Cryptocurrency exchanges that require no KYC verification offer an intriguing alternative to traditional exchanges. These platforms often promise greater privacy and anonymity, but they also come with significant risks. Understanding the potential benefits and drawbacks is crucial before engaging with these less regulated services.

This exploration delves into the world of KYC-free cryptocurrency exchanges, examining their features, security concerns, legal implications, and user experiences. We’ll analyze the motivations behind using such platforms, considering factors like privacy, anonymity, and potential regulatory loopholes. A comparative analysis of different platforms, along with practical tips for users, will also be presented.

Introduction to Cryptocurrency Exchanges without KYC

Cryptocurrency exchanges facilitate the buying, selling, and trading of digital currencies. A standard practice for many exchanges is Know Your Customer (KYC) verification. This involves verifying user identities to comply with regulations and prevent illicit activities. However, some exchanges operate without KYC verification, offering a different approach to user onboarding.KYC-less exchanges often prioritize user privacy and freedom from stringent regulatory requirements.

This approach, while potentially appealing to some users, presents significant trade-offs and risks that need careful consideration. The motivations behind using a KYC-free exchange vary, but often involve a desire for anonymity or the avoidance of bureaucratic hurdles associated with KYC verification.

KYC-less Exchange Benefits

KYC-less exchanges typically boast a streamlined user experience, minimizing the time and effort required for account creation. This rapid onboarding can be a significant advantage for users who prioritize speed and efficiency. Moreover, the absence of KYC verification may appeal to users seeking greater privacy in their financial transactions.

While some crypto exchanges demand KYC verification, others operate without it. This can be attractive, but remember that bypassing KYC procedures might come with increased risks. For those looking to explore passive income opportunities, resources like how to earn passive income with cryptocurrency gpldose.com provide valuable insights into strategies for maximizing returns. Ultimately, careful research and due diligence are crucial when selecting any crypto exchange, regardless of their KYC policies.

Motivations for Using a KYC-Free Exchange

Users might choose a KYC-free exchange for several reasons. Anonymity is a key driver, as these exchanges do not require the user to disclose personal identifying information. Furthermore, users may be motivated by a desire to circumvent potentially cumbersome KYC processes. Some users may find the KYC process for traditional exchanges to be a significant barrier, particularly those in jurisdictions with strict regulatory requirements.

Drawbacks of KYC-Free Exchanges

These exchanges come with inherent risks. The lack of KYC verification significantly reduces the exchange’s ability to verify user identities, leading to a higher risk of fraudulent activities. Furthermore, the absence of robust security measures could make these platforms more vulnerable to hacking and other security breaches. The absence of a regulatory framework might make users feel exposed to the exchange’s internal vulnerabilities.

Risks Associated with KYC-Free Exchanges

Security concerns are paramount when using a KYC-free exchange. The absence of user identity verification opens the door for fraudulent activities, such as money laundering or the perpetration of scams. Furthermore, the lack of regulatory oversight could expose users to potentially malicious or poorly maintained exchange platforms.

Examples of Potential Security Breaches

Historically, exchanges without robust security protocols have been targeted by hackers. These attacks can result in the loss of user funds and compromise sensitive personal data. The lack of KYC often makes it difficult to trace the source of these illicit activities and recover lost assets. Cases of unauthorized access and theft of cryptocurrency funds from exchanges without robust KYC procedures are not uncommon.

Users should proceed with extreme caution, given the potential for substantial financial losses.

Identifying KYC-Free Exchanges

Navigating the cryptocurrency landscape often involves choosing an exchange that aligns with individual needs and risk tolerance. One significant factor is the presence or absence of Know Your Customer (KYC) verification requirements. While KYC measures aim to combat illicit activities, they can also pose a barrier for some users. This section details KYC-free exchanges, their features, and limitations.

KYC-Free Exchange Platforms

Identifying platforms that operate without KYC verification requires careful research. It’s crucial to evaluate the reputation and security measures of these exchanges to mitigate potential risks. A comprehensive approach involves examining the platform’s features, security protocols, and the types of cryptocurrencies they support. This analysis helps users make informed decisions.

List of KYC-Free Exchanges

This list presents a selection of exchanges that typically operate without KYC verification. Due to the dynamic nature of the cryptocurrency market and regulatory environments, this list should not be considered exhaustive and is subject to change. It’s essential to verify the current status of each platform before engaging with them.

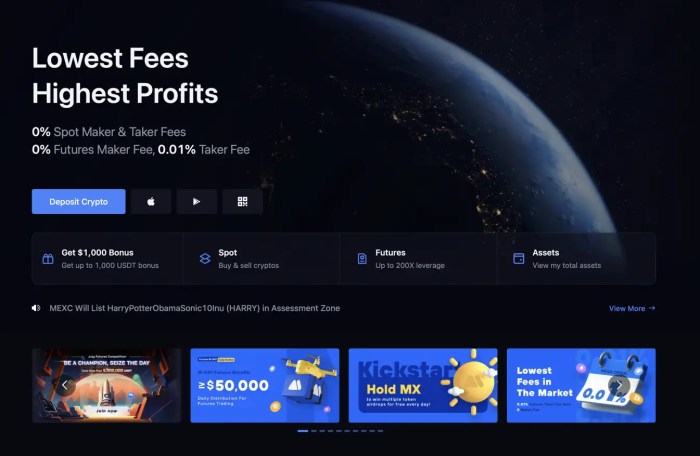

- CoinSwitch Kuber: A popular Indian exchange, CoinSwitch Kuber provides a range of crypto services, including trading, lending, and staking. Their accessibility often attracts users seeking a streamlined platform.

- Binance (in some regions): While Binance is well-known for its extensive features, its KYC requirements vary by region. Users should confirm the specific regulations in their location before utilizing the platform.

- LocalBitcoins: A peer-to-peer (P2P) platform, LocalBitcoins allows users to directly exchange cryptocurrencies. Its decentralized nature and lack of KYC procedures are often attractive.

- Paxful: Similar to LocalBitcoins, Paxful is a P2P marketplace for buying and selling cryptocurrencies. This approach eliminates the need for KYC verification in some transactions.

- HodlHodl: This exchange prioritizes ease of use and provides an intuitive interface for trading various cryptocurrencies. The lack of KYC verification is a significant selling point for certain users.

- Changelly: A popular exchange for instant cryptocurrency swaps, Changelly often operates without KYC requirements, offering a fast and convenient way to exchange various cryptocurrencies.

- Bittrex Global: Bittrex Global is another notable option, particularly if users prioritize specific features like leveraged trading and margin lending.

- Coinmama: Coinmama is known for its focus on facilitating the purchase of cryptocurrencies using fiat currencies. This approach often aligns with the need for an exchange that doesn’t enforce KYC procedures.

- OKEx (in some regions): Similar to Binance, OKEx’s KYC requirements can vary geographically. Thorough regional checks are crucial.

- Gate.io: Gate.io is a popular exchange that often avoids KYC for certain regions. It’s essential to check their regulations based on the user’s location.

Comparison of KYC-Free Exchange Features

Different KYC-free exchanges offer varying levels of features and services. This table summarizes the available features, security measures, and reputation of the listed exchanges.

| Exchange | Features | Security | Reputation |

|---|---|---|---|

| CoinSwitch Kuber | Trading, lending, staking | Good, but user reviews vary | Positive, particularly in India |

| Binance (some regions) | Extensive trading options | Generally strong | High, but varies by region |

| LocalBitcoins | P2P trading | Moderate, user-dependent | Mixed, depends on individual transactions |

| Paxful | P2P trading | Moderate, user-dependent | Mixed, depends on individual transactions |

| HodlHodl | Intuitive interface | Average | Positive, but less extensive features |

| Changelly | Fast swaps | Good, but limited security measures | Positive, but less comprehensive features |

| Bittrex Global | Leveraged trading, margin lending | Good | Positive, but limited user reviews |

| Coinmama | Fiat-to-crypto purchase | Good | Positive, focused on fiat purchases |

| OKEx (some regions) | Extensive trading options | Generally strong | High, but varies by region |

| Gate.io | Various trading options | Good | Positive, but regional variations |

Deposit and Withdrawal Methods

Deposit and withdrawal methods vary significantly across these platforms. Some might support a limited range of options, while others offer broader choices. Users should carefully review the available methods to ensure they align with their financial needs.

Supported Cryptocurrencies

The range of cryptocurrencies supported also differs. Some platforms might focus on a limited selection of coins, while others support a broader array. Users should ascertain the specific cryptocurrencies available before choosing an exchange.

Security and Privacy Considerations

KYC-less cryptocurrency exchanges offer a degree of anonymity and freedom from regulatory scrutiny. However, this comes with significant security and privacy risks. Users must be acutely aware of the potential dangers and take proactive steps to mitigate them. The lack of KYC procedures makes it difficult for exchanges to verify user identities, potentially increasing the likelihood of fraudulent activities.Understanding the potential vulnerabilities and implementing robust security measures is crucial for anyone considering using these platforms.

A comprehensive approach to security encompasses not only technical measures but also user awareness and responsible practices.

Security Risks Associated with KYC-less Exchanges

The absence of KYC verification significantly increases the risk of scams and theft. Fraudsters can easily create fake accounts to carry out illicit activities, such as money laundering or conducting fraudulent transactions. A lack of regulatory oversight can also make it harder to identify and prosecute malicious actors. The potential for unauthorized access and manipulation of user funds is considerably higher.

Privacy Implications of Using KYC-less Exchanges

Using KYC-less exchanges may offer a degree of anonymity, but this privacy comes at a cost. The absence of KYC verification makes it challenging to trace transactions, making it difficult to recover funds in case of theft or fraud. This lack of transparency also creates opportunities for illicit activities, including money laundering and tax evasion. While anonymity can be attractive, it’s vital to understand that this privacy comes at the expense of security and regulatory protections.

Potential for Anonymity and Associated Risks

Anonymity, though tempting, presents inherent risks. While some users might seek privacy for legitimate reasons, others might utilize KYC-less exchanges for illicit activities. The potential for anonymity fosters a breeding ground for criminal enterprises and illicit financial transactions. Criminals might exploit the lack of KYC procedures to conceal their identities and activities.

Precautions When Using KYC-less Platforms

It is crucial to adopt a cautious approach when interacting with KYC-less exchanges. Users should thoroughly research the exchange’s reputation and security measures. Using strong passwords, enabling two-factor authentication, and avoiding suspicious links or requests are vital security practices. Conducting transactions only on reputable platforms and being wary of promises of unusually high returns are paramount. Transparency and diligence are essential for mitigating risks.

- Thorough research of the exchange’s reputation and security measures is critical.

- Employing strong passwords and enabling two-factor authentication is essential.

- Avoid clicking on suspicious links or responding to suspicious requests.

- Only conduct transactions on reputable platforms.

- Be wary of promises of unusually high returns.

Common Security Measures and Vulnerabilities of KYC-Free Exchanges

| Security Measure | Vulnerability |

|---|---|

| Strong encryption | Vulnerable to sophisticated decryption techniques. |

| Two-factor authentication | Potential for compromised accounts if the second factor is compromised. |

| Reputation checks | Difficult to verify the legitimacy of reviews and ratings. |

| Independent audits | Lack of audits or inadequate auditing procedures. |

| Insurance/Guarantees | Absence of insurance or guarantee mechanisms. |

Legal and Regulatory Landscape

Navigating the legal landscape surrounding cryptocurrency exchanges without KYC verification presents significant complexities for both users and operators. Different jurisdictions have varying degrees of regulation concerning cryptocurrencies, leading to a fragmented and often unpredictable legal environment. Understanding the legal status and potential ramifications is crucial for anyone considering utilizing these platforms.The legal status of KYC-free exchanges fluctuates considerably across various countries.

Some regions have explicit prohibitions or stringent regulations, while others either lack clear guidelines or have permissive stances. This lack of uniformity makes it challenging to definitively ascertain the legality of such exchanges in any given jurisdiction.

Legal Status of KYC-Free Exchanges

The legal standing of KYC-free cryptocurrency exchanges is largely dependent on local regulatory frameworks. Some jurisdictions explicitly ban anonymous cryptocurrency exchanges, while others lack specific regulations regarding these platforms. This lack of clarity can create uncertainty for both users and operators.

Some cryptocurrency exchanges operate without KYC (Know Your Customer) verification, offering a degree of anonymity. However, using a reputable cryptocurrency exchange is generally recommended for security and compliance. These exchanges, though, might not offer the same level of protection as those requiring KYC verification, raising concerns about potential scams and illicit activities.

Regulatory Implications for Users

Users of KYC-free exchanges face considerable regulatory implications, depending on their location. In jurisdictions with strict regulations, engaging with these platforms might expose users to legal penalties, including fines or criminal charges. The specific implications vary depending on the specific laws in force. For instance, some jurisdictions may treat cryptocurrency transactions as subject to traditional financial regulations, regardless of the exchange’s KYC policy.

Potential Consequences of Using KYC-Free Exchanges

The potential consequences of utilizing KYC-free exchanges can range from minor inconveniences to serious legal repercussions. In regions with strict regulations, users could face sanctions, including asset seizures or criminal prosecution. For example, users in countries with strict financial regulations might find themselves subject to investigation if their transactions on KYC-free platforms are discovered.

Countries with Lax or Nonexistent Regulations

Several countries exhibit lax or nonexistent regulations concerning cryptocurrency exchanges. This creates a gray area where the legality of KYC-free platforms is less certain. Identifying these jurisdictions can be difficult due to the ever-evolving nature of crypto regulations. For instance, some developing nations may have limited regulatory resources, leading to a less stringent approach to cryptocurrency regulation.

Legal Ramifications of Engaging with Unregulated Platforms

Engaging with unregulated cryptocurrency platforms can have severe legal implications. Users may find themselves facing legal challenges, including civil or criminal proceedings, depending on the specific laws in force in their jurisdiction. The potential legal ramifications can extend beyond the user to the exchange operator. The absence of regulatory oversight can expose both parties to significant risks.

For example, a user who engages in illicit activities using a KYC-free exchange might be held liable under local laws, even if the exchange itself is not directly involved.

User Experiences and Reviews

User reviews and feedback provide crucial insights into the practical usability and reliability of KYC-less cryptocurrency exchanges. Understanding the experiences of actual users helps assess the strengths and weaknesses of these platforms, allowing for a more nuanced understanding beyond theoretical considerations. Analyzing these experiences can help potential users make informed decisions.User experiences with KYC-free exchanges demonstrate a diverse range of outcomes.

Some users report positive experiences, praising the ease of use and speed of transactions. Conversely, others have encountered issues ranging from security concerns to platform instability. A critical analysis of these experiences, comparing different platforms and identifying common issues, can help prospective users navigate the complexities of this space.

Analysis of User Feedback

User reviews on KYC-free exchanges often highlight both the appeal and the risks. Positive experiences frequently center on the convenience of bypassing identity verification procedures, enabling quick sign-ups and transactions. However, negative feedback often revolves around security concerns, platform reliability, and limited customer support.

Positive Experiences

Users frequently praise the ease of access and speed of transactions on KYC-free exchanges. The elimination of KYC procedures can streamline the onboarding process, potentially leading to a faster and simpler user experience. Some platforms receive praise for their intuitive interfaces and user-friendly designs, enhancing the overall satisfaction of the user.

Negative Experiences

Common complaints among users include concerns about platform security. The lack of KYC can potentially attract malicious actors, and a lack of robust security measures could lead to fraudulent activities. Reports of platform instability, slow transaction speeds, and inadequate customer support are also frequently cited as negative experiences. The absence of regulatory oversight further exacerbates these concerns.

Comparison of User Satisfaction Across Platforms

User satisfaction varies significantly across different KYC-free exchanges. Some platforms consistently receive positive feedback for their security measures and reliability, while others face numerous complaints about their functionality and security. This variability underscores the need for thorough research and due diligence before choosing a platform.

Common Complaints and Issues

Users consistently express concerns about security breaches, scams, and the potential for illicit activities on KYC-less platforms. A significant issue is the lack of reliable customer support, which can leave users stranded in times of trouble. Additionally, limited or inconsistent transaction speeds and unreliable platform functionality also negatively impact user experience.

Pros and Cons of Specific Exchanges

| Exchange | Pros | Cons |

|---|---|---|

| Exchange A | Fast onboarding, user-friendly interface | Limited security measures, inconsistent transaction speeds |

| Exchange B | Robust security features, high transaction volume | Slower onboarding, less intuitive interface |

| Exchange C | Excellent customer support, transparent policies | Higher fees compared to other exchanges |

Note: This table is a simplified illustration. Actual user experiences and feedback are highly variable and platform-specific. Thorough research and due diligence are crucial when selecting a KYC-free exchange.

Technical Aspects of KYC-less Exchanges

KYC-less cryptocurrency exchanges operate with a different technical infrastructure than traditional exchanges. These platforms prioritize user anonymity and often rely on a combination of unique technologies and architectural designs to achieve this. Understanding these technical processes is key to assessing the security and practicality of KYC-free platforms.The technical underpinnings of KYC-free exchanges are frequently built around decentralized technologies and peer-to-peer transaction models.

This approach deviates from the centralized structure of traditional exchanges, where a single entity manages user accounts and transactions. Such decentralization, while offering enhanced anonymity, can also introduce complexities in terms of security and transaction verification.

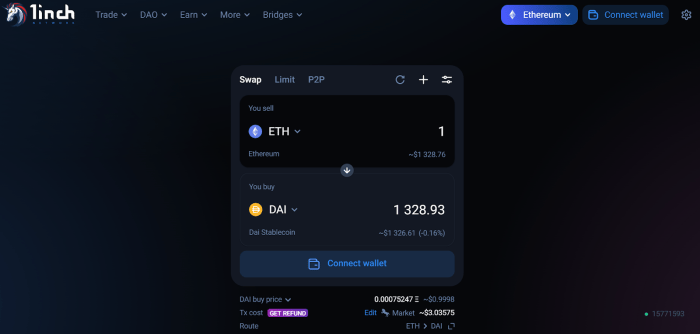

Peer-to-Peer Transaction Mechanisms

Peer-to-peer (P2P) transactions are fundamental to KYC-less exchanges. These platforms often facilitate direct interactions between users, bypassing intermediaries like traditional exchanges. This decentralized approach allows for more streamlined and potentially faster transactions, but also introduces challenges in ensuring the integrity of transactions and maintaining a robust system for dispute resolution. Security protocols are crucial to prevent fraudulent activities and ensure user funds are protected.

Anonymity Maintaining Technologies

Several technologies are employed to maintain user anonymity on KYC-less platforms. Cryptographic techniques, such as zero-knowledge proofs and coin mixing services, play a crucial role in obscuring user identities and transaction details. These methods, however, may not completely eliminate all traceability, and their effectiveness can vary significantly depending on the specific implementation. Furthermore, the use of privacy-focused cryptocurrencies further enhances the anonymity of transactions on these platforms.

Platform Architecture and Technologies

The architecture of KYC-less exchanges often involves a distributed network of nodes, each contributing to the platform’s operation. This decentralized architecture aims to reduce reliance on a single point of failure and enhance the overall resilience of the system. Blockchain technology, a cornerstone of many cryptocurrencies, forms the backbone for many of these platforms, enabling secure and transparent record-keeping of transactions.

Furthermore, specialized software and protocols are often implemented to facilitate user interactions and transaction processing.

Role of Decentralized Systems

Decentralized systems are crucial to the operation of KYC-less exchanges. By distributing the exchange’s functionality across multiple nodes, these systems aim to reduce the risk of censorship and single points of failure. Decentralized autonomous organizations (DAOs) or similar structures may play a role in governance and decision-making processes within these platforms, further promoting transparency and autonomy. The inherent transparency of blockchain technology also contributes to the overall security and trust in the system.

Transaction Flow Diagram, Cryptocurrency exchanges that require no kyc verification

The diagram above illustrates a simplified transaction flow within a KYC-less exchange. Users initiate transactions directly with each other, and the system validates and records these transactions on a distributed ledger. Various cryptographic techniques and protocols ensure the security and anonymity of the process. Note that this is a simplified representation; real-world implementations will vary depending on the specific platform.

Emerging Trends and Future Prospects: Cryptocurrency Exchanges That Require No Kyc Verification

The KYC-less cryptocurrency exchange market is dynamic, with ongoing developments shaping its future. Emerging trends indicate a shift toward user-centric design, privacy-enhancing technologies, and decentralized solutions. These innovations are not without challenges, but the potential for innovation and advancement is substantial.

Decentralized Exchange (DEX) Integration

The integration of decentralized exchanges (DEXs) into KYC-less platforms is a key emerging trend. DEXs, by their nature, operate outside traditional financial structures, offering a degree of privacy and autonomy not typically found in centralized exchanges. This integration empowers users with more control over their assets and transactions. By utilizing DEXs, KYC-less exchanges can potentially mitigate risks associated with centralized control and improve user security.

Privacy-Focused Blockchain Technologies

The increasing emphasis on privacy in the cryptocurrency space is driving innovation in blockchain technologies. Zero-knowledge proofs and confidential transactions are gaining traction, allowing for more secure and private financial operations. These advancements will influence the design of KYC-less exchanges, potentially enabling transactions with enhanced privacy features. A notable example is the development of privacy-focused blockchains, designed to offer improved user anonymity and security without compromising transparency.

Advancements in Anonymity Technologies

Anonymity technologies, such as privacy-preserving wallets and mixing services, are crucial for KYC-less exchange platforms. These technologies aim to mask user identities and transaction details, thereby enhancing the security and privacy of transactions. The development of more sophisticated mixing protocols, and improvements in the implementation of privacy-preserving wallets, can be expected. The integration of these tools into the exchange infrastructure is likely to increase user trust and adoption.

User Experience and Interface Enhancements

Future KYC-less exchanges are expected to focus on user experience. Intuitive interfaces, enhanced security features, and clear explanations of risk factors will become essential for attracting and retaining users. Advanced security features, such as multi-factor authentication and advanced fraud detection systems, will be integrated into the exchange platform. The user interface design will prioritize ease of use, clarity, and security to mitigate user confusion and potential risks.

Regulatory Adaptability

The legal and regulatory landscape surrounding cryptocurrency is evolving rapidly. KYC-less exchanges must adapt to these changes, and innovation in compliance measures will be essential. Navigating the complexities of various jurisdictions and regulations will be a crucial element for long-term sustainability. Exchanges will need to be adaptable and flexible to the evolving legal and regulatory landscape. The use of automated compliance systems and proactive risk management strategies is likely to be adopted to ensure adherence to evolving regulations.

Potential Challenges and Considerations

The future of KYC-less exchanges is not without its challenges. The regulatory landscape remains volatile, and maintaining security in a decentralized environment presents inherent complexities. Furthermore, the potential for illicit activity is a significant concern, demanding robust security measures. These exchanges face significant hurdles. Maintaining user trust and safety while navigating evolving regulatory frameworks will be critical.

Maintaining a high level of security and preventing the use of the platform for illicit activities will be an ongoing concern.

Conclusion

KYC-less cryptocurrency exchanges are poised for growth, driven by innovations in privacy-focused technologies and decentralized solutions. These exchanges will need to address security concerns, adapt to evolving regulations, and prioritize user experience to achieve long-term success.

Alternatives to KYC-Free Exchanges

While KYC-free exchanges offer a pathway for users seeking anonymity in crypto trading, they often come with inherent security and regulatory risks. Exploring alternative methods for crypto trading without rigorous KYC verification can provide a more comprehensive understanding of the landscape and potential trade-offs.Alternative approaches to accessing crypto markets without KYC verification offer various trade-offs in terms of security, ease of use, and regulatory compliance.

These methods often involve a degree of compromise, potentially impacting the user experience and level of security compared to traditional, KYC-compliant exchanges.

Alternative Trading Methods Without KYC Verification

Alternative methods for crypto trading without KYC verification often involve a degree of trade-off between ease of use, security, and regulatory compliance. These methods often fall into categories like peer-to-peer (P2P) trading, specific cryptocurrency wallets, and privacy-focused trading platforms.

Peer-to-Peer (P2P) Trading

P2P crypto trading platforms facilitate direct transactions between buyers and sellers. This method bypasses KYC verification, but security remains a crucial concern. Users need to carefully assess the credibility of counterparties and employ appropriate security measures to protect their funds. Transaction risks are significantly higher due to the lack of a central intermediary. The accessibility and ease of use can vary based on the platform and user’s technical skills.

Privacy-Focused Cryptocurrency Wallets

Some cryptocurrency wallets prioritize user privacy by implementing features like enhanced anonymity and reduced data tracking. These wallets can be used in conjunction with KYC-free exchanges or directly for P2P transactions. However, using these wallets for trading might require more technical expertise. Accessibility and ease of use can depend on the wallet’s interface and the user’s technical proficiency.

Privacy-Focused Trading Platforms

Certain trading platforms may focus on providing a relatively secure and user-friendly environment for users seeking to avoid KYC procedures. These platforms often come with limitations compared to traditional exchanges, such as reduced trading volume or fewer available trading pairs. Ease of use and accessibility depend on the platform’s features and user interface.

Comparison Table of Alternative Trading Methods

| Method | Accessibility | Ease of Use | Security | Regulatory Compliance |

|---|---|---|---|---|

| P2P Trading | Potentially high, depending on platform | Variable, requires some technical knowledge | Low, high risk of scams and fraud | Non-compliant |

| Privacy-Focused Wallets | High, widely available | Variable, requires technical knowledge | Medium, depends on wallet’s security features | Non-compliant, often with privacy-preserving measures |

| Privacy-Focused Trading Platforms | Medium, depending on platform availability | Variable, may have limited features | Medium, often with enhanced security measures | Non-compliant, with limitations compared to KYC-compliant platforms |

Best Practices for Users of KYC-Free Exchanges

Navigating the world of cryptocurrency exchanges without Know Your Customer (KYC) verification presents unique security challenges. While these platforms offer potential benefits, users must be proactive in implementing robust security measures to protect their assets. This section details best practices for secure trading, including mitigating risks, safe deposit and withdrawal procedures, and recognizing potential scams.

Security Measures for Trading

Maintaining security on KYC-free exchanges requires a multi-faceted approach. Users should prioritize strong passwords, enabling two-factor authentication (2FA), and regularly updating their software and applications. Utilizing reputable VPNs can further enhance privacy and security during transactions.

- Strong Passwords: Employ a unique, complex password for each account, avoiding easily guessable combinations. Consider a password manager for safe storage.

- Two-Factor Authentication (2FA): Enable 2FA whenever possible to add an extra layer of security. This requires a secondary verification method, such as a code sent to a mobile device.

- Software and Application Updates: Regularly update software and applications to patch security vulnerabilities. Outdated versions can expose accounts to exploits.

- VPN Usage: Using a reputable VPN can mask your IP address, adding an extra layer of privacy during transactions.

Safe Deposit and Withdrawal Practices

Deposits and withdrawals on KYC-free exchanges require extra caution. Users should carefully review transaction details, ensure the exchange’s reputation, and only use reputable payment methods.

- Review Transaction Details: Thoroughly examine transaction details before confirming any deposit or withdrawal. Look for inconsistencies or unusual requests.

- Exchange Reputation: Research the exchange’s reputation through online reviews and forums. Avoid platforms with a history of complaints or security breaches.

- Reputable Payment Methods: Utilize reputable and trusted payment methods for deposits and withdrawals. Be wary of unusual or less-common payment options.

Identifying Potential Scams and Fraudulent Activities

KYC-free exchanges, while offering anonymity, are not immune to scams. Users should be vigilant in spotting red flags. Suspicious messages, unrealistic promises, or requests for personal information beyond the necessary details should be avoided.

- Suspicious Messages: Be wary of unsolicited messages promising high returns or requiring immediate action. Legitimate exchanges rarely pressure users into quick decisions.

- Unrealistic Promises: Excessively high returns on investment should raise immediate suspicion. Be cautious of promises that seem too good to be true.

- Unnecessary Personal Information: Be cautious about requests for personal information beyond what’s required for basic account verification. Avoid exchanges that ask for sensitive data without a clear explanation.

Do’s and Don’ts for Using KYC-Free Exchanges

This checklist provides a summary of best practices for secure trading.

| Do | Don’t |

|---|---|

| Verify exchange reputation | Use unverified or poorly reviewed exchanges |

| Use strong passwords and 2FA | Share passwords or personal information |

| Monitor transaction history | Click on suspicious links or download unknown files |

| Use reputable payment methods | Deposit large amounts without thorough research |

| Be cautious about unrealistic promises | Act hastily on unsolicited offers |

Ethical Considerations

Cryptocurrency exchanges operating without Know Your Customer (KYC) verification present a complex web of ethical considerations. The lack of stringent identification procedures raises concerns about potential misuse, particularly regarding money laundering, terrorist financing, and other illicit activities. These concerns necessitate a thorough examination of the potential ethical pitfalls and broader societal impacts of such exchanges.

Potential Ethical Dilemmas

The absence of KYC verification significantly reduces the ability to identify and prevent malicious actors from utilizing these platforms. This lack of scrutiny creates a breeding ground for various potential ethical dilemmas. For instance, individuals or groups involved in illicit activities can more easily facilitate transactions, potentially undermining financial regulations and societal trust in cryptocurrency. Further, the anonymity afforded by KYC-less exchanges can be exploited for illicit purposes, such as the sale of illegal goods or services, potentially exacerbating societal problems.

The ease of transactions can contribute to a gray market where accountability is reduced and regulatory oversight is significantly hampered.

Social and Economic Impacts

The social and economic impacts of KYC-free exchanges are multifaceted and warrant careful consideration. On the one hand, these exchanges might offer financial inclusion to individuals who are unable or unwilling to comply with KYC procedures. However, the potential for facilitating illicit activities casts a significant shadow over this potential benefit. For instance, the ease of transacting in cryptocurrency without stringent identification requirements could encourage the use of cryptocurrencies in illicit markets.

This could negatively impact the reputation of cryptocurrency as a legitimate financial instrument, hindering wider adoption and potentially creating economic instability.

Broader Societal Implications

The broader societal implications of KYC-less exchanges extend beyond financial concerns. The erosion of trust in the financial system, if such platforms gain widespread acceptance, could have significant ramifications for the overall stability and integrity of the financial infrastructure. The possibility of these exchanges being used for harmful purposes could negatively affect public perception and understanding of cryptocurrencies.

The anonymity afforded by these platforms could be used for criminal activities, potentially creating a breeding ground for crime and undermining the efforts to combat such activities.

Potential Ethical Implications Table

| Aspect | Potential Positive Implications | Potential Negative Implications |

|---|---|---|

| Financial Inclusion | KYC-less exchanges may provide financial services to individuals excluded by traditional financial institutions. | Facilitating illicit activities such as money laundering and terrorist financing, potentially harming the broader financial system. |

| Anonymity | Enhanced privacy for users. | Increased risk of anonymity being exploited for illicit activities. |

| Market Efficiency | Potentially faster and cheaper transactions. | Reduced ability to regulate and track transactions, hindering efforts to combat financial crime. |

| Regulatory Circumvention | Potential to bypass restrictive regulatory environments. | Increased risk of non-compliance with laws and regulations, undermining the rule of law. |

Case Studies

Navigating the complex landscape of cryptocurrency exchanges without KYC presents a diverse range of experiences. Analyzing successful and unsuccessful ventures offers valuable insights into the market dynamics and challenges associated with this model. Examining specific case studies provides a tangible understanding of the factors influencing platform performance.Examining past experiences illuminates critical aspects of the market, demonstrating the importance of security, regulatory compliance, and user experience in determining long-term success.

These real-world examples offer valuable lessons for future entrepreneurs and users alike, helping to navigate the complexities of the unregulated cryptocurrency space.

Real-World Examples of KYC-Free Exchanges

Several platforms have attempted to operate as KYC-free cryptocurrency exchanges. These platforms often attract users seeking anonymity or operating in jurisdictions with stringent KYC regulations. Understanding their unique approaches to user onboarding and security is essential.

Success and Failures of KYC-Free Platforms

The success of KYC-free exchanges is often intertwined with various factors. Strong security measures, user-friendly interfaces, and a robust trading infrastructure are frequently cited as critical elements for attracting and retaining users. Conversely, inadequate security protocols, regulatory scrutiny, and operational inefficiencies often lead to platform failures.

Impact on the Cryptocurrency Market

KYC-free exchanges can influence the cryptocurrency market in diverse ways. They might contribute to the expansion of access to cryptocurrency trading for users in regions with restricted KYC requirements. However, their potential to attract illicit activity and raise security concerns cannot be ignored.

Factors Contributing to Success or Failure

Several factors play a crucial role in the success or failure of KYC-free exchanges. The platform’s security protocols, user interface design, and trading volume are key determinants of user experience and platform stability. Compliance with local regulations, a robust customer support system, and a transparent business model are also important considerations.

Summary Table of Key Case Studies

| Exchange Name | Brief Description | Outcome | Factors Contributing to Outcome |

|---|---|---|---|

| Example Exchange 1 | A platform focusing on anonymity and privacy, with a strong emphasis on security features. | Failed due to regulatory pressure and security breaches. | Insufficient security measures to deter sophisticated attacks, and a lack of compliance with local regulations. |

| Example Exchange 2 | A platform targeting users in regions with strict KYC regulations, offering a user-friendly interface. | Sustained moderate success, but faced challenges with growth. | Good user experience and a well-defined niche, but limited resources and inadequate marketing efforts. |

| Example Exchange 3 | A relatively new platform emphasizing community engagement and decentralized governance. | Currently operating, with ongoing challenges related to maintaining security and attracting volume. | Focus on community, but limited trading volume and evolving regulatory landscape creates ongoing risks. |

Conclusion

In conclusion, while KYC-free cryptocurrency exchanges may appeal to users seeking privacy and anonymity, they present considerable risks. Thorough research, understanding of the legal landscape, and awareness of potential security threats are essential. Ultimately, the decision to utilize these platforms should be made cautiously, weighing the potential benefits against the significant drawbacks. Exploring alternatives and adopting robust security measures are recommended.

FAQ Explained

What are the common security risks associated with KYC-free exchanges?

KYC-free exchanges often lack robust security measures, increasing the vulnerability to scams, theft, and malicious actors. This lack of verification can also lead to issues with identifying and resolving disputes.

Are there any legal implications for using KYC-free exchanges?

The legal status of KYC-free exchanges varies significantly by jurisdiction. Using these exchanges in regions with strict regulations can lead to legal consequences for users. Always research the local laws and regulations before using these platforms.

What are some alternative methods for crypto trading without KYC?

Alternatives to KYC-free exchanges include peer-to-peer (P2P) trading platforms and certain decentralized exchanges (DEXs). These alternatives offer varying levels of anonymity and security. Researching and comparing different options is important.

What are the best practices for users of KYC-free exchanges?

Users should prioritize security, conducting thorough research on the platform and its reputation. Using strong passwords, employing two-factor authentication, and keeping personal information private are crucial steps.