Is cryptocurrency a good investment? This exploration delves into the multifaceted world of cryptocurrencies, examining their potential as an investment alongside the inherent risks and rewards. From the basics of blockchain technology to the nuances of market analysis, we’ll cover a spectrum of topics to provide a comprehensive understanding of this dynamic asset class.

The cryptocurrency market, while promising, is known for its volatility. This volatility, coupled with the relative novelty of the technology, makes it a complex investment area. We’ll explore various investment strategies, risk assessments, and regulatory considerations to help you navigate this terrain.

Introduction to Cryptocurrency Investments

Cryptocurrency represents a revolutionary shift in the financial landscape, offering a decentralized alternative to traditional fiat currencies. This new digital asset class relies on cryptographic principles to secure transactions and control the creation of new units, often referred to as “coins” or “tokens.” Understanding the underlying technology and the various types of cryptocurrencies is crucial for anyone considering investment in this exciting, albeit volatile, market.

Defining Cryptocurrency

Cryptocurrencies are digital or virtual currencies designed to work as a medium of exchange. They are not issued by a central bank or government, relying instead on decentralized networks for security and transaction processing. This characteristic sets them apart from traditional fiat currencies. Key features include cryptographic security, decentralization, and transparency.

Blockchain Technology Explained

Blockchain technology forms the foundation of most cryptocurrencies. It’s a distributed, immutable ledger that records and verifies transactions across a network of computers. Each block in the chain contains a set of transactions and is linked to the previous block, creating a secure and transparent record of all activity. This cryptographic structure ensures the integrity and security of the transactions, making it highly resistant to tampering or fraud.

Types of Cryptocurrencies

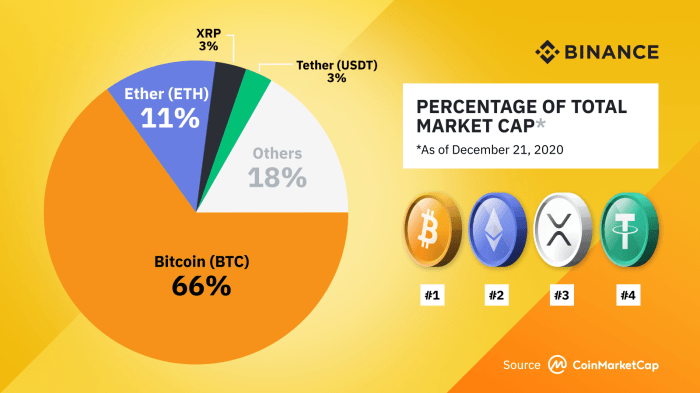

Various cryptocurrencies exist, each with its unique characteristics and applications. Bitcoin, often considered the pioneer, is a decentralized digital currency designed for peer-to-peer transactions. Ethereum, another prominent example, extends beyond simple currency to support smart contracts and decentralized applications (dApps). Other notable cryptocurrencies include Litecoin, Ripple, and Cardano, each serving distinct purposes and having varying levels of adoption and market share.

History and Evolution of Cryptocurrency

The history of cryptocurrency began in 2009 with the introduction of Bitcoin. Subsequent years witnessed a steady evolution, with the emergence of alternative cryptocurrencies aiming to improve upon existing platforms or introduce novel functionalities. The development of blockchain technology has significantly influenced the growth and development of the cryptocurrency market. Initial coin offerings (ICOs) became a prominent fundraising mechanism for new projects, while regulatory scrutiny has become increasingly prevalent.

Comparison of Cryptocurrencies

| Cryptocurrency | Market Capitalization (USD) | Transaction Volume (USD) | Price Volatility |

|---|---|---|---|

| Bitcoin (BTC) | High | High | Moderate to High |

| Ethereum (ETH) | High | High | Moderate to High |

| Litecoin (LTC) | Moderate | Moderate | Moderate |

| Ripple (XRP) | Moderate | High | Moderate to High |

| Cardano (ADA) | Moderate | Moderate | Moderate to High |

This table provides a basic comparison of key metrics for some prominent cryptocurrencies. It is crucial to note that market capitalization, transaction volume, and price volatility are dynamic and subject to change. Investors should conduct thorough research and carefully consider their risk tolerance before investing in any cryptocurrency.

Risk Assessment and Volatility

Cryptocurrency investments, while potentially lucrative, come with inherent risks. Understanding these risks is crucial for making informed decisions. Price volatility is a defining characteristic of this market, and investors must be prepared for significant fluctuations. A comprehensive risk assessment should also consider factors like security vulnerabilities and the overall market environment.

Inherent Risks of Cryptocurrency Investments

Cryptocurrency investments are inherently risky due to the decentralized nature of the underlying technology. This lack of central oversight and regulation contributes to price volatility and the potential for significant losses. The absence of established regulatory frameworks and protections adds another layer of risk to consider. Investors need to be prepared for substantial price swings and potential losses.

Factors Influencing Cryptocurrency Price Fluctuations

Numerous factors influence the fluctuating cryptocurrency market. Speculation, news events, regulatory changes, and technological advancements can all impact market sentiment and drive price movements. Social media trends and community reactions also play a significant role in the dynamics of the cryptocurrency market.

Comparison of Cryptocurrency Risks with Other Investments

Comparing cryptocurrency risks to other investment options reveals important distinctions. While stocks can experience significant price drops, they typically have more established regulatory frameworks and investor protections. Bonds, on the other hand, offer more stable returns but often lack the potential for high growth associated with cryptocurrencies. The lack of historical data for cryptocurrencies presents a significant difference compared to traditional assets.

Security Risks and Vulnerabilities in Cryptocurrency Transactions

Security concerns are paramount in the cryptocurrency realm. Hacking, scams, and malicious actors pose a significant threat to cryptocurrency users. Protecting private keys and wallets is critical, and users must be vigilant about phishing attempts and other fraudulent activities. The decentralized nature of cryptocurrencies also exposes them to risks that are not present in centralized financial systems.

Historical Price Trends of Major Cryptocurrencies

The following table illustrates the historical price trends of major cryptocurrencies over the past five years. Note that this data represents past performance and does not guarantee future results. It’s essential to understand that historical trends do not predict future market behavior.

| Cryptocurrency | 2018-2023 Price Trends (USD) |

|---|---|

| Bitcoin | A significant price fluctuation with periods of high growth and sharp declines. The price has experienced extreme volatility. |

| Ethereum | Similar to Bitcoin, experiencing periods of substantial price swings. Growth has been interspersed with sharp drops. |

| Tether | Generally stable, acting as a store of value. However, it has been affected by market events and news. |

| Binance Coin | Shows substantial fluctuations and growth, influenced by the performance of the Binance exchange. |

| Solana | Significant price variations, affected by technological advancements and market speculation. |

Investment Strategies and Approaches

Cryptocurrency investment strategies encompass a wide range of approaches, from straightforward buy-and-hold to complex algorithmic trading. Understanding these strategies is crucial for navigating the dynamic cryptocurrency market and mitigating potential risks. Successful investors often tailor their strategies to their risk tolerance, financial goals, and available resources.

Different Investment Strategies

Various strategies exist for approaching cryptocurrency investments. These include, but are not limited to, buy-and-hold, swing trading, day trading, and arbitrage. Each strategy has its own set of advantages and disadvantages. Understanding these nuances allows investors to choose a strategy aligned with their personal circumstances and risk tolerance.

Portfolio Management Approaches

Effective portfolio management is vital for long-term cryptocurrency success. Diversification, a cornerstone of sound investment principles, is crucial for mitigating risks associated with a concentrated investment in a single cryptocurrency. Dollar-cost averaging (DCA) can also help mitigate volatility. By investing a fixed amount at regular intervals, investors can buy more cryptocurrency when prices are low and fewer when prices are high.

Market Analysis in Decision Making

Thorough market analysis plays a pivotal role in informed cryptocurrency investment decisions. This analysis involves evaluating market trends, news, and technical indicators to gauge potential future price movements. This analysis often involves studying charts, identifying patterns, and considering economic indicators that may impact the cryptocurrency market.

Risk Mitigation Strategies

Cryptocurrency trading inherently carries risks. Risk mitigation strategies can help minimize potential losses. These strategies include setting stop-loss orders, which automatically sell cryptocurrency if the price falls below a certain threshold, and diversifying one’s portfolio across various cryptocurrencies and assets.

Table of Investment Strategies

| Investment Strategy | Description | Pros | Cons |

|---|---|---|---|

| Buy-and-Hold | Holding cryptocurrency for an extended period, typically years. | Relatively low-maintenance, potential for long-term gains, less susceptibility to short-term market fluctuations. | Potentially missing out on short-term gains, exposure to market downturns. |

| Swing Trading | Holding cryptocurrency for a few days to a few weeks, aiming for profits from price swings. | Potential for significant profits, less time commitment than day trading. | Requires active market monitoring and analysis, risk of substantial losses if the trade goes against expectations. |

| Day Trading | Holding cryptocurrency for a short period, typically hours, aiming for profits from intraday price fluctuations. | High potential for quick gains, allows for more frequent trading opportunities. | Extremely high risk, requires significant market analysis skills, potential for substantial losses. |

| Arbitrage | Exploiting price discrepancies of the same cryptocurrency across different exchanges. | Potential for quick profits, leverages market inefficiencies. | Requires extensive market knowledge, quick execution, and significant transaction fees. |

Market Analysis and Trends

The cryptocurrency market is dynamic and ever-evolving, influenced by a complex interplay of factors. Understanding current trends and the performance of different cryptocurrencies is crucial for assessing potential investment opportunities. Analyzing market capitalization, trading volume, and institutional adoption provides valuable insights for informed decision-making.The cryptocurrency landscape is characterized by periods of rapid growth and significant volatility. This inherent instability necessitates a thorough understanding of the market forces at play to make sound investment choices.

Careful analysis of historical data and current trends is essential for navigating this complex market.

Current Market Landscape Overview

The cryptocurrency market encompasses a vast array of digital assets, each with its unique characteristics and functionalities. Bitcoin, Ethereum, and other prominent cryptocurrencies often dominate discussions, yet numerous other projects exist. The market’s decentralized nature means there is no single controlling entity, and prices are determined by supply and demand, making it subject to substantial fluctuations.

Key Market Trends and Impact

Several key trends are shaping the current cryptocurrency market. Increased adoption by institutional investors is driving significant capital inflows, potentially leading to price appreciation and market stability. Technological advancements, such as the development of new blockchain platforms and decentralized applications, present both opportunities and challenges. Furthermore, regulatory developments and governmental policies worldwide are significantly influencing the market’s trajectory.

These trends directly impact investment decisions, requiring a nuanced understanding of their potential influence.

Cryptocurrency Performance Comparison

The performance of different cryptocurrencies varies considerably. Bitcoin, as the pioneering cryptocurrency, often acts as a leading indicator, with its price movements impacting the overall market sentiment. Altcoins, or alternative cryptocurrencies, often exhibit higher volatility and can demonstrate significant growth potential, but they also carry a higher risk profile. Analyzing historical performance data is crucial to evaluate potential returns, considering factors like market capitalization, trading volume, and technological advancements.

Comparing performance across different time periods provides a clearer picture of the dynamic nature of this market.

Institutional Investor Adoption

Institutional investors are increasingly entering the cryptocurrency market, driven by several factors. These include the potential for high returns, the growing acceptance of digital assets as legitimate investment instruments, and the increasing sophistication of cryptocurrency investment strategies. Furthermore, regulatory clarity and the development of robust infrastructure are encouraging institutional participation. These factors contribute to the growth and evolution of the cryptocurrency market.

Top 10 Cryptocurrencies Market Data

| Rank | Cryptocurrency | Market Cap (USD) | Trading Volume (24h) (USD) |

|---|---|---|---|

| 1 | Bitcoin | (Source: CoinMarketCap) | (Source: CoinMarketCap) |

| 2 | Ethereum | (Source: CoinMarketCap) | (Source: CoinMarketCap) |

| 3 | … | (Source: CoinMarketCap) | (Source: CoinMarketCap) |

| … | … | … | … |

| 10 | … | (Source: CoinMarketCap) | (Source: CoinMarketCap) |

Note: Data is current as of [Date] and is sourced from reputable cryptocurrency market tracking websites like CoinMarketCap. Figures are subject to change.

Regulatory Environment and Legal Considerations

The cryptocurrency market is a relatively new and rapidly evolving space, leading to significant regulatory uncertainty across various jurisdictions. Different countries have varying approaches to regulating digital assets, resulting in a complex and fragmented landscape. This necessitates a careful understanding of the legal and regulatory frameworks governing cryptocurrency investments before engaging in any transactions.The legal and regulatory environment surrounding cryptocurrency investments is constantly evolving, with new laws and regulations being introduced regularly.

This dynamic environment makes it crucial for investors to stay informed and adapt to the changing legal landscape. Navigating these complexities is essential for mitigating potential risks and ensuring compliance.

Regulatory Frameworks in Different Jurisdictions

Different countries have adopted various approaches to regulating cryptocurrency investments. Some have embraced a more cautious approach, while others have taken a more proactive stance. This diversity in regulatory frameworks creates a complex environment for investors, who need to carefully consider the legal landscape in the jurisdictions where they are operating or considering investing.

| Country | Regulatory Framework |

|---|---|

| United States | The US regulatory landscape for cryptocurrencies is fragmented, with no single, comprehensive regulatory framework. Different agencies, including the SEC and CFTC, oversee various aspects of the market. This results in a complex and often ambiguous regulatory environment for investors. |

| European Union | The EU has been working towards a harmonized approach to regulating cryptoassets, with proposals for a Markets in Crypto-Assets (MiCA) regulation. This regulation aims to provide a common set of rules for crypto-related services and products across the EU. |

| United Kingdom | The UK has taken a more proactive stance on regulating cryptocurrencies, with the Financial Conduct Authority (FCA) playing a key role in overseeing crypto-related activities. This approach seeks to balance innovation with consumer protection. |

| Japan | Japan has implemented a relatively comprehensive regulatory framework for cryptocurrencies, aiming to foster innovation while mitigating risks. The approach has focused on licensing and registration for crypto exchanges. |

| China | China has largely banned cryptocurrency trading and mining, presenting a significant hurdle for investors seeking to participate in the Chinese market. This approach reflects a more cautious regulatory stance compared to some other jurisdictions. |

Legal Implications of Cryptocurrency Transactions

Cryptocurrency transactions, like any financial transactions, have legal implications. These implications can vary significantly depending on the jurisdiction. Understanding these legal implications is crucial for investors to avoid potential legal issues. Contracts, ownership, and transfer of digital assets are key legal considerations that vary across jurisdictions.

Tax Implications of Cryptocurrency Gains and Losses

Cryptocurrency gains and losses are typically subject to taxation, although the specific tax treatment varies widely by country. Investors need to understand the applicable tax laws in their jurisdictions to ensure compliance. Capital gains tax laws regarding crypto assets are frequently updated, so staying informed is essential.

Evolving Regulatory Landscape of Cryptocurrency

The regulatory landscape of cryptocurrency is constantly evolving. New regulations and guidelines are emerging frequently, often in response to the dynamic nature of the market. The evolving nature of the crypto market necessitates continuous monitoring of regulatory developments to ensure compliance and adapt to changing legal landscapes. Investors need to be prepared to adapt to these changes.

Technical Analysis and Indicators

Technical analysis is a crucial tool for cryptocurrency investors seeking to understand market trends and make informed trading decisions. It focuses on historical price and volume data to identify patterns and predict future price movements. This approach, while not foolproof, can provide valuable insights alongside fundamental analysis.

Methods Used in Technical Analysis

Technical analysis employs various methods to interpret price charts and identify potential trading opportunities. These methods rely on identifying recurring patterns and relationships in price movements, volume, and trading activity. Key methods include chart patterns, trend lines, support and resistance levels, and various indicators.

Examples of Technical Indicators

A wide range of technical indicators are employed to gauge market sentiment and potential price changes. These indicators, often represented by mathematical formulas, help to filter noise and highlight important price patterns. Moving averages, relative strength index (RSI), and volume indicators are some examples.

Importance of Chart Patterns and Price Action

Chart patterns, such as triangles, head and shoulders, and flags, can suggest potential price reversals or continuations. Price action, which considers the details of price movements, volume, and order book data, offers a deeper understanding of market sentiment and potential turning points.

Use of Technical Analysis Tools for Trading Decisions

Technical analysis tools aid in the process of making informed trading decisions. Tools can be used to identify potential entry and exit points, assess risk, and manage positions. This data can be combined with other factors to create a comprehensive trading strategy.

Technical Analysis Case Study: Bitcoin

Analyzing Bitcoin’s price chart reveals periods of significant price volatility and frequent changes in trend. A technical analysis of Bitcoin’s price chart, from [Start Date] to [End Date], could illustrate the application of moving averages, support and resistance levels, and volume analysis. For example, identifying periods of significant price consolidation, followed by strong breakouts, would highlight potential trading opportunities.

A key indicator to consider in this case study is the RSI, which could help determine overbought or oversold conditions. The 200-day moving average, for instance, could be used to determine the prevailing trend, and a close observation of volume patterns during periods of price movement would further provide context.

Fundamental Analysis and Project Evaluation

Fundamental analysis in cryptocurrency investment goes beyond simply tracking price charts. It delves into the intrinsic value of a project, considering factors like its utility, team, and market adoption. This deeper understanding can provide valuable insights for investors seeking to make informed decisions.Evaluating the fundamental aspects of a cryptocurrency project is crucial for assessing its potential. This involves examining the project’s core technology, its market positioning, and the overall viability of its proposed solutions.

A well-researched fundamental analysis can reveal hidden opportunities or potential risks within the market, allowing investors to make more calculated and informed decisions.

Project Analysis and Potential

Cryptocurrency projects vary significantly in their goals, technologies, and market positions. Understanding the specific aims and underlying technology of each project is vital. For example, a project focused on decentralized finance (DeFi) will be evaluated differently from one aiming to create a new payment system. This difference in purpose directly impacts the fundamental evaluation process.

Factors Influencing Fundamental Value

Several factors play a role in determining the fundamental value of a cryptocurrency. These include:

- Utility and Functionality: A cryptocurrency with a practical use case, like facilitating transactions or enabling smart contracts, generally holds more fundamental value than one without a clear purpose.

- Market Demand and Adoption: High market demand and adoption by businesses and consumers signal a potentially strong and sustainable use case for the cryptocurrency. For instance, the widespread adoption of Bitcoin for payments demonstrates a strong fundamental value driver.

- Team and Development: A reputable and experienced team behind a cryptocurrency project instills confidence in its future development and maintenance. The expertise of the team is crucial to the project’s long-term success.

- Technological Innovation: A project employing innovative and robust technology to solve a specific problem is likely to command a higher valuation. This innovation often creates a competitive advantage.

- Security and Governance: A cryptocurrency project with a secure and transparent governance structure is more likely to maintain trust and stability. Transparency is essential for attracting investors.

Team Evaluation and Impact

The team behind a cryptocurrency project significantly impacts its success. Their experience, expertise, and dedication play a critical role in the project’s development and future direction.

- Experience and Expertise: A team with proven track records in blockchain technology, finance, or related fields demonstrates a higher potential for project success.

- Commitment and Vision: A team that consistently demonstrates commitment to the project and its long-term vision instills confidence and attracts investors.

- Transparency and Communication: A team that communicates transparently and openly with the community builds trust and fosters a positive image for the project.

Fundamental Analysis in Value Evaluation

Fundamental analysis involves a comprehensive evaluation of the project, considering the factors listed above. This process aims to estimate the intrinsic value of a cryptocurrency, independent of market fluctuations.

A comprehensive fundamental analysis considers a multitude of factors, leading to a more realistic assessment of a cryptocurrency’s value.

Comparison of Fundamental Aspects

The following table provides a comparative overview of fundamental aspects for different cryptocurrencies, highlighting their strengths and weaknesses.

| Cryptocurrency | Utility | Market Adoption | Team | Technology |

|---|---|---|---|---|

| Bitcoin | Established payment system | Widespread adoption | Experienced team | Proven technology |

| Ethereum | Decentralized applications (dApps) | Growing adoption | Experienced team | Innovative smart contract platform |

| Solana | Scalable blockchain | Growing adoption | Experienced team | High-throughput blockchain |

Security Measures and Best Practices

Securing cryptocurrency investments is paramount to mitigating potential losses. Robust security measures are crucial, encompassing various aspects from wallet protection to transaction protocols. Implementing these best practices significantly reduces the risk of theft or unauthorized access.A comprehensive approach to cryptocurrency security involves understanding the vulnerabilities and implementing strategies to counteract them. This includes not only technical measures but also responsible user habits and vigilance.

By understanding the importance of strong passwords, multi-factor authentication, and regular audits, investors can enhance their overall security posture.

Deciding if crypto is a good investment hinges heavily on the volatility of the market. Fluctuations in cryptocurrency price make it a risky proposition, but the potential rewards are equally substantial. Ultimately, whether or not it’s a good bet for you depends on your risk tolerance and investment strategy.

Securing Cryptocurrency Wallets

Effective wallet management is critical for safeguarding digital assets. This involves selecting reputable wallets and employing robust security protocols. Choosing a reputable and secure wallet provider, whether software or hardware, is a cornerstone of cryptocurrency security. Thorough research and user reviews are important to avoid potential vulnerabilities. Employing robust security measures, such as two-factor authentication (2FA), within the wallet application itself is essential.

Importance of Strong Passwords and Multi-Factor Authentication

Strong passwords and multi-factor authentication (MFA) are fundamental to protecting cryptocurrency wallets. Strong passwords are more than just a series of characters; they are a combination of uppercase and lowercase letters, numbers, and symbols. Use a unique and complex password for each cryptocurrency wallet and avoid reusing passwords from other online accounts. MFA adds an extra layer of security, requiring a secondary verification method (e.g., a code sent to a mobile phone) in addition to a password.

This significantly reduces the risk of unauthorized access even if a password is compromised.

Importance of Regular Security Audits and Updates

Regular security audits and software updates are vital to maintaining a secure environment. Regular audits help identify and address vulnerabilities before they can be exploited. This involves checking for potential flaws in the software or hardware used to store and manage cryptocurrency. Software updates frequently patch security holes, improving the overall security posture of the system. Regularly updating wallet software is crucial to ensuring the latest security patches are applied.

Different Methods of Safeguarding Cryptocurrency Assets

Various methods can be employed to safeguard cryptocurrency assets, ranging from hardware wallets to cold storage solutions. Hardware wallets are physical devices that store cryptocurrency offline, providing an added layer of security against online threats. Cold storage, which involves storing private keys offline, is a more general term encompassing methods beyond hardware wallets. Cold storage solutions effectively mitigate the risk of hacking and theft by isolating the private keys from online threats.

Diversification of holdings across different wallets and exchanges is also a key component of overall security.

Security Recommendations for Cryptocurrency Storage and Transactions

| Security Aspect | Recommendation |

|---|---|

| Wallet Selection | Choose reputable wallets with strong security features. |

| Password Strength | Use unique, complex passwords for each wallet. |

| Multi-Factor Authentication (MFA) | Enable MFA whenever available. |

| Software Updates | Regularly update wallet software to patch security vulnerabilities. |

| Hardware Wallets | Consider using hardware wallets for offline storage. |

| Cold Storage | Employ cold storage solutions for increased security. |

| Transaction Security | Use secure and reputable exchanges for transactions. |

| Transaction History Monitoring | Actively monitor transaction history for suspicious activity. |

Community and Social Factors

The cryptocurrency market is significantly influenced by the collective sentiment and actions of its community. Beyond technical analysis and market trends, social dynamics play a crucial role in shaping investor behavior and ultimately, price fluctuations. This section explores the multifaceted impact of community engagement, social media, and broader social factors on cryptocurrency investments.

The Role of the Cryptocurrency Community

The cryptocurrency community, comprising developers, investors, and enthusiasts, acts as a vital force in driving market trends. Active communities foster innovation, provide support, and disseminate information about new projects and developments. Strong community engagement often translates to increased project adoption and investment interest. A supportive and engaged community can build trust and credibility, attracting further investment.

Influence of Social Media on Cryptocurrency Adoption and Pricing

Social media platforms have become powerful catalysts in the cryptocurrency market. Discussions, news dissemination, and the sharing of opinions on social media platforms can rapidly sway public perception and consequently, price movements. Positive sentiment often correlates with price increases, while negative sentiment can trigger price drops. The speed and reach of social media make it a critical tool for both project promotion and market manipulation.

Importance of Community Engagement for Cryptocurrency Projects

Community engagement is crucial for the success of any cryptocurrency project. Active participation from developers, investors, and users can enhance project credibility and foster a sense of community ownership. A strong community can provide valuable feedback, contribute to development, and increase the project’s long-term viability. This interaction helps to identify potential problems early on, and fosters a collaborative environment that can propel the project forward.

Impact of Social Factors on Cryptocurrency Investment Decisions

Beyond technical factors, social influences significantly impact investment decisions. FOMO (Fear of Missing Out) and herd mentality can drive impulsive buying and selling decisions. The prevalence of misinformation or speculation can also lead to irrational market movements. Investors often base their decisions on the opinions and actions of others within the community, influencing overall market sentiment. Therefore, understanding the social dynamics of the cryptocurrency market is essential for informed decision-making.

Correlation Between Social Media Sentiment and Cryptocurrency Price Movements

| Social Media Sentiment | Cryptocurrency Price Movement | Example |

|---|---|---|

| Positive | Generally Upward | A surge in positive tweets about a specific cryptocurrency often leads to increased trading volume and price appreciation. |

| Negative | Generally Downward | A wave of negative news and criticism on social media regarding a project can lead to a decrease in trading volume and a drop in the cryptocurrency’s price. |

| Neutral | Stable or Limited Movement | When social media sentiment is neutral, the cryptocurrency’s price tends to remain relatively stable, with limited fluctuations. |

Note: This table represents a general trend. Precise correlations can be complex and influenced by various other factors.

Diversification and Portfolio Management: Is Cryptocurrency A Good Investment

Diversifying a cryptocurrency portfolio is crucial for mitigating risk and maximizing potential returns. A well-diversified portfolio spreads investments across various cryptocurrencies, reducing the impact of a single coin’s price fluctuations on the overall portfolio. This strategy can help investors navigate market volatility and achieve long-term success.A diversified approach is essential because the cryptocurrency market is inherently volatile. Price swings in one coin can dramatically affect the value of an entire portfolio if not properly managed.

Strategic diversification allows investors to weather market downturns and capitalize on opportunities as they arise.

Importance of Diversification, Is cryptocurrency a good investment

A diversified cryptocurrency portfolio reduces risk by spreading investments across a range of cryptocurrencies with different characteristics. This approach helps insulate against significant losses if a single coin experiences a substantial price drop. Diversification also increases the potential for long-term growth by allowing investors to participate in the overall growth of the cryptocurrency market, even if some individual coins underperform.

Allocating Investments Across Different Cryptocurrencies

Effective allocation involves considering various factors, including the cryptocurrency’s market capitalization, technological advancement, community support, and historical performance. Allocating a portion of the portfolio to established coins with a large market capitalization can provide stability, while a smaller allocation to newer, potentially high-growth coins can enhance the portfolio’s overall potential return.

Examples of Diversified Crypto Portfolios

A diversified portfolio could include Bitcoin, Ethereum, Litecoin, and a selection of smaller-cap altcoins, representing a balance between established and emerging projects. The specific allocation within each category depends on the investor’s risk tolerance and investment goals. Consider a portfolio allocated as follows: 40% Bitcoin, 30% Ethereum, 15% Litecoin, and 15% smaller-cap altcoins. Alternatively, a portfolio could allocate more towards stablecoins and decentralized finance (DeFi) tokens.

Deciding if cryptocurrency is a good investment hinges heavily on market fluctuations. Understanding the volatility of cryptocurrency prices is crucial. Factors like supply and demand, regulatory changes, and overall market sentiment all play a role in price action. For a deeper dive into how these elements influence cryptocurrency values, check out this resource on cryptocurrency and prices.

Ultimately, the question of whether it’s a good investment depends on individual risk tolerance and a thorough understanding of the market.

Adjusting a Cryptocurrency Portfolio Based on Market Changes

Market conditions necessitate periodic portfolio adjustments. As certain cryptocurrencies outperform others, investors might consider increasing their allocation to those performing well. Conversely, underperforming coins may warrant a reduction in allocation or complete removal from the portfolio. Regular monitoring and analysis of market trends are essential for effective portfolio adjustments.

Asset Allocation in Cryptocurrency Investments

Asset allocation in cryptocurrency investments involves determining the proportion of a portfolio dedicated to different cryptocurrencies. A well-structured asset allocation plan considers the investor’s risk tolerance, time horizon, and financial goals. For example, a risk-averse investor might favor a larger allocation to stablecoins and established cryptocurrencies, while a more aggressive investor might allocate a larger portion to high-growth altcoins.

Dynamic asset allocation strategies allow for adjustments based on market conditions.

Future of Cryptocurrency Investments

The cryptocurrency market is evolving rapidly, driven by technological advancements and shifting investor attitudes. Predicting the future trajectory is challenging, but examining current trends and potential developments offers a glimpse into possible scenarios. This analysis considers the influence of institutional investment, technological advancements, regulatory landscapes, and market dynamics.

Potential Market Predictions

The cryptocurrency market is experiencing a period of substantial growth and development. While precise predictions are inherently uncertain, the current trends suggest potential for both continued expansion and potential corrections. Factors like regulatory clarity, institutional adoption, and technological breakthroughs will significantly influence future market performance. The potential for a larger user base, coupled with increased institutional participation, suggests a future market with increased liquidity and trading volume.

Implications of Technological Advancements

Technological advancements are reshaping the cryptocurrency landscape. The development of more sophisticated blockchain technologies, like improved scalability and security, can significantly impact user experience and adoption rates. For instance, advancements in layer-2 scaling solutions are addressing transaction speed and cost issues, which could attract more mainstream users. Integration with existing financial systems, through advancements in interoperability, could also increase the acceptance of cryptocurrencies.

Role of Institutional Investment

Institutional investment is a key driver of market maturation. Large financial institutions entering the cryptocurrency market could lead to increased liquidity, greater trading volume, and more stable price action. This institutional participation brings significant capital and expertise, potentially fostering market growth and greater acceptance. However, the influx of institutional capital could also introduce a level of volatility.

Future of Regulation

The regulatory environment for cryptocurrencies is in constant flux. The ongoing efforts by governments to establish clear regulatory frameworks for cryptocurrencies can have a substantial impact on market stability and growth. The development of specific regulations for various cryptocurrency activities, including trading, exchanges, and staking, is likely to evolve.

Potential Future Scenarios

| Scenario | Key Drivers | Potential Outcomes |

|---|---|---|

| Mainstream Adoption | Improved user experience, regulatory clarity, and institutional investment | Increased mainstream acceptance, wider adoption by businesses, and potentially higher prices. |

| Regulatory Uncertainty | Lack of clear regulatory frameworks, legal disputes, and political uncertainties | Increased volatility, potential market corrections, and reduced investor confidence. |

| Technological Disruption | Breakthroughs in blockchain technology, new cryptocurrencies, and innovative applications | Potential for substantial market growth, new investment opportunities, and significant changes in the cryptocurrency ecosystem. |

| Institutional Domination | Large financial institutions controlling significant portions of the market | Increased stability and liquidity, but also potential for reduced market participation by individual investors and increased concentration of wealth. |

Final Summary

In conclusion, determining whether cryptocurrency is a good investment for you hinges on your risk tolerance, investment goals, and understanding of the market. This analysis highlights the complexity and potential of cryptocurrencies as an investment vehicle, emphasizing the importance of thorough research, careful planning, and responsible risk management. Ultimately, the decision rests with you.

Clarifying Questions

Is cryptocurrency highly volatile?

Yes, cryptocurrency markets are notoriously volatile. Prices can fluctuate significantly in short periods, presenting both substantial profit potential and considerable risk.

What are some of the security risks associated with cryptocurrency?

Security risks include hacking, phishing scams, and loss of private keys. Strong security measures are crucial for safeguarding cryptocurrency holdings.

What role do regulations play in the cryptocurrency market?

Regulations vary significantly across jurisdictions. Understanding the regulatory landscape in your area is essential for compliance and legal considerations.

Are there specific investment strategies for cryptocurrency?

Yes, diverse strategies exist, including diversification, dollar-cost averaging, and technical/fundamental analysis. Different strategies align with varying risk tolerances.