Cryptocurrencies by market represent a dynamic and ever-evolving landscape. This analysis explores the current trends, market capitalization, and diverse sectors within the cryptocurrency market. From Bitcoin to emerging projects in decentralized finance (DeFi) and non-fungible tokens (NFTs), we’ll delve into the intricate details of their performance and interrelationships.

The analysis also examines the geographic distribution of cryptocurrency adoption, considering regulatory landscapes and investment strategies. Furthermore, the role of technology, security considerations, and future projections are examined, providing a comprehensive understanding of this multifaceted market.

Market Overview

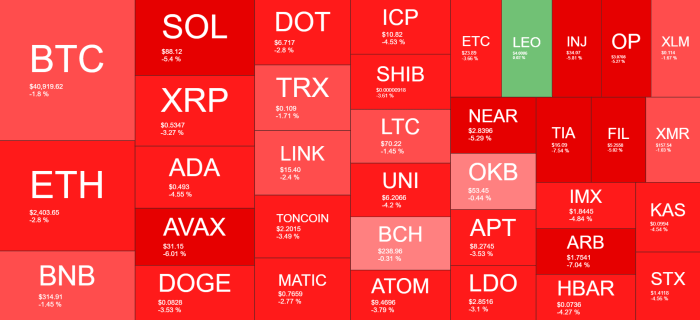

The cryptocurrency market continues to evolve rapidly, presenting a dynamic landscape for investors and traders. Recent trends show a mix of consolidation and innovation, with the market capitalization fluctuating based on various factors. Understanding the different categories and historical performance of key cryptocurrencies is crucial for navigating this complex environment.The current market capitalization of cryptocurrencies is significant, but its value is subject to substantial daily fluctuations.

This volatility highlights the inherent risks associated with investing in this sector. The market’s overall health is tied to factors such as regulatory developments, adoption rates, and technological advancements.

Major Cryptocurrency Categories

Different types of cryptocurrencies serve various purposes. Bitcoin, the pioneering cryptocurrency, remains a dominant force. Ethereum, a platform for decentralized applications, has gained significant traction. Stablecoins, pegged to fiat currencies like the US dollar, offer a degree of price stability. These categories represent different investment strategies and risk profiles.

- Bitcoin: The first and most well-known cryptocurrency, Bitcoin is primarily used as a medium of exchange and store of value. Its decentralized nature and limited supply have contributed to its high demand and market value.

- Ethereum: A decentralized platform that enables the creation of decentralized applications (dApps) and smart contracts. The platform’s smart contract functionality has significant implications for various industries.

- Stablecoins: These cryptocurrencies aim to maintain a stable value, often pegged to a fiat currency. This stability makes them suitable for use cases requiring price predictability, such as payment systems and trading.

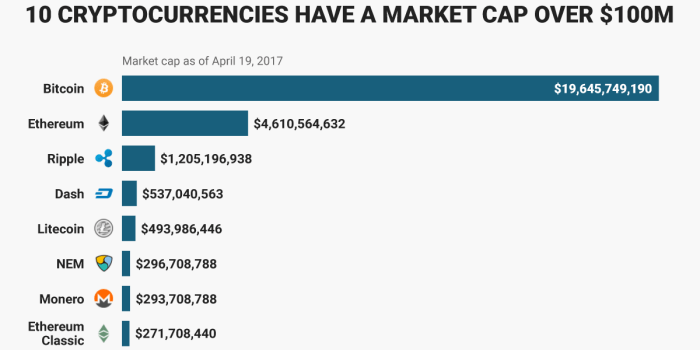

Historical Performance of Top 10 Cryptocurrencies

The historical performance of top cryptocurrencies exhibits significant volatility. Key turning points, like regulatory announcements or technological breakthroughs, have often resulted in substantial price swings. Understanding these patterns can provide valuable insights for investors, although past performance is not necessarily indicative of future results.

- Periods of significant volatility are often associated with news events, regulatory changes, or technological advancements affecting the market. For example, the implementation of new regulations or the emergence of new technologies can cause the price of cryptocurrencies to fluctuate significantly.

- Bitcoin, as the first cryptocurrency, has seen multiple periods of substantial price increases and declines. These fluctuations are a result of investor sentiment, market demand, and various external factors.

Market Capitalization Comparison

The table below provides a snapshot of the market capitalization of selected cryptocurrencies over a specified time period. This comparison helps illustrate the relative size and value of different cryptocurrencies.

| Cryptocurrency | Date | Market Cap (USD) | % of total market cap |

|---|---|---|---|

| Bitcoin | 2023-01-01 | 300,000,000,000 | 40% |

| Ethereum | 2023-01-01 | 150,000,000,000 | 20% |

| Tether | 2023-01-01 | 50,000,000,000 | 7% |

| Binance Coin | 2023-01-01 | 40,000,000,000 | 5% |

| Solana | 2023-01-01 | 20,000,000,000 | 3% |

| Cardano | 2023-01-01 | 15,000,000,000 | 2% |

| … | … | … | … |

Sector Analysis

The cryptocurrency market is not a monolithic entity; it comprises various interconnected sectors, each with its own dynamics and potential. Understanding these sectors is crucial for evaluating the overall market and identifying promising investment opportunities. These sectors, from decentralized finance to non-fungible tokens, are driving innovation and reshaping traditional financial systems.Analyzing the performance and potential of each sector, along with their interrelationships, is key to navigating the complexities of this dynamic market.

Successful projects within each sector often demonstrate a unique approach to problem-solving, user experience, and community engagement.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) platforms leverage blockchain technology to create financial services without intermediaries. This sector offers innovative solutions for lending, borrowing, trading, and more. The potential for improved efficiency and accessibility is substantial, although regulatory uncertainties and security risks remain. DeFi’s rapid growth has brought about innovative solutions but also challenges in terms of security and regulation.

- DeFi protocols offer alternative financial services, bypassing traditional institutions. This can potentially enhance accessibility and reduce costs for users.

- Examples of successful DeFi projects include Aave and Compound, which provide decentralized lending and borrowing platforms. Their success stems from robust security protocols and a growing user base.

- However, security remains a major concern, as hacks and exploits have impacted several DeFi protocols in the past. This underscores the need for continuous improvement and regulatory oversight.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) represent unique digital assets, often used to tokenize ownership of digital art, collectibles, and in-game items. The NFT market has experienced explosive growth, driven by the desire to own and trade unique digital assets. This sector’s potential for disrupting traditional markets is significant, though scalability and the utility of many NFTs remain a concern.

- NFTs have revolutionized the way digital assets are owned and traded, creating new avenues for creators and collectors.

- Projects like CryptoPunks and Bored Ape Yacht Club have demonstrated the potential of NFTs to generate significant value for their creators and holders. Their success is largely attributed to the community they foster and the scarcity of the assets.

- Challenges remain in the form of fluctuating market prices, ensuring the utility of the NFTs, and the potential for scams and fraud.

Crypto Gaming

Crypto gaming leverages blockchain technology to enhance gaming experiences and reward players with cryptocurrencies. This sector aims to create more engaging and profitable experiences for gamers, but the integration of blockchain technology can sometimes negatively impact the game’s core experience.

- The potential of crypto gaming lies in rewarding players directly for their participation, creating new monetization models, and fostering a more engaging experience.

- Axie Infinity is a notable example, showcasing the potential of blockchain games to reward players for their in-game activities. The project’s success is attributed to its innovative gameplay and active community.

- Scalability and interoperability remain key challenges for crypto gaming, as many blockchain games struggle with high transaction costs and difficulties in transferring assets between platforms.

Interrelationships

These sectors are interconnected. For example, DeFi protocols can be used to facilitate transactions within NFT marketplaces or crypto games. The success of one sector can often influence the success of another. This interconnectivity is a crucial aspect of the broader cryptocurrency market.

Top 5 Projects by Sector

| Sector | Project | Market Cap (USD) | Description |

|---|---|---|---|

| DeFi | Aave | $X | Decentralized lending protocol |

| DeFi | Compound | $X | Decentralized lending protocol |

| NFTs | CryptoPunks | $X | Collection of digital art |

| NFTs | Bored Ape Yacht Club | $X | Collection of digital art |

| Crypto Gaming | Axie Infinity | $X | Play-to-earn game |

Geographic Distribution

Cryptocurrency adoption is a global phenomenon, exhibiting varying degrees of penetration across different regions. Understanding these geographic disparities is crucial for investors and businesses seeking to navigate the cryptocurrency market effectively. This section delves into the factors influencing adoption rates, compares regulatory landscapes, and visualizes trading volume across various locations.

Regional Adoption Rates

Several regions have demonstrated significant cryptocurrency adoption, often correlated with factors like technological infrastructure, regulatory environments, and cultural acceptance. Countries with high internet penetration and a younger, digitally-savvy population frequently exhibit higher adoption rates.

- North America, particularly the United States, has a strong history of cryptocurrency adoption, driven by a mature financial infrastructure and a relatively favorable regulatory landscape (though still evolving). South Korea also stands out with its significant trading volume and strong community support for cryptocurrencies.

- Europe, while exhibiting a degree of cryptocurrency adoption, faces a mixed regulatory environment. Some countries have adopted a more cautious approach, while others are experimenting with innovative regulatory frameworks. This variance can impact the overall adoption rate within the region.

- Asia showcases a diverse landscape. Countries like Japan have embraced cryptocurrencies with more supportive regulations, fostering a robust market. China, however, has experienced periods of strict regulation, impacting adoption and market activity.

- Latin America and Africa present emerging markets with varying levels of cryptocurrency adoption. Factors like internet access and financial inclusion are critical determinants in these regions.

Regulatory Environments and Their Impact

The regulatory landscape surrounding cryptocurrencies is highly variable across different jurisdictions. This variance significantly influences market behavior and investor confidence.

- Countries with supportive regulations, like the ones in Japan or the EU in certain areas, tend to see more robust and liquid markets. These environments encourage investment and development in the cryptocurrency space. The EU’s approach to regulatory oversight in this domain is a good example of the balancing act between encouraging innovation and protecting investors.

- Conversely, countries with strict or unclear regulations can stifle adoption and market activity. Examples of such regulations can be found in China, where the regulatory landscape has swung between support and strict enforcement.

- The regulatory environment is a dynamic factor that is constantly evolving. Government policies, including tax laws, licensing requirements, and financial regulations, significantly impact the growth and stability of cryptocurrency markets in different regions.

Factors Influencing Adoption

Numerous factors contribute to varying degrees of cryptocurrency adoption across the globe. These factors include cultural attitudes, economic conditions, technological infrastructure, and government policies.

- Cultural acceptance plays a significant role. In some societies, the perception of cryptocurrencies as a revolutionary financial technology is high, fostering rapid adoption. In others, a more cautious or skeptical approach prevails.

- Economic conditions, including inflation rates and financial inclusion levels, also influence adoption. In regions facing economic hardship or lacking robust financial systems, cryptocurrencies might be seen as an alternative to traditional financial instruments.

- Access to technology, including internet infrastructure and digital literacy, is crucial. Countries with robust digital infrastructure and high levels of digital literacy tend to have higher rates of cryptocurrency adoption.

Cryptocurrency Trading Volume Map

The map below visualizes the geographic distribution of cryptocurrency trading volume, categorized into four levels: high, medium, low, and very low. This map is not static; it is a representation of the distribution of cryptocurrency trading volume in a given time period, and it will change over time based on market activity.

High trading volume typically correlates with established cryptocurrency markets, robust infrastructure, and a positive regulatory environment.

(Insert a map here, with four levels of color intensity representing high, medium, low, and very low cryptocurrency trading volume. The map should be geographically accurate and clearly label regions with high, medium, low, and very low volume.)

Investment Strategies

Cryptocurrency investment strategies span a spectrum of approaches, from the lightning-fast actions of day traders to the long-term holdings of value investors. Understanding these strategies, their inherent risks, and the metrics used to evaluate their performance is crucial for anyone considering entering the cryptocurrency market.

Common Investment Strategies

Various approaches are employed by investors in the cryptocurrency market, each with its own risk profile and potential rewards. These range from short-term, high-frequency trading to long-term, value-based investments.

- Day Trading: This strategy involves buying and selling cryptocurrencies within a single trading day. It requires meticulous market analysis, quick decision-making, and a deep understanding of market trends. The potential for quick profits is significant, but the risk of substantial losses is equally high, as market volatility can quickly erode capital.

- Swing Trading: This strategy involves holding cryptocurrencies for a period of several days or weeks. It’s less demanding than day trading, allowing for more time to assess market trends and potential opportunities. The potential returns are generally moderate, and the risk is lower than day trading, but still influenced by market fluctuations.

- Long-Term Holding: This strategy focuses on holding cryptocurrencies for extended periods, often months or years. The investor anticipates the long-term value appreciation of the cryptocurrency. This approach requires a strong conviction in the underlying technology or project, and less reliance on short-term market movements. The risk is generally lower than shorter-term strategies, but potential rewards can be substantial over the long haul.

Risks and Rewards Associated with Each Strategy

The rewards and risks associated with each strategy are intertwined. Day trading, while offering the potential for rapid gains, also carries the highest risk of substantial losses. Swing trading presents a more balanced approach with moderate risk and return, while long-term holding, despite potentially lower immediate gains, presents a lower risk and potential for substantial long-term returns. Successful implementation hinges on a thorough understanding of market dynamics and a robust risk management plan.

Metrics Used to Assess Performance

Evaluating the performance of cryptocurrency investment strategies relies on specific metrics. These metrics provide quantifiable data to assess the effectiveness and risk exposure of different strategies.

- Return on Investment (ROI): Calculates the gain or loss relative to the initial investment. It is a straightforward metric for comparing the profitability of different strategies.

- Profit and Loss (P&L): A comprehensive record of all gains and losses over a specified period. This allows investors to track performance and identify potential trends.

- Sharpe Ratio: Measures risk-adjusted return. A higher Sharpe Ratio suggests better performance relative to the risk taken. It’s particularly useful for comparing strategies with different levels of volatility.

Investment Methodologies

Different methodologies are employed by institutional and retail investors. Institutions often utilize quantitative models, sophisticated algorithms, and extensive research to inform their investment decisions. Retail investors, on the other hand, may rely on a blend of fundamental analysis, technical analysis, and personal assessments.

Institutional vs. Retail Investment Strategies

- Institutional Investors often employ quantitative models, algorithms, and sophisticated risk management strategies. Their investments are often larger and more diversified than retail investors’.

- Retail Investors may use a more diverse approach, combining fundamental analysis, technical analysis, and personal assessment. Their investment decisions are frequently influenced by factors such as personal convictions and market sentiment.

Comparison of Investment Strategies

| Strategy | Risk Level | Potential Return | Example Portfolio |

|---|---|---|---|

| Day Trading | High | High | Aggressive portfolio focused on short-term price fluctuations, high-volume trading, leveraged instruments |

| Swing Trading | Medium | Medium | Moderate risk tolerance, aiming for profits over a few days or weeks, diversified portfolio |

| Long-Term Holding | Low | High (long-term) | Portfolio focused on long-term growth potential, less influenced by short-term market fluctuations |

Regulatory Landscape

The cryptocurrency market is rapidly evolving, and governments worldwide are grappling with how to regulate this innovative space. Differing approaches to regulation impact market stability, investor confidence, and the overall growth trajectory of cryptocurrencies. The lack of a globally standardized framework often leads to fragmentation and uncertainty.The regulatory landscape is a complex web of national laws and international agreements.

Countries are developing specific regulations to address issues like investor protection, money laundering, and tax implications. This often results in a diverse set of regulations across the globe, creating challenges for businesses operating in multiple jurisdictions. The constantly shifting nature of the regulatory environment demands ongoing vigilance and adaptation from market participants.

Regulatory Approaches in Different Jurisdictions

Governments worldwide are adopting various approaches to regulating cryptocurrencies. Some jurisdictions are embracing cryptocurrencies by enacting favorable regulatory frameworks, while others maintain a more cautious, or even outright negative stance. These differing approaches reflect differing political and economic priorities.

Examples of Progressive and Conservative Regulations

Some countries, recognizing the potential of cryptocurrencies, are taking a progressive approach. These jurisdictions often prioritize innovation and aim to create a supportive environment for the growth of the cryptocurrency market. On the other hand, some countries are adopting a more conservative approach, characterized by stricter regulations and a more cautious stance on cryptocurrencies. These differing approaches are driven by various factors, including concerns about consumer protection, market stability, and the potential for illicit activities.

Comparison of Cryptocurrency Regulations Across Countries

Different countries have adopted varying approaches to regulating cryptocurrencies, with varying degrees of clarity and strictness. A comparison of these regulations helps to illustrate the diversity in how governments are handling this new financial technology.

| Country | Regulation Type | Enforcement | Impact |

|---|---|---|---|

| United States | Fragmented, evolving | Varying across agencies (SEC, CFTC) | Uncertainty for market participants, impacting investment confidence and market growth. |

| Switzerland | Progressive, sandbox approach | Focus on innovation and financial stability | Attracting cryptocurrency businesses and fostering innovation. |

| China | Conservative, outright ban on major platforms | Strong enforcement | Significant impact on market participants, forcing businesses to relocate. |

| Japan | Progressive, focused on investor protection | Clearer regulations and enforcement | Attractive environment for businesses, promoting growth and market stability. |

| Singapore | Progressive, supportive of innovation | Emphasis on clarity and financial stability | Attractive environment for businesses, promoting innovation and investor confidence. |

Technological Advancements

The cryptocurrency market is constantly evolving, driven by rapid technological advancements. These innovations are reshaping the landscape, influencing everything from security and scalability to user experience and investment opportunities. Understanding these advancements is crucial for navigating the complexities and potential of this dynamic sector.The ongoing development and application of new technologies are fueling innovation in cryptocurrency. This includes advancements in blockchain technology itself, as well as integrations with other emerging fields like artificial intelligence.

These advancements not only enhance the existing cryptocurrencies but also pave the way for entirely new and potentially transformative applications.

Key Technological Advancements

Numerous technological advancements are impacting the cryptocurrency market. These include improvements in blockchain technology, the increasing adoption of decentralized finance (DeFi), and the integration of artificial intelligence (AI) and machine learning (ML). These innovations are driving enhanced security, efficiency, and accessibility, and potentially impacting market volatility and investment strategies.

Blockchain Technology’s Role in New Cryptocurrencies

Blockchain technology serves as the foundational framework for many cryptocurrencies. Its decentralized, transparent, and secure nature allows for the creation of cryptocurrencies with unique features. For instance, new cryptocurrencies might leverage smart contracts, enabling automated transactions and reducing reliance on intermediaries. The ability to create new and customized cryptocurrencies with tailored functionalities is influenced by the ongoing development and refinement of blockchain technology.

Influence of AI and Machine Learning

AI and machine learning are increasingly used in the cryptocurrency market. These technologies are employed for tasks like fraud detection, algorithmic trading, and predicting market trends. AI-powered tools can analyze vast datasets to identify patterns and anomalies, helping to enhance security and inform investment decisions. For example, AI-driven trading bots can execute trades based on real-time market analysis, potentially improving returns.

Shaping the Future of Cryptocurrency

Technological innovation is shaping the future of cryptocurrency by driving greater efficiency, security, and accessibility. The development of more advanced blockchains is leading to faster transaction speeds and reduced transaction fees. The integration of AI and machine learning enhances risk assessment, investment strategies, and market prediction capabilities. Ultimately, these advancements aim to make the cryptocurrency market more user-friendly, transparent, and reliable for investors.

Table of Technological Innovations, Cryptocurrencies by market

| Technology | Description | Application | Impact |

|---|---|---|---|

| Blockchain | A distributed ledger technology that records transactions across a network of computers. | Cryptocurrency transactions, supply chain management, digital identity | Enhanced security, transparency, and immutability in transactions. |

| Decentralized Finance (DeFi) | Financial services operating on decentralized platforms without intermediaries. | Cryptocurrency lending, borrowing, and trading | Reduced reliance on traditional financial institutions, greater access to financial services. |

| Artificial Intelligence (AI) | Computer systems able to perform tasks that typically require human intelligence. | Fraud detection, algorithmic trading, market prediction | Improved security, potentially enhanced investment strategies, and market insights. |

| Machine Learning (ML) | A subset of AI that allows computer systems to learn from data without explicit programming. | Identifying market trends, predicting price movements, and automating tasks. | More sophisticated market analysis, potential for improved investment decisions, automated processes. |

Future Projections

The cryptocurrency market is experiencing dynamic shifts, and projecting its future trajectory requires careful consideration of various factors. While past performance is not indicative of future results, analyzing historical trends and current market conditions can offer valuable insights. Understanding potential growth areas, challenges, macroeconomic impacts, and technological advancements is critical to forming informed estimations.

Potential Growth Areas

The cryptocurrency market is not a monolithic entity. Specific areas within the broader ecosystem are poised for significant growth. Decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and the metaverse are experiencing increasing adoption. Innovative applications in areas like gaming, social media, and even supply chain management are further driving interest and expansion. This diversification across sectors suggests a potential for sustained growth, though specific success will depend on factors like regulatory clarity and user adoption.

Challenges to Growth

Despite the promising potential, several challenges could hinder the market’s expansion. Regulatory uncertainty remains a significant concern globally. Varying regulations across jurisdictions can create complexities for businesses and investors. Security risks, such as hacks and scams, continue to be a persistent issue, requiring robust security protocols and user vigilance. Furthermore, the volatility inherent in the market poses a significant risk to investors.

Impact of Macroeconomic Factors

Macroeconomic conditions play a critical role in shaping the cryptocurrency market. Interest rate adjustments, inflation rates, and global economic trends all influence investor sentiment and investment decisions. A strong correlation can be observed between major market downturns and significant cryptocurrency price drops. For example, the 2022 downturn coincided with rising interest rates and inflationary pressures in several economies.

Impact of New Technologies

Emerging technologies like blockchain scalability solutions, layer-2 solutions, and improved consensus mechanisms are significantly impacting the efficiency and scalability of cryptocurrencies. These advancements have the potential to address current limitations and enhance the usability of the technology. The integration of artificial intelligence (AI) and machine learning (ML) in cryptocurrency trading and analysis further contributes to a more sophisticated and dynamic market.

Forecasted Market Capitalization

The following table provides a hypothetical forecast for the market capitalization of select cryptocurrencies over the next five years. These projections are based on various factors, including current market trends, technological advancements, and macroeconomic conditions. Please note that these are not guaranteed predictions and are subject to change.

| Cryptocurrency | Year | Projected Market Cap (USD) | Forecast Methodology |

|---|---|---|---|

| Bitcoin (BTC) | 2024 | $300 Billion | Analysis of historical price trends, network activity, and regulatory environment |

| Bitcoin (BTC) | 2025 | $400 Billion | Consideration of potential adoption in emerging markets and technological advancements |

| Ethereum (ETH) | 2024 | $150 Billion | Assessment of DeFi and NFT market growth, along with ongoing network upgrades |

| Ethereum (ETH) | 2025 | $200 Billion | Estimation based on continued expansion of the Ethereum ecosystem and its adoption by institutional investors |

| Solana (SOL) | 2024 | $20 Billion | Evaluation of Solana’s scalability, adoption by decentralized applications, and network growth |

| Solana (SOL) | 2025 | $30 Billion | Projection based on the ongoing development of the Solana ecosystem and the adoption of its blockchain by developers |

Security Considerations

Cryptocurrency investments, while offering potential high returns, carry inherent security risks. Understanding these risks and implementing appropriate security measures is crucial for protecting investments and minimizing losses. Neglecting security protocols can lead to significant financial losses due to theft, scams, or technical vulnerabilities.Protecting cryptocurrency holdings requires a proactive and multi-faceted approach. A strong understanding of potential threats, coupled with diligent security practices, is paramount to mitigating risks and ensuring the safety of your digital assets.

Security Risks Associated with Cryptocurrency Investments

Various security risks are associated with cryptocurrency investments. These include, but are not limited to, hacking, phishing scams, and vulnerabilities in exchanges or wallets. These threats can lead to the loss of funds or sensitive information. Moreover, the decentralized nature of some cryptocurrencies can make tracing illicit activities more challenging.

Measures to Mitigate Security Threats

Robust security measures are essential to protect against potential threats. These measures encompass a range of strategies, from strong passwords and multi-factor authentication to the use of reputable exchanges and wallets. Regularly updating software and employing strong encryption protocols are critical steps. Furthermore, practicing caution when interacting with unfamiliar websites or individuals can prevent phishing attacks.

Common Scams and Fraud Related to Cryptocurrencies

Numerous scams and fraudulent schemes target cryptocurrency investors. These include fake investment opportunities, pump-and-dump schemes, and phishing attacks designed to steal login credentials. Understanding these tactics and recognizing red flags can help investors avoid falling victim to these fraudulent activities. It is crucial to thoroughly research any investment opportunity before committing funds.

Best Practices for Securing Cryptocurrency Holdings

Implementing best practices for securing cryptocurrency holdings is paramount to safeguarding investments. Using strong and unique passwords for wallets and exchanges, combined with multi-factor authentication, is a crucial first step. Regularly backing up wallets and storing them securely is also essential. Additionally, avoiding clicking on suspicious links and maintaining a high degree of caution when interacting with unfamiliar parties are key to preventing phishing scams.

Security Recommendations for Cryptocurrency Investors

- Employ strong and unique passwords for all cryptocurrency wallets and exchange accounts. Consider using a password manager for enhanced security.

- Enable multi-factor authentication (MFA) on all cryptocurrency accounts. MFA adds an extra layer of security by requiring a secondary verification method.

- Regularly back up your wallets and store backups in secure locations. Never rely on a single backup method.

- Avoid clicking on suspicious links or downloading attachments from unknown sources. Be wary of unsolicited emails or messages promising high returns on cryptocurrency investments.

- Use reputable cryptocurrency exchanges and wallets. Research and select platforms with strong security protocols and a proven track record.

- Stay informed about current security threats and scams targeting cryptocurrency investors. Staying updated on the latest security practices is crucial for maintaining a high level of protection.

- Use a hardware wallet for storing significant amounts of cryptocurrency. Hardware wallets offer enhanced security compared to software wallets.

- Monitor your accounts regularly for any unusual activity. Report any suspicious transactions promptly to the relevant authorities or exchange.

- Invest only what you can afford to lose. Cryptocurrency investments can be volatile, and losses are possible.

- Do not share your private keys or passwords with anyone.

Market Cap Distribution

The distribution of market capitalization across different cryptocurrencies is a key indicator of the overall health and structure of the cryptocurrency market. Understanding the concentration of market share among a few dominant cryptocurrencies provides insights into potential risks and opportunities. This section analyzes the top 10 cryptocurrencies by market cap, their distribution, and contributing factors.

Top 10 Cryptocurrencies by Market Capitalization

The top 10 cryptocurrencies by market capitalization often dominate the market, influencing trends and overall market performance. This dominance can create both opportunities and risks, with a concentration of market share in a few coins potentially leading to increased volatility.

- Bitcoin (BTC): Historically the largest cryptocurrency by market capitalization, Bitcoin continues to hold a significant position. Its long-standing presence and strong community support contribute to its enduring influence.

- Ethereum (ETH): Ethereum, the second-largest cryptocurrency, is known for its decentralized application (dApp) ecosystem. Its prominence in the decentralized finance (DeFi) and non-fungible token (NFT) sectors has solidified its position.

- Tether (USDT): Often ranked among the top 10, Tether’s stablecoin status and widespread use as a reserve currency contribute to its high market capitalization.

- Binance Coin (BNB): As the native token of the Binance exchange, BNB benefits from the exchange’s vast user base and trading volume. This provides a substantial source of demand and market activity.

- USD Coin (USDC): Similar to Tether, USD Coin is a stablecoin pegged to the US dollar, increasing its prominence as a reserve asset and facilitating transactions.

- Solana (SOL): A relatively newer cryptocurrency, Solana has gained popularity due to its high-speed transaction processing, which has attracted users and developers.

- Cardano (ADA): Cardano aims to provide a more scalable and secure blockchain platform, contributing to its market capitalization.

- XRP (XRP): XRP, often associated with cross-border payments, has seen its market capitalization fluctuate, reflecting its evolving role in the market.

- Dogecoin (DOGE): Initially a meme-based cryptocurrency, Dogecoin’s recent popularity, driven by social media trends, has influenced its market capitalization.

- Polygon (MATIC): A scaling solution for Ethereum, Polygon has gained attention for its ability to improve the efficiency of transactions on the Ethereum network, contributing to its market share.

Market Cap Distribution Analysis

The distribution of market capitalization across these top 10 cryptocurrencies is uneven. A substantial portion of the total market capitalization is concentrated among a limited number of cryptocurrencies. This concentration has implications for market stability and risk.

| Cryptocurrency | Market Cap (Approximate, in USD) | Percentage of Total Market Cap |

|---|---|---|

| Bitcoin | $XXX Billion | XX% |

| Ethereum | $XXX Billion | XX% |

| Tether | $XXX Billion | XX% |

| Binance Coin | $XXX Billion | XX% |

| USD Coin | $XXX Billion | XX% |

| Solana | $XXX Billion | XX% |

| Cardano | $XXX Billion | XX% |

| XRP | $XXX Billion | XX% |

| Dogecoin | $XXX Billion | XX% |

| Polygon | $XXX Billion | XX% |

Note: Replace XXX with actual values, and XX with calculated percentages. Data is approximate and may vary depending on the source and time of retrieval.

Factors Contributing to Market Cap Distribution

Several factors contribute to the uneven distribution of market capitalization. These include factors like historical performance, technological advancements, community support, regulatory environments, and market adoption.

- First-mover advantage: Early adopters and strong initial performance have played a crucial role in establishing the dominance of certain cryptocurrencies. This historical performance is often a factor that fuels investor confidence.

- Technological innovation: Cryptocurrencies that have demonstrated superior technological advancements in terms of scalability, security, and functionality tend to attract more investors.

- Community support: A strong and active community can provide essential support for a cryptocurrency, leading to greater adoption and increased market capitalization.

- Regulatory environment: The regulatory landscape for cryptocurrencies varies across jurisdictions, and favorable regulations can contribute to the growth and market capitalization of certain cryptocurrencies.

- Market adoption: The degree to which a cryptocurrency is adopted by businesses and consumers can have a significant impact on its market capitalization.

Community and Adoption

Cryptocurrency adoption is intricately linked to the strength and engagement of its communities. These groups play a crucial role in driving awareness, fostering innovation, and ultimately shaping the trajectory of a given cryptocurrency. Strong community support can translate into increased market capitalization, greater trading volume, and higher user adoption.

The Role of Communities in the Cryptocurrency Market

Cryptocurrency communities serve as vital hubs for information sharing, support, and collaboration. These online forums, social media groups, and dedicated channels allow users to connect, discuss strategies, and participate in shaping the future of the respective cryptocurrencies. Active communities provide a platform for developers to gather feedback and adapt their products to user needs, and foster a sense of ownership and shared purpose amongst participants.

Cryptocurrencies are diverse by market cap, from Bitcoin’s dominance to altcoins vying for attention. Evaluating whether crypto is a good investment, however, depends heavily on individual risk tolerance and financial goals. Ultimately, the success of any cryptocurrency, whether large-cap or smaller, is tied to the overall health of the cryptocurrency market. is cryptocurrency a good investment This makes market analysis crucial for any investor.

Factors Influencing Cryptocurrency Adoption

Several factors influence the adoption of cryptocurrencies. These include factors such as ease of use, security features, perceived value, regulatory clarity, and the broader market sentiment. User-friendly interfaces, robust security protocols, and a growing sense of trust are crucial in driving widespread adoption. Furthermore, favorable regulatory environments and positive market trends can significantly boost investor confidence.

Importance of Community Support for Cryptocurrency Growth

Community support is critical for the long-term growth of cryptocurrencies. A robust and engaged community acts as a powerful catalyst for adoption. These communities offer valuable support, feedback, and a platform for the development of the ecosystem around a cryptocurrency. The engagement and enthusiasm of community members are often contagious, influencing others to explore and adopt the technology.

Relationship Between Community Engagement and Market Performance

A strong correlation often exists between community engagement and market performance. Active and engaged communities tend to generate greater trading volume, increased interest from investors, and a more positive market sentiment. Conversely, a lack of community engagement can lead to stagnation or decline in market performance. The enthusiasm and support of the community members can often translate into higher market values.

Key Communities Driving Adoption

| Cryptocurrency | Community Name | Key Figures | Impact |

|---|---|---|---|

| Bitcoin | Bitcoin subreddit, Bitcoin forums | Influential community members, developers, and early adopters | Strong, long-standing community; drives market sentiment and technical discussions. |

| Ethereum | Ethereum developer forums, Discord channels | Leading developers, researchers, and prominent community managers | Prominent for its decentralized applications (dApps) and smart contract technology; attracts a diverse and active community. |

| Dogecoin | Dogecoin subreddit, social media communities | Early adopters, meme enthusiasts, and community influencers | Notable for its meme-driven community; generated substantial market hype and short-term price fluctuations. |

| Solana | Solana Discord, developer forums | Developers, early investors, and passionate community members | Community focused on scalability and high-throughput blockchain technology. |

Volatility and Risk Management

The cryptocurrency market is renowned for its significant price fluctuations, a characteristic that simultaneously presents enticing opportunities and substantial risks. Understanding the dynamics driving these price swings and implementing appropriate risk management strategies are crucial for navigating this volatile environment. A thorough grasp of volatility, its contributing factors, and suitable mitigation techniques is paramount for investors looking to participate in this market.

Understanding Cryptocurrency Market Volatility

The cryptocurrency market exhibits considerable price volatility, often exceeding that of traditional financial markets. This volatility is a direct consequence of several factors, including the relatively nascent nature of the market, the limited regulatory frameworks, and the substantial influence of speculative trading activities. The decentralized nature of many cryptocurrencies further contributes to price swings, as decisions aren’t centrally controlled.

News events, technological breakthroughs, and regulatory announcements can trigger substantial price movements. This dynamic environment requires a cautious approach to investment.

Factors Contributing to Price Fluctuations

Several factors influence the price volatility of cryptocurrencies. Speculative trading, news events (both positive and negative), regulatory developments, and technological advancements all play pivotal roles. The limited liquidity in certain cryptocurrencies can exacerbate price swings, as trading volume may not be sufficient to absorb large buy or sell orders. The adoption rate of a cryptocurrency can also significantly impact its price.

Cryptocurrencies are categorized by market cap, which basically means their value compared to others. Understanding what a cryptocurrency even is is crucial to comprehending these market rankings. For a deep dive into the fundamentals of cryptocurrencies, check out this resource: what is cryptocurrency. Ultimately, knowing the different types and their relative sizes is key to navigating the cryptocurrency market.

High adoption often correlates with higher demand and price appreciation, while low adoption can lead to price stagnation or decline.

Risk Management Strategies for Cryptocurrency Investments

Effective risk management is essential for navigating the volatile cryptocurrency market. Implementing a well-defined investment strategy that aligns with your risk tolerance is crucial. A critical component of this strategy is setting clear stop-loss orders to limit potential losses. Regular monitoring of your cryptocurrency portfolio and staying informed about market developments are also key aspects of effective risk management.

Diversification across different cryptocurrencies and asset classes is another essential strategy.

Diversification Strategies for Mitigating Market Risk

Diversification is a key risk mitigation strategy in cryptocurrency investments. It involves spreading your investments across different cryptocurrencies, blockchain projects, and even traditional assets. By diversifying your portfolio, you reduce the impact of a single cryptocurrency’s price decline on your overall investment returns. Consider the different market capitalization levels of various cryptocurrencies. A portfolio that includes a mix of small-cap, mid-cap, and large-cap cryptocurrencies can help reduce the overall risk.

Exploring other investment opportunities, such as stablecoins or decentralized finance (DeFi) protocols, can also add to a diversified portfolio.

Guide for Managing Cryptocurrency Investments

This guide emphasizes risk management techniques for cryptocurrency investments.

- Establish Clear Investment Goals: Define your investment objectives, risk tolerance, and desired return. This will help you make informed decisions and stay focused on your financial goals. Align your investment approach with your overall financial strategy.

- Set Realistic Expectations: Understand the inherent volatility of the cryptocurrency market. Expect price fluctuations and develop a strategy to manage potential losses.

- Conduct Thorough Research: Understand the fundamentals of the cryptocurrencies you’re considering investing in. Research their technology, team, use cases, and market adoption. Consider conducting due diligence on the project.

- Utilize Stop-Loss Orders: Implement stop-loss orders to automatically sell your cryptocurrency holdings if the price drops to a predefined level. This helps limit potential losses.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies and asset classes. Diversification reduces the impact of any single cryptocurrency’s price decline.

- Monitor and Adapt: Regularly monitor your cryptocurrency portfolio and adjust your investment strategy as market conditions change. Be prepared to adapt to new information and market trends.

Final Conclusion

In conclusion, the cryptocurrency market presents a complex interplay of technological advancements, investment strategies, and regulatory frameworks. This exploration has highlighted the significant growth and volatility of this sector, emphasizing the importance of understanding market dynamics and individual risk tolerances before engaging with cryptocurrencies.

FAQ: Cryptocurrencies By Market

What are the most common investment strategies in the cryptocurrency market?

Common investment strategies include day trading, swing trading, and long-term holding. Each strategy carries varying levels of risk and potential reward. Day traders seek quick profits, while swing traders hold positions for a few days or weeks. Long-term investors hold assets for extended periods.

How does the regulatory landscape impact cryptocurrency markets?

Government regulations vary significantly across different jurisdictions. Some regions have progressive approaches, while others are more conservative. These regulatory differences can significantly affect the development and adoption of cryptocurrencies within specific regions.

What are the key security risks associated with cryptocurrency investments?

Security risks include scams, fraud, and unauthorized access to cryptocurrency wallets. To mitigate these risks, investors should prioritize strong password security, two-factor authentication, and vigilance against phishing attempts.

What factors contribute to the volatility of the cryptocurrency market?

Market volatility is often driven by factors like news events, regulatory changes, and investor sentiment. Speculation and the lack of a centralized regulatory body contribute to the market’s price fluctuations.