantly on the interplay between its community and development team. A vibrant and engaged community fosters adoption and drives innovation, while robust development ensures the coin’s long-term viability and security. This section explores the critical role of community engagement, developer activity, and governance in shaping the future of a cryptocurrency.

The Role of Community in Coin Adoption

A strong community is vital for a cryptocurrency’s success. Active participation translates into increased awareness, user engagement, and ultimately, adoption. Community members act as advocates, spreading the word about the coin’s potential and fostering trust within the wider market. They also contribute valuable feedback on product improvements, which can lead to better user experiences and greater appeal.

This dynamic interplay between the community and the coin’s developers is essential for growth and innovation.

Importance of Developer Activity

The sustained functionality and security of a cryptocurrency depend heavily on consistent developer activity. Regular updates, bug fixes, and improvements to the underlying protocol are crucial for maintaining a stable and reliable platform. A lack of developer engagement can lead to security vulnerabilities, stagnation, and ultimately, the demise of the project. A proactive and dedicated development team ensures the longevity and value of the cryptocurrency.

Successful Community Engagement Strategies

Various strategies foster active and engaged communities. These include regular communication channels, such as forums, social media groups, and dedicated Telegram channels, enabling direct interaction between developers and users. Hosting community events, such as online workshops, webinars, or hackathons, encourages active participation and provides valuable opportunities for networking. Providing avenues for community members to contribute to the project, such as open-source code contributions or proposals for improvement, further strengthens the sense of ownership and encourages active participation.

Governance Mechanisms

Different cryptocurrency projects utilize varying governance mechanisms to ensure community input and decision-making. Some employ DAO (Decentralized Autonomous Organization) structures, allowing token holders to vote on proposals and updates to the project. Others use token-based voting systems to determine important decisions, empowering the community to participate in the project’s direction. The chosen governance mechanism directly impacts the coin’s community structure and its ability to adapt to changing market conditions.

Challenges Faced by Development Teams

Cryptocurrency development teams face unique challenges, such as maintaining code security in a rapidly evolving environment, balancing the needs of different community segments, and keeping pace with advancements in blockchain technology. Maintaining an efficient development workflow and managing resource allocation effectively are crucial aspects of overcoming these challenges. Keeping up with evolving regulatory landscapes, ensuring the project’s compliance, and navigating legal complexities are also significant hurdles.

Security and Risks

Cryptocurrency, while offering exciting investment opportunities, carries inherent security risks. Understanding these vulnerabilities and implementing appropriate safeguards is crucial for mitigating potential losses. The decentralized nature of cryptocurrencies, while a strength in some aspects, also exposes them to various attack vectors. Consequently, diligent security practices are essential for protecting investments and maintaining trust in the digital asset ecosystem.The landscape of cryptocurrency security is constantly evolving, with attackers adapting their strategies to exploit new vulnerabilities.

This necessitates a proactive and adaptable approach to security, embracing ongoing learning and refinement of defensive mechanisms.

Security Vulnerabilities

Cryptocurrency systems are vulnerable to various attacks, ranging from simple phishing scams to sophisticated exploits targeting the underlying blockchain technology. These vulnerabilities can result in significant financial losses for investors. Key areas of concern include compromised wallets, vulnerabilities in exchange platforms, and exploits targeting smart contracts.

Types of Attacks

A variety of attacks target cryptocurrency coins. Phishing attempts are a common tactic, tricking users into revealing private keys or login credentials. Malware infections can compromise user devices, stealing sensitive information. Exploiting vulnerabilities in cryptocurrency exchanges can lead to large-scale thefts. Smart contract exploits, where flaws in the code allow attackers to manipulate transactions, are another significant threat.

Strategies for Protecting Cryptocurrency Coins

Robust security measures are paramount for safeguarding cryptocurrency assets. Implementing strong password policies, enabling two-factor authentication (2FA), and using reputable hardware wallets are vital steps. Regularly updating software and checking for security patches is essential to mitigate vulnerabilities. It is crucial to avoid clicking on suspicious links or downloading untrusted files. Furthermore, educating oneself about common attack vectors is a critical aspect of defense.

Wallet Security and Best Practices

Wallet security is paramount in cryptocurrency ownership. Choosing a reputable wallet provider, employing strong passwords, and enabling 2FA are crucial steps. Cold storage wallets, which are offline, are generally considered more secure than hot wallets, which are connected to the internet. Regular backups and monitoring for suspicious activity are also recommended.

Real-World Security Breaches, Cryptocurrency coin

Numerous security breaches have occurred in the cryptocurrency space. For instance, the 2016 Bitfinex hack resulted in the theft of a significant amount of cryptocurrency. This, and other incidents, underscore the need for robust security measures in the cryptocurrency ecosystem. The constant evolution of hacking techniques and the ever-present possibility of new exploits necessitates ongoing vigilance and adaptation by both users and developers.

The Mt. Gox exchange collapse, one of the earliest and most significant breaches, exemplifies the potential for devastating consequences when security measures are inadequate. This highlights the critical need for a multi-layered approach to cryptocurrency security, incorporating robust protocols and user education.

Use Cases and Applications

Cryptocurrency coins are rapidly expanding beyond their initial role as digital currencies. Their decentralized nature and inherent flexibility offer a wide array of potential applications across diverse industries, from finance to supply chain management. This section explores the multifaceted use cases and applications of these digital assets, highlighting their impact on traditional financial systems and showcasing innovative implementations.

Diverse Applications Across Industries

The versatility of cryptocurrency extends beyond simple transactions. Different coins are designed with specific use cases in mind, leading to diverse applications across various sectors. This includes decentralized finance (DeFi), remittances, and even digital identity management.

- Decentralized Finance (DeFi): Cryptocurrencies enable peer-to-peer lending, borrowing, and trading without intermediaries. This removes reliance on traditional financial institutions, potentially offering lower fees and greater accessibility. Platforms like Compound and Aave are examples of DeFi applications built on blockchain technology.

- Remittances and Cross-Border Payments: Cryptocurrencies can significantly reduce transaction costs and processing times for international money transfers. This is particularly advantageous in regions with limited or expensive banking infrastructure.

- Supply Chain Management: Blockchain technology can track goods throughout the supply chain, ensuring transparency and accountability. This is particularly useful in industries like food and pharmaceuticals, where traceability is critical.

- Digital Identity Management: Cryptocurrencies can facilitate the creation of secure and verifiable digital identities, reducing fraud and streamlining identity verification processes. These applications are currently being explored and are expected to grow in importance as technology advances.

Impact on Traditional Financial Systems

Cryptocurrencies are not simply an alternative to traditional financial systems; they are challenging established norms. While there are concerns about volatility and regulation, the potential for disruption is undeniable.

The introduction of cryptocurrency has introduced competition and fostered innovation in the financial sector. This has led to the development of new financial instruments and services, which can potentially improve the efficiency and accessibility of financial transactions. For instance, cryptocurrencies have allowed individuals in underserved communities to access financial services that were previously unavailable.

Innovative Applications

The development of new and creative applications for cryptocurrency continues to progress. These range from decentralized voting systems to digital collectibles, showcasing the potential for disruption across various sectors.

- Decentralized Voting Systems: Cryptocurrency-based platforms can facilitate secure and transparent voting processes, potentially reducing fraud and enhancing trust in democratic institutions. These platforms are still under development and require careful consideration of implementation to ensure fairness and security.

- Digital Collectibles: Non-Fungible Tokens (NFTs) have enabled the creation of unique digital assets, from art to virtual land. This has opened new avenues for creators and collectors in the digital realm.

- Gaming and Entertainment: Cryptocurrencies are being integrated into gaming and entertainment platforms, offering new possibilities for in-game economies and virtual assets. This is creating new revenue streams for game developers and expanding the possibilities for gamers.

Examples of Real-World Applications

Many companies are exploring and implementing cryptocurrency solutions to enhance their operations. For example, some companies are using blockchain technology to improve supply chain transparency, while others are utilizing cryptocurrencies for faster and more affordable cross-border payments.

- Supply Chain Transparency (Example): A food company uses a blockchain-based platform to track the origin and journey of their products, providing consumers with complete transparency and traceability. This example showcases the practical application of cryptocurrency in ensuring food safety and building consumer trust.

- Cross-Border Payments (Example): A remittance company uses cryptocurrency to facilitate faster and cheaper money transfers between individuals across international borders. This case illustrates the potential of cryptocurrency to address the limitations of traditional financial systems in certain regions.

Regulation and Legal Considerations

The cryptocurrency market operates in a complex and evolving regulatory environment. Jurisdictions vary significantly in their approaches to regulating digital assets, leading to a fragmented and often uncertain legal landscape for businesses and investors. This necessitates a deep understanding of the legal implications and challenges associated with cryptocurrency use, as well as the contrasting regulatory strategies adopted worldwide.The legal status of cryptocurrencies continues to be debated and refined.

While some countries have embraced cryptocurrencies, others remain cautious or outright prohibit their use. The lack of a universally accepted regulatory framework can hinder market growth and adoption, potentially impacting innovation and investment opportunities.

Regulatory Landscape by Jurisdiction

Different countries have adopted diverse approaches to regulating cryptocurrencies. Some have implemented specific licensing and registration requirements for cryptocurrency exchanges, while others have taken a more hands-off approach. This variation reflects differing priorities and concerns among nations regarding the potential risks and benefits of cryptocurrencies.

- United States: The regulatory landscape in the US is fragmented, with various agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) having jurisdiction over different aspects of the cryptocurrency market. This often leads to uncertainty and ongoing legal battles regarding the classification of tokens and the appropriate regulatory framework.

- European Union: The EU is actively developing a regulatory framework for cryptoassets, aiming for a harmonized approach across member states. The Markets in Crypto Assets (MiCA) regulation is intended to provide a consistent set of rules for crypto-related activities, fostering innovation while mitigating risks.

- China: China has largely banned cryptocurrency trading and mining, highlighting the varied regulatory approaches taken by different nations. This complete ban has impacted the Chinese cryptocurrency market significantly, demonstrating a strong stance against the technology.

Legal Implications of Using Cryptocurrencies

The legal implications of using cryptocurrencies extend to various aspects of financial transactions, investments, and contracts. The lack of clear legal frameworks in some jurisdictions can create uncertainty regarding the validity of transactions, the enforceability of contracts, and the potential liability of individuals and businesses.

- Taxation: Cryptocurrency transactions are subject to tax regulations, but the specific tax treatment varies across jurisdictions. In some countries, cryptocurrency is treated as property, while in others, it may be classified as currency, leading to differing tax obligations for individuals and businesses.

- Contract Law: The legal framework for contracts involving cryptocurrencies is still developing in many jurisdictions. The lack of clarity can make it challenging to enforce contracts and resolve disputes involving digital assets.

- Criminal Activities: Cryptocurrencies have been used in illicit activities, such as money laundering and financing terrorism. Regulators are facing the challenge of preventing the misuse of cryptocurrencies while ensuring that legitimate use cases are not stifled.

Challenges Faced by Regulators

Regulators face numerous challenges in managing cryptocurrencies, stemming from the inherent volatility, complexity, and global nature of the market. The decentralized nature of cryptocurrencies and the rapid pace of technological advancements make it difficult to keep pace with evolving trends and potential risks.

- Keeping Pace with Innovation: The rapid evolution of cryptocurrency technologies and protocols poses a constant challenge for regulators. The need to adapt regulations to new developments is crucial, but this often requires substantial resources and expertise.

- International Coordination: The global nature of cryptocurrencies necessitates international cooperation and coordination among regulators. However, differences in regulatory approaches across countries often create hurdles in establishing a consistent and effective global framework.

- Balancing Innovation and Risk: Regulators must strike a balance between fostering innovation and mitigating potential risks associated with cryptocurrencies. This delicate balance requires careful consideration of the benefits and drawbacks of different regulatory approaches.

Comparison of Regulatory Approaches

The comparison of regulatory approaches across countries highlights significant differences in philosophies and priorities.

| Country | Regulatory Approach | Key Considerations |

|---|---|---|

| United States | Fragmented, with various agencies having jurisdiction | Uncertainty, ongoing legal battles |

| European Union | Harmonized approach via MiCA | Consistency, risk mitigation |

| China | Ban on trading and mining | Strong stance against cryptocurrencies |

Future of Cryptocurrency Coins

The future of cryptocurrency coins is a dynamic and complex subject, shaped by evolving technological advancements, shifting market dynamics, and regulatory landscapes. While predicting the precise trajectory is impossible, analyzing current trends and potential factors provides a framework for understanding the potential evolution of this rapidly changing field.

Potential Development Trends

The cryptocurrency landscape is characterized by continuous innovation and adaptation. New technologies, such as improved consensus mechanisms and decentralized finance (DeFi) platforms, are constantly emerging, influencing the design and functionality of cryptocurrency coins. This dynamism fuels ongoing development, potentially leading to more secure, efficient, and versatile cryptocurrencies.

Impact of Emerging Technologies

Emerging technologies significantly impact the future of cryptocurrency coins. Blockchain technology itself is constantly evolving, with improvements in scalability, transaction speeds, and security. Artificial intelligence (AI) and machine learning (ML) are being integrated into various aspects of cryptocurrencies, from algorithmic trading to fraud detection. Quantum computing, while still in its early stages, poses both a threat and an opportunity for the future of cryptography, potentially impacting the security of current systems.

For example, the development of more efficient consensus mechanisms like Proof-of-Stake has allowed for faster transaction speeds and reduced energy consumption.

Role in Shaping Future Finance

Cryptocurrencies have the potential to disrupt traditional financial systems by offering alternative payment methods, increased accessibility, and new investment avenues. The potential for decentralized finance (DeFi) to streamline financial processes, reduce reliance on intermediaries, and offer novel investment opportunities is substantial. For example, decentralized exchanges (DEXs) offer alternative trading platforms with potentially lower fees and greater transparency compared to traditional exchanges.

However, regulatory hurdles and consumer protection concerns remain significant obstacles.

Influencing Factors

Several factors significantly influence the future trajectory of cryptocurrency coins. Regulatory clarity and adoption are crucial, as supportive policies can foster widespread acceptance. Technological advancements, such as improvements in blockchain technology and the integration of AI, play a pivotal role in enhancing the functionality and security of cryptocurrencies. Market adoption, driven by increasing user engagement and institutional investment, can significantly shape the future.

For instance, the increased adoption of Bitcoin and other cryptocurrencies by institutional investors like Tesla indicates a growing recognition of cryptocurrencies as legitimate assets. Furthermore, public perception, shaped by both positive and negative experiences, plays a significant role in the acceptance and adoption of cryptocurrencies.

Comparison of Specific Coins

A crucial aspect of cryptocurrency investment is understanding the relative strengths and weaknesses of different coins. This section delves into a comparative analysis of two prominent cryptocurrencies, focusing on technical characteristics, market performance, community engagement, and investment potential. This allows investors to make more informed decisions based on a nuanced understanding of the chosen coins’ strengths and weaknesses.A thorough comparison requires a multi-faceted approach, evaluating not just market capitalization but also technical innovation, community support, and the practical applications of each coin.

This comprehensive evaluation is vital for navigating the complex landscape of the cryptocurrency market and identifying promising investment opportunities.

Technical Characteristics

Different cryptocurrencies employ varying consensus mechanisms and blockchain technologies. Understanding these technical differences is critical for assessing the scalability, security, and overall efficiency of each coin. Bitcoin, for instance, utilizes Proof-of-Work (PoW), while Ethereum employs Proof-of-Stake (PoS). These variations influence transaction speeds, energy consumption, and potential for future development.

- Bitcoin’s PoW mechanism, while secure, is known for its energy intensity. This contrasts with Ethereum’s PoS, which is generally more energy-efficient. This energy consumption difference is a critical factor for environmental sustainability concerns.

- The transaction throughput and speed of Bitcoin are relatively lower compared to newer cryptocurrencies. This impacts the efficiency of transactions on the network.

Market Capitalization and Trading Volume

Market capitalization and trading volume are key indicators of a cryptocurrency’s market presence and liquidity. These metrics reflect the overall investor interest and market activity surrounding a particular coin.

- Bitcoin consistently holds a significant portion of the overall cryptocurrency market capitalization. This high market cap indicates strong investor confidence and liquidity.

- The trading volume of a cryptocurrency reflects the daily trading activity. High trading volume suggests a more active and liquid market, potentially indicating greater investor interest and price volatility.

- The market capitalization of a coin is the total value of all circulating coins, calculated by multiplying the current price per coin by the total number of coins in circulation.

Community Engagement and Development Efforts

A strong community and active development team are vital for the long-term success of any cryptocurrency. These factors influence the coin’s adaptability to evolving market needs and user expectations.

- Active development teams contribute to enhancing the coin’s functionality, addressing security vulnerabilities, and improving overall usability.

- A vibrant community, characterized by active participation and engagement, fosters innovation and promotes adoption of the coin.

- A strong community can be a crucial factor in the longevity of a cryptocurrency project, especially when it faces market challenges or criticism.

Investment Prospects

Evaluating the investment prospects of a cryptocurrency requires careful consideration of various factors, including market trends, technical characteristics, and community support.

- Bitcoin, with its established history and strong community, presents a more stable, though potentially less volatile, investment opportunity.

- Other cryptocurrencies, particularly those with innovative technologies and strong development teams, offer potential for higher returns but also carry a greater degree of risk.

Final Review

In conclusion, cryptocurrency coins represent a fascinating blend of technological innovation and financial speculation. Their decentralized nature, while offering exciting possibilities, also presents considerable risks. Thorough research and careful consideration are essential before engaging with this complex market. We’ve covered a wide range of factors, from technical aspects and investment strategies to market trends and regulatory considerations, equipping you with a solid foundation to navigate the world of cryptocurrency coins.

FAQ Explained

What is the difference between a cryptocurrency coin and a token?

Coins are the foundational digital assets built on their own blockchain networks, like Bitcoin. Tokens, on the other hand, are built on existing blockchains, like Ethereum, and often represent a specific utility or asset within that network. This distinction is key to understanding their respective functions and uses.

What are some common investment risks associated with cryptocurrency coins?

Volatility, regulatory uncertainty, security breaches, and the potential for scams are all significant risks in the cryptocurrency market. Due diligence and a robust understanding of the risks are crucial for responsible investment.

What are some of the key factors influencing the price of a cryptocurrency coin?

Market sentiment, news events, regulatory changes, technological advancements, and overall market conditions can all influence a coin’s price. It’s a dynamic environment, so staying informed is essential.

How can I protect my cryptocurrency investments from theft?

Using strong and unique passwords, enabling two-factor authentication, storing your coins in secure wallets, and avoiding phishing attempts are critical steps in protecting your investments. Staying informed about the latest security threats is also important.