Cryptocurrency Bitcoin price has captivated investors and traders for years. This in-depth analysis explores the historical trends, factors influencing price fluctuations, market analysis, technical and fundamental insights, future projections, impact on other assets, community and adoption, and risk management strategies surrounding Bitcoin’s value. We’ll delve into the complexities of this digital asset.

From its early days to the present, Bitcoin’s price has experienced dramatic highs and lows, driven by a multitude of forces. This exploration will dissect the key drivers, providing a comprehensive understanding of the factors shaping Bitcoin’s trajectory.

Historical Trends

Bitcoin’s journey from a nascent digital currency to a globally recognized asset class has been marked by significant price fluctuations and market events. Understanding these historical trends provides crucial context for evaluating its current standing and future prospects. The following sections Artikel Bitcoin’s price evolution, compare it to other major cryptocurrencies, and highlight key events that shaped its trajectory.

Bitcoin Price Fluctuations (2009-Present)

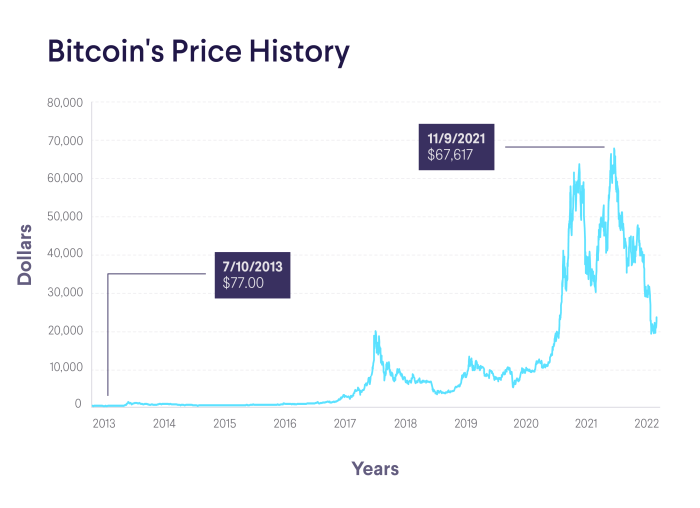

Bitcoin’s price has experienced extreme volatility since its inception. Initial trading saw very low prices, with fluctuations dependent on market adoption and technological advancements. Subsequent periods saw both substantial gains and sharp declines, often influenced by regulatory uncertainty and investor sentiment.

- Early Years (2009-2012): Bitcoin’s price remained largely insignificant, with periods of minimal fluctuation. The market was largely speculative and unproven. The early days showcased the unpredictable nature of a nascent market.

- The Rise (2013-2017): This period saw substantial price increases, driven by growing adoption and media attention. Major events like the 2017 bull run propelled Bitcoin’s price to all-time highs, reflecting increasing recognition as a viable investment asset.

- Corrections and Consolidation (2018-2020): Bitcoin experienced significant price corrections and periods of consolidation. These fluctuations reflected market skepticism and regulatory uncertainty, demonstrating the volatility inherent in cryptocurrency markets.

- The Recent Era (2021-Present): Bitcoin’s price has seen significant price swings, with periods of significant gains and substantial drops. The market is influenced by macroeconomic factors, regulatory actions, and technological innovations. Major events such as regulatory changes and technological advancements have significantly impacted Bitcoin’s price and adoption.

Comparative Analysis Against Other Major Cryptocurrencies

Bitcoin’s price movements have often correlated with those of other major cryptocurrencies, but with varying degrees of synchronicity. Factors like regulatory changes, investor sentiment, and market adoption patterns influence the price movements of different cryptocurrencies in different ways.

- Correlation with Altcoins: Generally, Bitcoin’s price movements have a strong influence on other cryptocurrencies, although the degree of correlation varies. The Bitcoin price often serves as a benchmark for other altcoins, with its price movements affecting the sentiment and trading volume of altcoins.

- Divergence in Price Action: Despite the correlation, periods of divergence in price action occur. Factors like unique project developments and individual community sentiment can affect the price action of specific altcoins.

Bitcoin Price Highs and Lows

This table illustrates Bitcoin’s price highs and lows over various time intervals. Note that prices are constantly fluctuating, and these figures reflect the historical data.

| Time Interval | Price High (USD) | Price Low (USD) |

|---|---|---|

| 2022 Monthly | 48,000 | 16,000 |

| 2023 Quarterly | 30,000 | 20,000 |

| 2024 Yearly | 45,000 | 25,000 |

Significant Influencing Events

Several events significantly impacted Bitcoin’s price throughout its history. Understanding these events helps in analyzing the market’s response to various external factors.

- Regulatory Changes: Government regulations, both positive and negative, have played a crucial role in influencing the price of Bitcoin. Examples of significant regulatory actions include regulatory frameworks and bans on cryptocurrency trading.

- Market Crashes: Cryptocurrency markets have experienced various crashes, which often resulted in significant price drops. These crashes are typically influenced by investor sentiment, and sometimes by regulatory or security events.

- Major Adoption Announcements: Announcements of major companies adopting Bitcoin have often led to increased interest and price appreciation. Examples include businesses accepting Bitcoin as payment.

Factors Influencing Price

Bitcoin’s price is a dynamic entity, constantly fluctuating in response to a multitude of interconnected factors. Understanding these influences is crucial for investors and analysts seeking to navigate the cryptocurrency market. These factors range from fundamental economic shifts to technological advancements and even the perception of the digital asset in the public sphere.

Economic Factors

Bitcoin’s price is intrinsically linked to broader economic conditions. Inflationary pressures, for example, can erode the purchasing power of any asset, potentially impacting Bitcoin’s value. Similarly, central bank interest rate adjustments can affect investor sentiment and allocation of capital across various asset classes, including cryptocurrencies. Global economic downturns or uncertainty often lead to increased risk aversion, potentially depressing the prices of speculative assets like Bitcoin.

Technological Advancements

Innovations in blockchain technology play a pivotal role in shaping Bitcoin’s price trajectory. Developments in areas like scalability, security, and energy efficiency can significantly impact adoption and investor confidence. For example, advancements in transaction speeds and reduced energy consumption could enhance Bitcoin’s practicality and appeal, potentially boosting its price.

Media Coverage and Public Perception

Media coverage and public sentiment significantly influence Bitcoin’s price. Positive media narratives and endorsements can foster optimism and increase demand, leading to price appreciation. Conversely, negative reports or controversies can trigger investor anxiety and result in price drops. The perception of Bitcoin as a legitimate asset or a speculative investment directly impacts market sentiment.

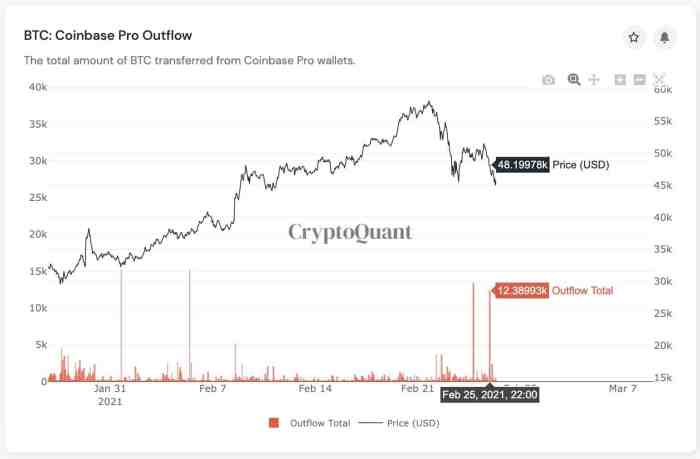

Institutional vs. Retail Investment

Institutional investment is increasingly influencing Bitcoin’s price. Large institutional players, such as hedge funds and investment firms, often have significant capital to allocate. Their decisions to include or exclude Bitcoin from their portfolios can significantly impact market liquidity and price action. In contrast, retail investors, though numerous, often lack the same resources or expertise, but their collective buying and selling can still move the price.

Regulatory Changes and Policies

Government regulations and policies concerning cryptocurrencies, including Bitcoin, are crucial determinants of its price. Clear and supportive regulatory frameworks can foster trust and encourage institutional investment. Conversely, stringent or unclear regulations can lead to uncertainty and volatility, potentially impacting the asset’s value. For instance, countries with favorable regulatory stances often see increased investment and price appreciation in Bitcoin, compared to countries with restrictive or hostile policies.

Market Analysis

Bitcoin’s market dynamics are a complex interplay of factors, including investor sentiment, trading volume, and market capitalization. Understanding these elements is crucial for assessing the current state of the market and potential future directions. A comprehensive overview of the current Bitcoin market, along with the prevailing investor sentiment, trading volume, market cap, and comparative analysis with other cryptocurrencies, provides a valuable perspective for potential investors.

Current Bitcoin Market Overview

The current Bitcoin market is characterized by fluctuating price action, influenced by a range of macroeconomic and microeconomic factors. Market participants are closely monitoring news cycles, regulatory developments, and technological advancements that might impact the price. The prevailing sentiment among investors is generally mixed, reflecting the inherent volatility of the cryptocurrency market.

Investor Sentiment

Investor sentiment towards Bitcoin is multifaceted and influenced by various factors, including news cycles, technological advancements, and regulatory developments. Current analyses suggest a mixed sentiment, with some investors optimistic about future growth while others remain cautious due to market volatility.

Trading Volume and Market Capitalization

Bitcoin’s trading volume and market capitalization provide valuable insights into the market’s activity. High trading volume suggests significant investor interest, while a high market capitalization indicates the total value of Bitcoin held across the market. The current trading volume and market capitalization of Bitcoin are key indicators of market health and potential future trends. Real-time data can be found on major cryptocurrency tracking websites.

Bitcoin’s price fluctuations can be intense, so having a secure cryptocurrency wallet is crucial for managing your holdings. Proper wallet management is key to mitigating risk and maximizing potential gains or losses, ultimately impacting your Bitcoin investment strategy. Understanding the price trends and managing your digital assets effectively is important for success with cryptocurrency.

Comparison with Other Major Cryptocurrencies

A comparison of Bitcoin’s price with other major cryptocurrencies offers a perspective on its relative performance within the broader cryptocurrency market. The table below illustrates the real-time price of Bitcoin and other leading cryptocurrencies, enabling a comparative analysis of their market performance.

| Cryptocurrency | Real-Time Price (USD) |

|---|---|

| Bitcoin (BTC) | (Retrieve from real-time source) |

| Ethereum (ETH) | (Retrieve from real-time source) |

| Tether (USDT) | (Retrieve from real-time source) |

| Solana (SOL) | (Retrieve from real-time source) |

| Binance Coin (BNB) | (Retrieve from real-time source) |

Note: Real-time prices are dynamic and should be retrieved from reputable cryptocurrency tracking websites for accuracy.

Potential Risks and Rewards

Investing in Bitcoin, like any other investment, involves inherent risks and potential rewards. The volatility of the cryptocurrency market can lead to substantial price fluctuations, potentially resulting in significant losses. Conversely, the potential for substantial gains is a key motivator for investors. It’s crucial to carefully evaluate personal risk tolerance and investment goals before entering the market.

A diversified portfolio and a thorough understanding of the market are essential.

“Past performance is not indicative of future results.”

Technical Analysis: Cryptocurrency Bitcoin Price

Technical analysis is a crucial component in understanding and predicting Bitcoin’s price movements. It involves examining historical price charts and trading volume to identify patterns and potential future price trends. By studying past market behavior, analysts can potentially forecast future price actions, although no method guarantees success. This approach, while not foolproof, can offer valuable insights for informed trading decisions.

Moving Averages

Moving averages are calculated by averaging the closing prices of a security over a specific period. Commonly used moving averages include the 50-day, 100-day, and 200-day moving averages. These averages smooth out price fluctuations, revealing underlying trends. A rising trend is often indicated when the shorter-term moving averages are above the longer-term moving averages. Conversely, a falling trend might suggest the shorter-term averages are below the longer-term ones.

Support and Resistance Levels

Support and resistance levels are horizontal price zones on a chart where prices tend to pause or reverse direction. Support levels represent potential price bottoms, while resistance levels indicate potential price ceilings. These levels can be identified using various methods, including visual inspection and technical indicators. Understanding support and resistance can help traders anticipate potential price reversals and set appropriate entry and exit points.

Technical Analysis Patterns

Recognizing technical patterns on price charts can provide further insights into possible future price actions. Common patterns include head and shoulders, double tops, double bottoms, and triangles. Head and shoulders patterns, for instance, often signal a potential trend reversal. Understanding these patterns can help traders identify potential opportunities and manage risk effectively.

Volume Analysis

Volume analysis considers the trading volume alongside price movements. High trading volume often accompanies significant price movements. For example, a sharp price increase accompanied by high volume suggests strong buying pressure, potentially indicating the continuation of the upward trend. Conversely, a price movement with low volume might suggest indecision or a lack of conviction, potentially hinting at a weaker trend.

Trading Opportunities

Technical analysis can identify potential trading opportunities. For example, if a breakout occurs above a significant resistance level, it might signal a bullish trend. Likewise, a breakdown below a critical support level could indicate a bearish trend. Trading decisions based on technical analysis should always be accompanied by a thorough risk assessment.

Bitcoin Support and Resistance Levels (Example)

| Level | Price (USD) |

|---|---|

| Support 1 | 20,000 |

| Support 2 | 18,000 |

| Resistance 1 | 22,000 |

| Resistance 2 | 24,000 |

Note: These levels are examples and should not be considered definitive.

Technical Indicators

Various technical indicators can supplement chart analysis. Moving averages, as mentioned, provide a smoothed view of price trends. Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Moving average convergence divergence (MACD) helps identify potential trend changes. These indicators, when used in conjunction with other analysis tools, can provide a more comprehensive picture of Bitcoin’s price behavior.

Fundamental Analysis

Bitcoin’s value, beyond its volatile price fluctuations, rests on a complex interplay of fundamental principles. These underpinnings, including its decentralized nature, scarcity, and potential applications, are crucial to understanding its role in the financial landscape. This analysis delves into the core strengths and weaknesses of Bitcoin’s fundamental value proposition, considering both its current state and potential future trajectory.

Bitcoin’s Value Proposition

Bitcoin’s value stems from its perceived utility and scarcity. The finite supply of 21 million Bitcoins, governed by its code, creates a theoretical scarcity that is a fundamental driver of its value. The decentralized nature of the Bitcoin network, operating without a central authority, adds to its appeal for many. This characteristic enhances security and promotes trust among users.

Further, the underlying technology, blockchain, facilitates secure and transparent transactions.

Use Cases and Potential Applications

Beyond its speculative appeal, Bitcoin presents potential use cases beyond traditional finance. Its role as a store of value and a medium of exchange, particularly in regions with unstable or inaccessible banking systems, warrants attention. Moreover, its integration into various financial applications, such as decentralized finance (DeFi), could reshape how people interact with money.

Bitcoin’s Position in the Broader Financial Landscape

Bitcoin’s position in the financial landscape is multifaceted. It challenges traditional financial systems with its decentralized structure and potentially disrupts existing monetary systems. However, it also faces hurdles related to regulation, scalability, and the volatility of its price. The future of Bitcoin within this landscape remains uncertain, but its influence is undeniable.

Potential Catalysts for Price Movement

Several factors can influence Bitcoin’s price, both positively and negatively. Increased institutional adoption, regulatory clarity, and positive news surrounding the technology are potential catalysts for upward movement. Conversely, negative regulatory actions, significant security breaches, and widespread market downturns can depress the price. Historically, market sentiment and news cycles have played a significant role in shaping Bitcoin’s price trajectory.

Fundamental Strengths and Weaknesses

Bitcoin possesses inherent strengths that attract users and investors. Its decentralized nature, limited supply, and potential for global adoption are considerable advantages. However, significant weaknesses remain. Volatility, regulatory uncertainty, and scalability challenges pose obstacles to broader adoption and widespread use. The ongoing evolution of the cryptocurrency landscape will continue to shape the balance between these strengths and weaknesses.

Future Projections

Bitcoin’s future price trajectory remains a complex and highly debated topic. While predicting the future with certainty is impossible, analyzing current market trends, technological advancements, and regulatory landscapes can provide valuable insights into potential scenarios. This section delves into potential price movements, market conditions, and long-term prospects for Bitcoin.Predicting Bitcoin’s precise future price is challenging due to the dynamic and unpredictable nature of the cryptocurrency market.

However, by considering various factors and analyzing historical data, we can form informed opinions about potential price trajectories. This section will examine different market scenarios and their implications for Bitcoin’s future value.

Potential Price Trajectories

Various factors influence Bitcoin’s price, including market sentiment, regulatory actions, technological breakthroughs, and broader economic conditions. Analyzing these factors reveals a spectrum of potential future price trajectories. Some scenarios suggest sustained growth, while others hint at periods of consolidation or even correction. A range of outcomes are plausible, and investors should approach any prediction with a degree of caution.

Market Scenarios, Cryptocurrency bitcoin price

Market scenarios often depend on how various influencing factors interact. Here are some potential scenarios:

- Sustained Growth: Continued adoption by institutional investors and mainstream financial institutions, coupled with robust technological advancements, could lead to a substantial increase in Bitcoin’s price. The increasing interest of institutional investors in crypto assets, like in the case of Grayscale’s recent trust investment, exemplifies this potential.

- Period of Consolidation: The market might experience a period of consolidation, where Bitcoin’s price fluctuates within a relatively narrow range. This could be due to regulatory uncertainties or a slowdown in institutional adoption. The recent periods of sideways consolidation in other asset classes serve as an example.

- Significant Correction: Adverse regulatory developments or major market corrections could trigger a significant decline in Bitcoin’s price. Previous market crashes and regulatory concerns in certain jurisdictions are cautionary tales in this regard.

Long-Term Outlook

Bitcoin’s long-term outlook hinges on several key factors. The increasing integration of blockchain technology into various sectors, along with the evolving regulatory landscape, will shape the long-term viability of Bitcoin. The adoption of blockchain technology by other industries, such as supply chain management and healthcare, is a significant factor influencing its potential.

Technological Advancements

Technological advancements can significantly impact Bitcoin’s future.

- Scaling Solutions: Improvements in scaling solutions, such as the Lightning Network, could enhance Bitcoin’s transaction throughput and reduce fees, thereby increasing its usability. The Lightning Network’s potential for reducing transaction fees is a key development.

- Enhanced Security: Advancements in cryptography and consensus mechanisms could strengthen Bitcoin’s security and resilience against attacks. Improved security measures are vital to the long-term viability of cryptocurrencies.

- Integration with Other Technologies: The integration of Bitcoin with other emerging technologies, such as AI and the Metaverse, could open up new avenues for adoption and value creation. The development of decentralized applications (dApps) on Bitcoin’s blockchain is a significant development.

Regulatory Changes

Regulatory changes can significantly impact Bitcoin’s future. A favorable regulatory environment can foster greater adoption and investment, while unfavorable regulations could hinder growth.

Bitcoin’s price fluctuations are pretty wild, right? Understanding how these prices are affected requires looking at the overall cryptocurrency market, specifically the mechanisms of a cryptocurrency exchange. A key factor influencing Bitcoin’s price is the activity on cryptocurrency exchange platforms. Ultimately, the interplay between supply, demand, and trading on these exchanges directly impacts the Bitcoin price.

- Favorable Regulations: Clear and supportive regulations can provide legal certainty and encourage wider adoption by businesses and individuals. Clear regulatory frameworks in some jurisdictions are encouraging adoption.

- Unfavorable Regulations: Strict or restrictive regulations could limit access and investment opportunities, potentially leading to price fluctuations and reduced market participation. Unfavorable regulations in some jurisdictions have led to market volatility.

Impact on Other Assets

Bitcoin’s price fluctuations have a noticeable impact on other asset classes, extending beyond the cryptocurrency market. This ripple effect is evident in correlations with traditional investments like gold and stocks, and can influence global financial markets. Understanding these relationships is crucial for investors navigating the dynamic landscape of digital assets.The interconnectedness of financial markets means that price movements in one asset class often influence others.

Bitcoin’s volatility, for example, can trigger responses in the stock market, impacting investor sentiment and potentially causing cascading effects across various asset classes. This interdependency requires careful analysis and consideration when assessing the potential impact of Bitcoin’s price on other investments.

Correlation with Other Asset Classes

Bitcoin’s price exhibits a complex relationship with other asset classes, particularly gold and stocks. These relationships are not always consistent, varying based on market conditions and investor sentiment.

- Bitcoin and Gold: The correlation between Bitcoin and gold is often cited as a hedge against inflation. When economic uncertainty or inflation pressures rise, investors may seek safe haven assets like gold and Bitcoin. This can lead to positive correlations, where both asset prices tend to move in tandem. However, this relationship is not always consistent. For instance, during periods of strong market confidence, the correlation can weaken.

- Bitcoin and Stocks: The correlation between Bitcoin and stocks is often less pronounced and more complex than the relationship with gold. While both assets are influenced by market sentiment, the specific factors influencing each can differ, leading to fluctuations in correlation strength. Sometimes, investors may perceive Bitcoin as a high-risk alternative to stocks, leading to a negative correlation during times of market uncertainty.

Conversely, positive correlations can emerge during periods of strong market performance.

Comparison with Major Assets

A direct comparison of Bitcoin’s price performance with major assets like gold and stocks requires careful consideration of timeframes and market conditions. It’s essential to consider the specific periods being analyzed and the prevailing economic environment.

| Asset | Typical Correlation with Bitcoin | Factors Influencing Correlation |

|---|---|---|

| Gold | Often positive, particularly during periods of market uncertainty or inflation concerns. | Investor sentiment, inflation expectations, and global economic conditions. |

| Stocks (e.g., S&P 500) | Can be positive or negative, often less consistent than with gold. | Market sentiment, investor confidence, and overall economic outlook. |

| Other Cryptocurrencies | Generally positive, with various degrees of correlation. | Similar investment strategies, market trends, and technological advancements. |

Impact on Global Financial Markets

Bitcoin’s price fluctuations can trigger a cascade of effects across global financial markets. The volatility in the cryptocurrency market can impact investor confidence and potentially lead to broader market corrections.

Spillover Effects

Bitcoin’s price movements can have spillover effects on other financial markets. This can manifest as increased investor attention to cryptocurrencies, which may influence investor behavior in traditional markets, or it can trigger cascading effects through the interconnected nature of global markets.

Influence on Other Cryptocurrencies

Bitcoin’s price often acts as a benchmark for other cryptocurrencies. A rise or fall in Bitcoin’s value can lead to similar movements in other cryptocurrencies, particularly those perceived as closely related to Bitcoin in terms of technology or market strategy.

Community and Adoption

The Bitcoin community plays a significant role in shaping the cryptocurrency’s trajectory. Active participation, engagement, and the spread of information among users directly impact public perception and consequently, market sentiment. This dynamic interplay between community and price is a critical factor to understand when analyzing Bitcoin’s overall performance.

Role of the Bitcoin Community

The Bitcoin community’s influence on price stems from its collective actions and interactions. Strong community support and engagement often translate to increased trading volume, heightened interest, and a positive feedback loop for the price. Conversely, discord or negative sentiment can lead to price fluctuations. This interconnectedness highlights the importance of a vibrant and supportive community in fostering a healthy and thriving Bitcoin market.

Bitcoin Adoption by Businesses and Institutions

Bitcoin’s adoption by businesses and institutions is a key indicator of its growing legitimacy and practicality. Companies embracing Bitcoin demonstrate its potential as a viable payment method and investment asset. This institutional adoption can significantly influence market confidence and encourage further widespread adoption.

Factors Accelerating or Decelerating Bitcoin Adoption

Several factors can influence the rate of Bitcoin adoption. Positive regulatory developments, the launch of user-friendly interfaces, and the development of sophisticated financial products tailored to Bitcoin can accelerate its adoption. Conversely, negative regulatory actions, security breaches, or a lack of widespread educational resources can decelerate its adoption.

Adoption by Major Corporations

| Corporation | Nature of Adoption |

|---|---|

| Tesla | Initially purchased a significant amount of Bitcoin as an investment, later selling a portion. |

| MicroStrategy | Has significantly invested in Bitcoin, viewing it as a strategic asset. |

| Square | Offers Bitcoin buying and selling services through its Cash App platform. |

| PayPal | Allows users to buy, sell, and hold Bitcoin. |

This table provides a snapshot of prominent corporations that have adopted Bitcoin in various capacities. The diversity in approaches reflects the evolving nature of Bitcoin’s integration into the broader financial landscape.

Relationship Between Adoption and Price Volatility

A correlation exists between Bitcoin adoption and price volatility. Increased adoption often coincides with heightened price fluctuations. As more institutions and businesses integrate Bitcoin into their operations, the market becomes more sensitive to external factors and news, which can lead to price volatility. This dynamic relationship emphasizes the importance of considering both the positive aspects of adoption and the potential for increased volatility.

Risk Management

Bitcoin investments, while potentially lucrative, carry inherent risks. Understanding and managing these risks is crucial for any investor seeking to navigate the volatile cryptocurrency market successfully. Effective risk management strategies can help mitigate potential losses and maximize the likelihood of positive returns.A well-defined risk management strategy is a proactive approach to safeguarding investments in Bitcoin. It encompasses several crucial elements, including the meticulous assessment of risk factors, the implementation of diversification strategies, the use of protective orders, and the importance of continuous due diligence.

Diversification Strategies for Bitcoin Portfolios

Diversification is a key strategy in mitigating risk. It involves spreading investments across different asset classes and reducing reliance on a single asset, like Bitcoin. A diversified Bitcoin portfolio can include various cryptocurrencies beyond Bitcoin, such as Ethereum or Litecoin, as well as traditional assets like stocks, bonds, or real estate. This approach can help reduce the impact of negative market trends affecting Bitcoin’s price.

- Including Altcoins: Investing in alternative cryptocurrencies (altcoins) can diversify a portfolio. Altcoins often have different market dynamics than Bitcoin, offering potential for growth while hedging against Bitcoin-specific risks.

- Adding Traditional Assets: Combining Bitcoin with traditional investments like stocks or bonds can create a more balanced portfolio. This approach can provide a degree of stability during periods of Bitcoin market volatility.

- Geographic Diversification: While not directly applicable to cryptocurrencies, diversifying across different exchanges and regions can protect against regulatory changes or localized market issues affecting Bitcoin trading.

Risk Assessment Before Investing in Bitcoin

Thorough risk assessment is paramount before entering the Bitcoin market. Understanding your investment goals, risk tolerance, and financial situation is crucial. A detailed analysis of the potential downsides of investing in Bitcoin is essential. This includes factors like market volatility, regulatory uncertainty, and the possibility of scams.

- Defining Investment Goals: Before investing, establish clear financial goals and the desired return on investment. This helps determine the acceptable level of risk.

- Assessing Risk Tolerance: Evaluate your ability to withstand potential losses. Consider how much you can afford to lose without impacting your financial stability.

- Evaluating Financial Situation: Analyze your current financial resources and determine how much capital you can realistically allocate to Bitcoin investments.

Stop-Loss Orders and Their Application in Bitcoin Trading

Stop-loss orders are crucial tools for limiting potential losses in Bitcoin trading. They automatically sell a security when its price falls to a predetermined level, helping to prevent significant capital erosion. This strategy is vital for managing the inherent volatility of the cryptocurrency market.

- Setting the Stop-Loss Price: Determine the price point at which you’re willing to accept a loss and set the stop-loss order accordingly.

- Choosing a Suitable Stop-Loss Order Type: Various types of stop-loss orders exist, each with different triggering mechanisms. Choose the type that best suits your trading strategy and risk tolerance.

- Monitoring Stop-Loss Orders: Continuously monitor the market and adjust stop-loss orders as needed to reflect evolving price trends.

Due Diligence in Bitcoin Investment

Due diligence is critical in the Bitcoin market, where scams and fraudulent activities can occur. Thoroughly researching exchanges, wallets, and projects is vital to protect your investments. Ensuring transparency and security is essential.

- Researching Exchanges and Wallets: Investigate the reputation and security measures of Bitcoin exchanges and wallets before using them.

- Verifying Project Legitimacy: Thoroughly investigate any cryptocurrency project before investing, ensuring its authenticity and potential.

- Seeking Expert Advice: Consider consulting with financial advisors or cryptocurrency experts for guidance and insights.

Last Recap

In conclusion, Bitcoin’s price is a complex interplay of historical trends, economic factors, market sentiment, technical analysis, and fundamental principles. While predicting the future is inherently uncertain, this analysis offers a comprehensive view of the factors that have shaped Bitcoin’s past performance and potentially influence its future trajectory. Understanding the risks and rewards is crucial for anyone considering investing in this dynamic asset.

FAQ Insights

What is the average annual return on Bitcoin investment?

Bitcoin’s annual returns have been highly volatile, with periods of significant growth and substantial losses. There’s no fixed average, and past performance is not indicative of future results.

How does Bitcoin’s price compare to gold?

The correlation between Bitcoin and gold has been inconsistent. Sometimes, Bitcoin’s price moves in tandem with gold, and other times, they show little to no correlation, depending on various market conditions.

What is the impact of regulatory changes on Bitcoin’s price?

Government regulations and policies concerning cryptocurrencies can significantly influence Bitcoin’s price. Stricter regulations often lead to price drops, while favorable policies can potentially drive the price upward.

What is the relationship between Bitcoin adoption and price volatility?

Higher adoption by businesses and institutions can often lead to increased price stability, but rapid changes in adoption can sometimes correlate with higher volatility.