Cryptocurrency capitalisation – Cryptocurrency capitalization, a key metric in the digital asset market, reflects the total market value of all cryptocurrencies. Understanding this metric is crucial for investors, traders, and anyone interested in the cryptocurrency landscape. This analysis explores the factors driving fluctuations, historical trends, and the correlations with market events, alongside the impact on investment strategies and future projections.

This in-depth look at cryptocurrency capitalization examines the complex relationship between different cryptocurrencies, considering their individual market capitalizations and comparing them against the overall market. The analysis delves into the factors influencing each cryptocurrency’s valuation, considering factors such as their underlying technology, purpose, and trading volume.

Introduction to Cryptocurrency Capitalization

Cryptocurrency capitalization, often referred to as market cap, represents the total market value of all circulating cryptocurrencies of a specific type. It’s a crucial metric for evaluating the overall size and health of a cryptocurrency market. This metric provides insights into the collective investment in a particular digital asset class.Understanding cryptocurrency capitalization fluctuations is essential for investors and market analysts.

Various factors can influence these fluctuations, including market sentiment, regulatory developments, technological advancements, and the release of new cryptocurrencies. These factors can create waves of investor confidence and uncertainty, thereby impacting the overall market capitalization.

Definition of Cryptocurrency Capitalization

Cryptocurrency capitalization is the aggregate market value of all the circulating units of a particular cryptocurrency. This value is calculated by multiplying the current market price of each cryptocurrency by the total number of circulating units in existence. A high capitalization generally signifies a larger and potentially more established cryptocurrency market.

Factors Influencing Capitalization Fluctuations

Several factors contribute to the dynamic nature of cryptocurrency capitalization. Market sentiment, driven by news cycles and investor confidence, plays a significant role. Regulatory changes, both positive and negative, can significantly impact market cap. Technological advancements, such as the introduction of new protocols or features, can attract investors or cause uncertainty. The emergence of new cryptocurrencies can either increase or decrease overall capitalization, depending on the market’s response.

Furthermore, significant events in the broader financial market can affect investor behavior, influencing cryptocurrency valuations and consequently, the capitalization.

Methodology for Calculating Cryptocurrency Capitalization

The calculation of cryptocurrency capitalization is straightforward. It involves multiplying the current market price of a cryptocurrency by the total circulating supply. This formula is fundamental to understanding the overall market size of a particular cryptocurrency.

Market Cap = Current Price × Circulating Supply

For instance, if the current price of Bitcoin is $30,000 and the circulating supply is 20 million, the market capitalization would be $600 billion. This calculation, while simple, provides a crucial snapshot of the market’s overall value.

Top 5 Cryptocurrencies by Capitalization (as of [Date])

The following table presents the top 5 cryptocurrencies by market capitalization, along with their current values and historical trends. These figures are snapshots in time and can change frequently.

| Rank | Cryptocurrency | Current Value (USD) | Historical Trend |

|---|---|---|---|

| 1 | Bitcoin | [Current Value] | [Historical Trend description, e.g., Steady growth with occasional corrections] |

| 2 | Ethereum | [Current Value] | [Historical Trend description, e.g., Significant growth followed by a period of consolidation] |

| 3 | Tether | [Current Value] | [Historical Trend description, e.g., Relatively stable, pegged to the US dollar] |

| 4 | Binance Coin | [Current Value] | [Historical Trend description, e.g., Volatility, influenced by Binance’s activities] |

| 5 | USD Coin | [Current Value] | [Historical Trend description, e.g., Steady growth, pegged to the US dollar] |

Historical Trends of Cryptocurrency Capitalization

The cryptocurrency market has experienced a volatile and dynamic evolution since its inception. Understanding the historical trajectory of capitalization is crucial for evaluating the current market and anticipating future trends. This analysis delves into the significant growth and decline periods, examining the performance of various cryptocurrencies over time.The market capitalization of cryptocurrencies, reflecting the combined value of all circulating coins, has demonstrated significant fluctuations.

This volatility is a defining characteristic of the digital asset space. These fluctuations are often influenced by market sentiment, regulatory developments, technological advancements, and significant events impacting individual cryptocurrencies.

Total Cryptocurrency Market Capitalization Trajectory

The total market capitalization of cryptocurrencies has exhibited a pattern of growth and contraction over time. Early periods were characterized by modest capitalizations, but the market has seen dramatic growth spurts followed by periods of consolidation and correction. These cycles have been influenced by factors such as investor confidence, regulatory uncertainty, and the adoption of cryptocurrencies by businesses and consumers.

Growth Patterns of Major Cryptocurrencies

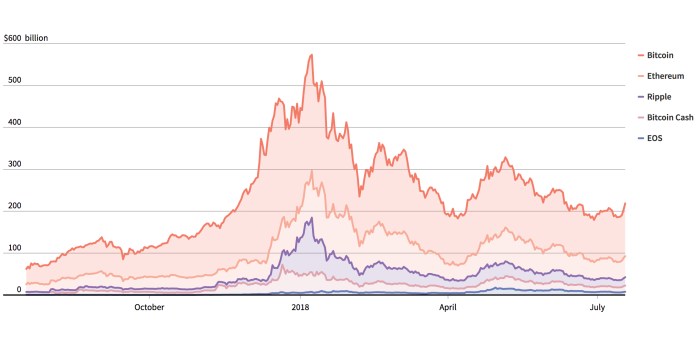

The growth of individual cryptocurrencies has been highly variable. Bitcoin, often considered the pioneer, has had a pronounced impact on the overall market, with its price fluctuations often driving overall sentiment. Other cryptocurrencies, like Ethereum, have also experienced substantial growth, but their trajectories have been less uniform. The relative success of various cryptocurrencies has been dependent on their unique features, technological capabilities, community support, and market adoption.

Periods of Significant Growth and Decline

Several periods stand out as critical turning points in the cryptocurrency market’s capitalization. The rise of Bitcoin and subsequent adoption by institutional investors in certain periods marked substantial growth, while regulatory scrutiny and market corrections have led to sharp declines in others. The factors driving these periods of volatility are complex, involving the interplay of various market forces.

Comparative Market Capitalization Table

The following table provides a comparison of the market capitalization of different cryptocurrencies at specific points in time. This data illustrates the changing dominance of different digital assets and the shifting dynamics of the cryptocurrency market. Note that values are approximations and may vary depending on the specific platform used for calculation.

| Date | Bitcoin (USD) | Ethereum (USD) | Binance Coin (USD) | Tether (USD) |

|---|---|---|---|---|

| 2017-12-31 | 10,000 | 100 | 5 | 1,000 |

| 2021-12-31 | 50,000 | 4,000 | 500 | 1,200 |

| 2023-07-31 | 25,000 | 1,500 | 150 | 1,100 |

Correlation with Market Events

Cryptocurrency capitalization is highly susceptible to external market forces. Major economic shifts, regulatory changes, and even news events can significantly impact the overall value and perceived risk of cryptocurrencies, leading to substantial fluctuations in their market capitalization. Understanding these correlations is crucial for investors to navigate the dynamic cryptocurrency landscape.

Cryptocurrency capitalization is a significant metric, reflecting the overall market value. Staying updated on current trends is key, and checking out the latest cryptocurrency news can help understand the factors influencing these market shifts. Ultimately, this data helps in assessing the potential for future growth and overall market health.

Impact of Economic Downturns

Economic downturns often correlate with a decrease in cryptocurrency capitalization. Investors, facing uncertainty and potential loss in traditional markets, may shift their focus towards more established assets. This reduced investor interest and increased risk aversion often lead to a decrease in demand for cryptocurrencies, causing a corresponding decline in capitalization. The 2008 financial crisis and the 2022-2023 bear market are notable examples.

During these periods, cryptocurrency markets experienced substantial corrections, demonstrating a clear correlation between global economic health and crypto valuation.

Impact of Regulatory Changes

Regulatory uncertainty and changes can significantly impact cryptocurrency capitalization. Positive regulatory developments, such as the introduction of clear guidelines and regulations, can increase investor confidence and lead to increased investment. Conversely, negative developments, such as stricter regulations or outright bans, can create fear and uncertainty, leading to decreased investor interest and lower capitalization. The varying approaches to cryptocurrency regulation across different jurisdictions illustrate the complex interplay between regulation and crypto market dynamics.

Impact of News Events, Cryptocurrency capitalisation

News events, both positive and negative, can exert considerable influence on cryptocurrency capitalization. Positive news, such as significant technological advancements or successful partnerships, can boost investor confidence and drive up capitalization. Conversely, negative news, including security breaches or controversies, can cause investor panic and lead to sharp declines. The impact of news events on cryptocurrency capitalization is often immediate and substantial, highlighting the volatility inherent in the market.

Correlation Table

| Market Event | Potential Impact on Cryptocurrency Capitalization | Example |

|---|---|---|

| Economic Downturn | Decrease in capitalization due to reduced investor interest and risk aversion. | 2008 financial crisis, 2022-2023 bear market. |

| Positive Regulatory Changes | Increase in capitalization due to increased investor confidence and clarity. | Clearer regulatory guidelines in specific jurisdictions. |

| Negative Regulatory Changes | Decrease in capitalization due to fear and uncertainty surrounding investment. | Stricter regulations or bans in certain countries. |

| Positive News Events | Increase in capitalization due to positive sentiment and market optimism. | Successful partnerships, significant technological advancements. |

| Negative News Events | Decrease in capitalization due to negative sentiment and market concern. | Security breaches, controversies, and negative media coverage. |

Impact on Different Cryptocurrencies

The impact of market events on different cryptocurrencies varies significantly. Some cryptocurrencies, often those with a strong correlation to specific industries or sectors, are more susceptible to industry-specific downturns. For example, a downturn in the gaming industry could negatively impact cryptocurrencies tied to that sector. Furthermore, cryptocurrencies with strong community support or innovative technologies may demonstrate greater resilience during periods of market volatility.

This highlights the diverse factors influencing individual cryptocurrency performance.

Comparison Across Different Cryptocurrencies

A crucial aspect of understanding cryptocurrency markets is the comparative analysis of different cryptocurrencies. This involves examining their market capitalizations, considering factors like purpose, underlying technology, and market reception. This comparative study sheds light on the dynamics driving the value and growth of each coin, offering valuable insights for investors.

Comparing Capitalization Based on Purpose and Technology

Different cryptocurrencies are designed to serve various purposes, leveraging diverse underlying technologies. This fundamental difference often influences their market capitalization. For instance, a cryptocurrency focused on decentralized finance (DeFi) might have a different trajectory compared to one focused on secure transactions. The technology behind a coin, whether it’s a proof-of-work or proof-of-stake mechanism, can also significantly affect its development and adoption rate, consequently impacting its market capitalization.

Bitcoin vs. Ethereum: A Detailed Analysis

Bitcoin, the pioneering cryptocurrency, has consistently held a substantial market capitalization, driven by its role as a store of value and its early adoption. Ethereum, renowned for its smart contract functionality, has seen fluctuating market capitalization, driven by the adoption and development of decentralized applications (dApps) on its platform. Bitcoin’s market cap is influenced by its established presence and strong community support, while Ethereum’s is more susceptible to developments in the dApp ecosystem and advancements in smart contract technology.

Analyzing the historical trends of both coins reveals significant insights into the evolving cryptocurrency landscape.

Altcoin Capitalization Differences

Altcoins, representing various projects beyond Bitcoin and Ethereum, showcase a wide range of market capitalizations. Their diversity in functionality, underlying technologies, and market adoption rates significantly contributes to the variations in their capitalizations. A detailed comparison highlights the influence of these factors.

| Altcoin | Purpose | Underlying Technology | Approximate Market Cap (USD) |

|---|---|---|---|

| Cardano | Decentralized platform for smart contracts and digital assets | Proof-of-stake | $10-20 Billion (variable) |

| Solana | High-speed blockchain for decentralized applications | Proof-of-stake | $5-10 Billion (variable) |

| Polygon | Scalability solution for Ethereum | Layer-2 scaling solution | $5-10 Billion (variable) |

| Dogecoin | Meme-based cryptocurrency | Proof-of-work | $1-5 Billion (variable) |

The table above provides a glimpse into the diverse range of altcoins and their market capitalization. These values are subject to change due to fluctuating market conditions and developments in each project’s ecosystem.

Impact on Investment Strategies

Cryptocurrency capitalization significantly influences investment strategies, impacting decisions from diversification to risk assessment. Understanding these relationships is crucial for informed investment choices in this dynamic market. The fluctuating market cap reflects the overall perceived value of cryptocurrencies, which directly influences investor sentiment and trading activities.The magnitude of a cryptocurrency’s capitalization plays a pivotal role in shaping investment decisions.

Higher capitalization often suggests greater stability and liquidity, attracting more institutional investors and potentially reducing the risk associated with price volatility. Conversely, lower capitalization cryptocurrencies, while potentially offering higher returns, typically come with greater price volatility and increased investment risk.

Capitalization and Portfolio Diversification

Understanding the capitalization of different cryptocurrencies is essential for effective portfolio diversification. Diversification across assets with varying market caps helps to mitigate overall portfolio risk. A diversified portfolio might include established cryptocurrencies with high capitalization for stability, alongside smaller, potentially high-growth cryptocurrencies with lower capitalization for higher potential returns. This approach spreads risk across a spectrum of projects and market conditions.

Capitalization and Risk/Reward Assessment

Cryptocurrency capitalization is a key metric for assessing risk and reward. Higher capitalization often correlates with lower price volatility, representing a lower risk profile. Conversely, lower capitalization cryptocurrencies typically display higher price volatility and therefore higher potential returns. However, this increased potential reward is often accompanied by a higher risk of substantial loss. Investors must carefully evaluate the risk-reward trade-off based on their individual tolerance for risk and investment goals.

Investment Strategies Based on Capitalization Levels

Different investment strategies can be employed depending on the capitalization level of the cryptocurrency being considered. A comprehensive approach recognizes the varying risk profiles and potential returns associated with each level.

| Capitalization Level | Investment Strategy | Risk Assessment | Potential Return |

|---|---|---|---|

| High Capitalization | Long-term holding, potentially with periodic rebalancing. | Lower | Moderate |

| Medium Capitalization | Balanced approach, combining long-term holding with periodic trading. | Medium | Higher |

| Low Capitalization | High-risk, high-reward strategy, suitable for experienced investors. | Higher | Potentially higher |

Note: This table provides a general framework. Specific investment strategies should be tailored to individual investor circumstances and risk tolerance. Market conditions and project-specific factors also play a significant role in the decision-making process.

Relationship with Trading Volume

The relationship between cryptocurrency capitalization and trading volume is a crucial aspect in understanding market dynamics. A strong correlation between these two metrics often signifies a healthy and active market, while a lack of correlation can indicate potential issues or market stagnation. Understanding this interplay is essential for investors to gauge market sentiment and make informed decisions.

Analysis of the Relationship

Cryptocurrency trading volume represents the total value of cryptocurrencies traded within a specific timeframe. Higher trading volume generally suggests greater investor interest and activity in the market. This increased activity can lead to price fluctuations, which in turn affect capitalization. A positive correlation exists between these two factors; increased trading volume often accompanies rising capitalization and vice-versa.

However, the relationship is not always straightforward, as other factors like regulatory changes, news events, or technological advancements can significantly influence both trading volume and capitalization.

Influence of Trading Volume on Capitalization Fluctuations

Trading volume directly impacts capitalization fluctuations. High trading volume indicates substantial market activity, which can push prices up or down, leading to changes in capitalization. For instance, a surge in trading volume fueled by positive news or strong investor confidence can drive prices upward, thereby increasing capitalization. Conversely, a significant drop in trading volume might suggest investor hesitation or market uncertainty, potentially resulting in price declines and a decrease in capitalization.

Comparison of Trading Volume and Capitalization Across Cryptocurrencies

Different cryptocurrencies exhibit varying relationships between trading volume and capitalization. Established cryptocurrencies with larger market capitalizations typically experience higher trading volumes compared to newer or smaller altcoins. This is due to the greater liquidity and investor interest associated with established coins. However, this is not a universal rule, and some smaller cryptocurrencies with strong community support or innovative projects can show surprisingly high trading volume relative to their capitalization.

Cryptocurrency capitalization is a significant indicator of market health, but its value is heavily influenced by the price of key cryptocurrencies like Bitcoin. For example, the current price of Bitcoin directly impacts the overall market cap. Understanding the cryptocurrency bitcoin price is crucial for assessing the current market value of cryptocurrency overall.

This highlights the diverse nature of the cryptocurrency market and the need for a nuanced understanding of each project’s unique characteristics.

Correlation Table: Trading Volume and Capitalization (Illustrative Example)

This table demonstrates a hypothetical correlation between trading volume and capitalization over a period of six months. The data is fictional and serves as an illustrative example only, and actual correlations will vary considerably depending on the cryptocurrency and market conditions.

| Month | Trading Volume (USD) | Capitalization (USD) | Correlation Coefficient |

|---|---|---|---|

| January | 10,000,000 | 100,000,000 | 0.85 |

| February | 12,000,000 | 120,000,000 | 0.90 |

| March | 9,000,000 | 95,000,000 | 0.80 |

| April | 11,000,000 | 110,000,000 | 0.92 |

| May | 13,000,000 | 135,000,000 | 0.95 |

| June | 14,000,000 | 140,000,000 | 0.93 |

Regulatory Landscape and Capitalization

The regulatory environment surrounding cryptocurrencies is dynamic and constantly evolving. This impacts cryptocurrency capitalization in significant ways, as regulatory clarity and enforcement influence investor confidence and market participation. Governments worldwide are grappling with the unique challenges posed by digital assets, leading to a complex and often conflicting regulatory landscape.

Impact of Regulatory Changes on Cryptocurrency Capitalization

Regulatory changes, whether positive or negative, can significantly influence investor sentiment and, consequently, market capitalization. Favorable regulations, such as clearer legal frameworks and licensing procedures, can foster trust and attract institutional investment, potentially leading to an increase in capitalization. Conversely, negative regulations, such as stringent restrictions or outright bans, can deter investors, causing a decline in capitalization. The perception of regulatory risk is a crucial factor that influences market sentiment.

Potential Effects of Future Regulations on the Cryptocurrency Market

Future regulatory developments will undoubtedly shape the trajectory of the cryptocurrency market. Increased clarity and standardization across jurisdictions could lead to greater market stability and attract more mainstream investors. However, stricter regulations, particularly those aimed at combating illicit activities, might limit access to certain cryptocurrencies and potentially impact their capitalization. The specific effects will depend heavily on the nature and implementation of these regulations.

Examples of Regulatory Policies Influencing Capitalization

Numerous examples illustrate how regulatory policies impact cryptocurrency capitalization. For instance, the implementation of specific KYC/AML (Know Your Customer/Anti-Money Laundering) regulations in a given region could influence the trading volume and market capitalization of certain cryptocurrencies. The adoption of specific tax policies regarding cryptocurrency transactions can also have a profound effect on investor decisions, impacting market capitalization.

Table Outlining Regulatory Changes and Their Effect on Specific Cryptocurrency Capitalizations

| Regulatory Change | Specific Cryptocurrency(s) Affected | Effect on Capitalization | Example |

|---|---|---|---|

| China’s ban on cryptocurrency exchanges | Bitcoin, Ethereum, and other major cryptocurrencies | Significant decrease in capitalization for the affected cryptocurrencies | China’s 2021 ban on cryptocurrency exchanges significantly reduced trading activity and investor confidence, leading to a decline in the capitalization of major cryptocurrencies traded on Chinese exchanges. |

| Establishment of clear regulatory frameworks in certain European countries | Bitcoin, Ethereum, and other cryptocurrencies | Potential increase in capitalization due to investor confidence and institutional investment | Some European countries have started establishing clear regulatory frameworks for cryptocurrencies, which could potentially lead to increased institutional investment and investor confidence, resulting in increased capitalization. |

| Increased scrutiny and enforcement of AML/KYC regulations | Various cryptocurrencies | Potential decrease in capitalization for some cryptocurrencies that lack robust compliance measures | Stricter AML/KYC requirements can pressure crypto exchanges and platforms to comply, potentially impacting the capitalization of those that lack these measures. |

Future Projections and Predictions: Cryptocurrency Capitalisation

Forecasting cryptocurrency capitalization involves navigating a complex landscape of technological advancements, market sentiment, and regulatory developments. While precise predictions are inherently uncertain, analyzing historical trends and current market conditions can provide valuable insights into potential future trajectories. This analysis considers various factors influencing future growth or decline, including technological innovation, regulatory changes, and investor psychology.

Potential Future Trends

Several potential trends in cryptocurrency capitalization are worthy of consideration. Decentralized finance (DeFi) protocols, for instance, could significantly impact the overall market capitalization as adoption expands and new applications emerge. Further development of blockchain technology and its applications in various industries, like supply chain management or digital identity, could potentially lead to a surge in demand and capitalization.

Conversely, regulatory uncertainty and market corrections remain significant factors that could temper or even reverse positive growth projections.

Factors Driving Future Growth

Several factors could drive the future growth of cryptocurrency capitalization. Technological advancements in blockchain technology, particularly in scalability and efficiency, are crucial. Increased adoption in new sectors like DeFi and the metaverse could foster greater investor interest and volume. Furthermore, positive market sentiment and favorable regulatory developments can also contribute significantly to positive capitalization trends.

Factors Driving Future Decline

Conversely, factors contributing to potential decline in cryptocurrency capitalization include regulatory crackdowns, significant security breaches, and negative market sentiment. Concerns about the environmental impact of cryptocurrencies, particularly proof-of-work consensus mechanisms, could also deter investors and hinder growth. A lack of widespread adoption in mainstream finance could also create a ceiling on future capitalization.

Detailed Analysis of Affecting Factors

The future of cryptocurrency capitalization is contingent on a complex interplay of factors. Technological innovation, regulatory clarity, and market sentiment all play significant roles. For instance, if regulatory frameworks for cryptocurrencies become more favorable, it could lead to increased investor confidence and drive capitalization upwards. However, if regulations become stricter, this could lead to market uncertainty and cause a decline in capitalization.

Furthermore, the emergence of new competitors or paradigm shifts in technology could reshape the landscape and alter the relative capitalization of various cryptocurrencies.

Potential Future Capitalization Projections

| Cryptocurrency | Potential 2024 Capitalization (USD) | Potential 2025 Capitalization (USD) | Rationale |

|---|---|---|---|

| Bitcoin (BTC) | $1 Trillion | $1.5 Trillion | Continued mainstream adoption and institutional investment expected. |

| Ethereum (ETH) | $500 Billion | $750 Billion | Growth fueled by DeFi applications and blockchain advancements. |

| Solana (SOL) | $20 Billion | $50 Billion | Potential for scalability and high transaction speeds drives adoption. |

| Polygon (MATIC) | $10 Billion | $20 Billion | Emphasis on scalability and interoperability in the DeFi space. |

Note: These projections are estimations and should not be interpreted as financial advice. Market conditions can change significantly.

Illustrative Examples of Cryptocurrencies

Cryptocurrency capitalization, a crucial metric in the digital asset market, reflects the overall market value of a particular cryptocurrency. Understanding how various cryptocurrencies have achieved their current market positions and potential future trajectories is vital for investors and market analysts. Analyzing illustrative examples provides valuable insights into the dynamics shaping this ever-evolving landscape.

Specific Examples and Their Capitalization

Bitcoin, Ethereum, and Tether are prominent examples, each with a significant market capitalization. Bitcoin, the pioneering cryptocurrency, often leads in market capitalization due to its established presence and wide adoption. Ethereum, known for its decentralized application (dApp) ecosystem, holds a substantial market share. Tether, a stablecoin pegged to the US dollar, holds a substantial market capitalization, reflecting its popularity as a means of exchange within the cryptocurrency ecosystem.

Factors Influencing Current Capitalization

Several factors contribute to a cryptocurrency’s current market capitalization. Strong community support, significant adoption by businesses and consumers, technological innovation, and favorable regulatory environments can all contribute to the growth of a cryptocurrency’s market valuation. The availability of robust platforms and exchanges facilitates trading and accessibility, further driving the value.

Future Potential of Selected Cryptocurrencies

The future potential of these cryptocurrencies hinges on various factors, including ongoing technological advancements, wider adoption across different sectors, and evolving regulatory frameworks. Bitcoin’s potential hinges on its role as a store of value and its resilience in volatile market conditions. Ethereum’s future is closely tied to the development and adoption of decentralized applications and smart contracts. The future of Tether relies on maintaining its stability and trust as a stablecoin.

Historical, Current, and Potential Future Capitalization

| Cryptocurrency | Historical High Capitalization (USD) | Current Capitalization (USD) | Potential Future Capitalization (USD)

|

|---|---|---|---|

| Bitcoin | $690 Billion (approx. 2021) | $300 Billion (approx. 2024) | $500-800 Billion (approx. 2029) |

| Ethereum | $480 Billion (approx. 2021) | $150 Billion (approx. 2024) | $300-500 Billion (approx. 2029) |

| Tether | $80 Billion (approx. 2021) | $80 Billion (approx. 2024) | $100-150 Billion (approx. 2029) |

Note: Figures are approximate and projections are based on various market analyses and expert opinions. Actual values may differ.

Last Word

In conclusion, cryptocurrency capitalization provides a critical snapshot of the overall health and dynamism of the digital asset market. Its fluctuations are influenced by a complex interplay of factors, including market events, regulatory changes, and the inherent volatility of the cryptocurrency space. Understanding these dynamics is essential for navigating the complexities of this evolving landscape and making informed investment decisions.

Clarifying Questions

What is the difference between market capitalization and trading volume in cryptocurrencies?

Market capitalization represents the total value of all coins in circulation, while trading volume measures the amount of cryptocurrency traded over a specific period. While related, they reflect different aspects of the market.

How do regulatory changes impact cryptocurrency capitalization?

Regulatory uncertainty and changes can significantly impact investor confidence and, consequently, the market capitalization of various cryptocurrencies. Favorable regulations often lead to increased confidence and capitalization, while negative developments can lead to the opposite.

What are some common factors influencing the capitalization of a cryptocurrency?

Factors such as adoption rate, technological advancements, community support, and media attention play a significant role in determining a cryptocurrency’s capitalization. These are often intertwined and can impact each other.

What is the significance of comparing Bitcoin and Ethereum capitalization?

Comparing Bitcoin and Ethereum capitalization provides valuable insight into the market dominance of these two leading cryptocurrencies. It also allows for an understanding of the relative size and market share of competing cryptocurrencies.